Earning credit card signup bonuses is one of the best ways to acquire a large amount of miles/points in a short period of time and can lead to a 20% or more return on your spending. By combining great signup bonuses with rewards credit cards that provide the best return on everyday purchases, you will be amazed at how many free flights or hotel stays you can earn. Keep in mind that most credit cards that come with lucrative sign-up bonuses also have an annual fee, and whether you should keep them long term depends on your personal situation.

This post provides a ranking of the best current signup bonuses based on our miles and points valuations. However, remember that point values are based on your own unique situation. Each card posted below has a link with our review and detailed information about that individual product. A chart showing the historical signup bonus history for each card is included to help you decide whether or not you should apply immediately or wait for a better offer.

The most lucrative signup bonuses are travel related and earn points/miles. Therefore, you usually need to spend some time researching how to best use the points/miles in order to maximize their value. For more casual credit enthusiasts that don’t want to spend as much time researching how to use their miles or points, we have also created the signup bonus ranking for casual gamers.

This post is updated in real time and is based on the value you receive for ONE year after signing up. After the first year, your return may not be enough to offset the annual fee. At that time you can choose to downgrade a card to a no-annual fee card (recommended) or just cancel them (not recommended). It is not recommended to cancel cards because one variable that determines your credit score is your average age of accounts. The first year value is calculated by subtracting the annual-fee from the sum of the sign-up bonus plus any credits and benefits you can get in the first 12 months.. The estimated values used for various points and miles are listed in our post Estimated Values for Bank Points, Airline Miles, and Hotel Points. We do not use the face value if a credit is hard to use or comes with restrictions; instead, we estimate its actual value by some percentage of the face value of the credit.

Download our app: USCreditCardGuide and get notifications whenever there’s a good deal! Besides, you can also rank the sign up bonuses by customized points value in our app.

![]()

![]()

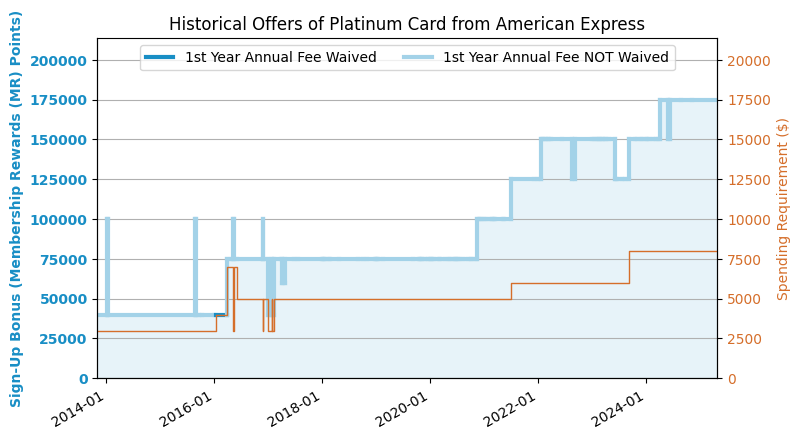

#:AmEx Platinum

175k

Offer

- The first year value is about $2,765.

- Sign-up bonus: 175,000 Membership Rewards (MR) Points.

- Spending requirement: $8,000 in 6 months.

- The points are worth about 1.6 cents/point.

- You can get $240 (estimated value) of various credits (Face values are: airline incidental credit $200, hotel credit $200, respectively. Actual values are estimated by 60% of face values) twice in the first year.

- You can get $180 (estimated value) of various credits (Face values are: Uber credit $200, Saks credit $100, respectively. Actual values are estimated by 60% of face values) once in the first year.

- $695 annual fee, NOT waived for the first year.

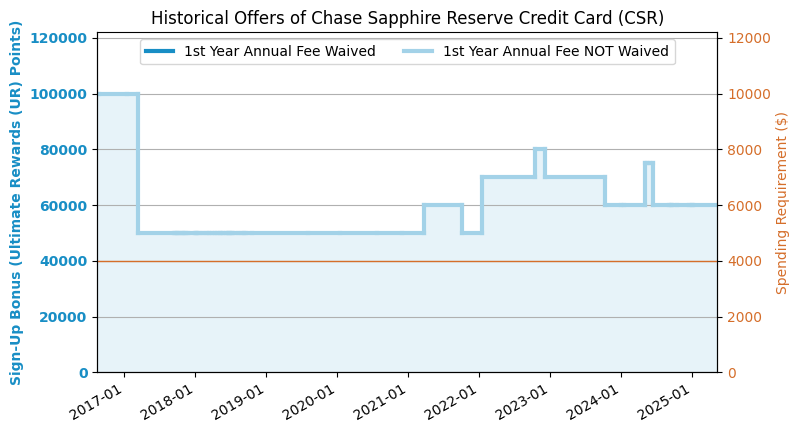

#:Chase Sapphire Reserve

100k

+$500 Offer

- The first year value is about $1,910.

- Sign-up bonus: 100,000 Ultimate Rewards (UR) Points + $500.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 1.6 cents/point.

- You can get $360 travel credit (easy) plus Doordash credit once in the first year.

- $550 annual fee, NOT waived for the first year.

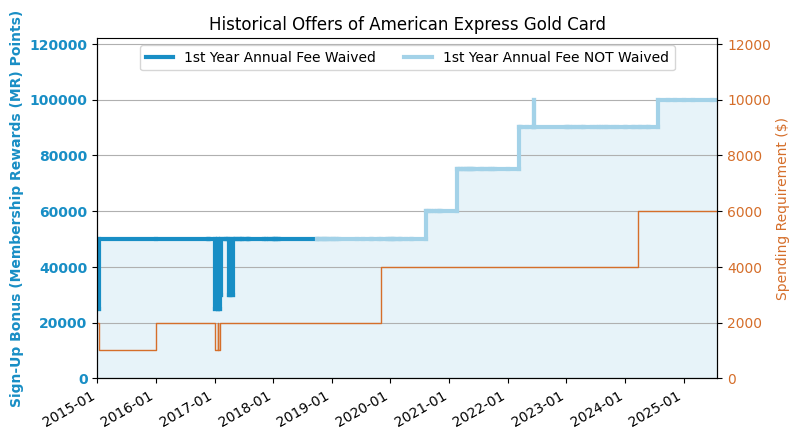

#:AmEx Gold

100k

Offer

- The first year value is about $1,419.

- Sign-up bonus: 100,000 Membership Rewards (MR) Points.

- Spending requirement: $6,000 in 6 months.

- The points are worth about 1.6 cents/point.

- You can get $144 (estimated value) of various credits ($120 face value for dining credit, $120 face value for Uber credit, and actual value is estimated by 60% of face value) once in the first year.

- $325 annual fee, NOT waived for the first year.

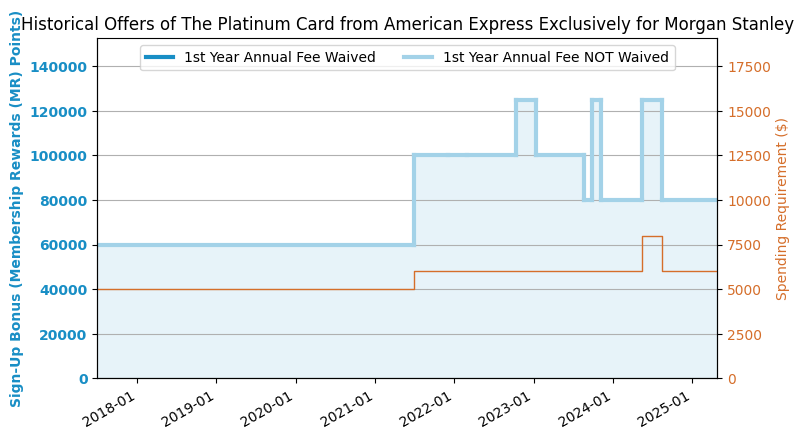

#:AmEx Platinum for Morgan Stanley

80k

Offer

- The first year value is about $1,245.

- Sign-up bonus: 80,000 Membership Rewards (MR) Points.

- Spending requirement: $6,000 in 3 months.

- The points are worth about 1.6 cents/point.

- You can get $240 (estimated value) of various credits (Face values are: airline incidental credit $200, hotel credit $200, respectively. Actual values are estimated by 60% of face values) twice in the first year.

- You can get $180 (estimated value) of various credits (Face values are: Uber credit $200, Saks credit $100, respectively. Actual values are estimated by 60% of face values) once in the first year.

- $695 annual fee, NOT waived for the first year.

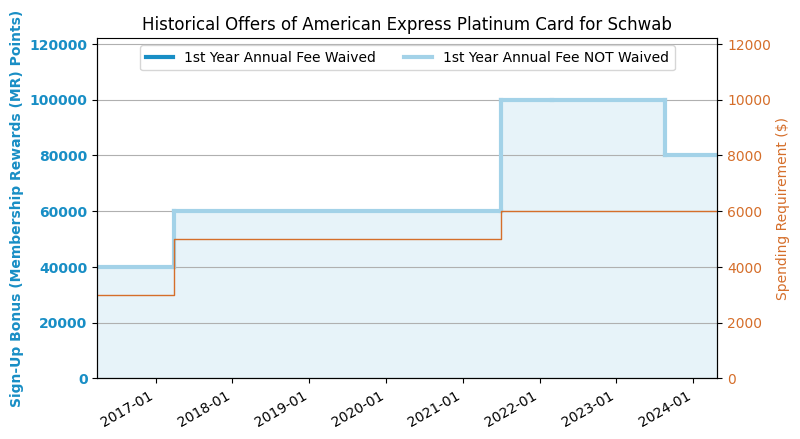

#:AmEx Platinum for Schwab

80k

Offer

- The first year value is about $1,245.

- Sign-up bonus: 80,000 Membership Rewards (MR) Points.

- Spending requirement: $6,000 in 6 months.

- The points are worth about 1.6 cents/point.

- You can get $240 (estimated value) of various credits (Face values are: airline incidental credit $200, hotel credit $200, respectively. Actual values are estimated by 60% of face values) twice in the first year.

- You can get $180 (estimated value) of various credits (Face values are: Uber credit $200, Saks credit $100, respectively. Actual values are estimated by 60% of face values) once in the first year.

- $695 annual fee, NOT waived for the first year.

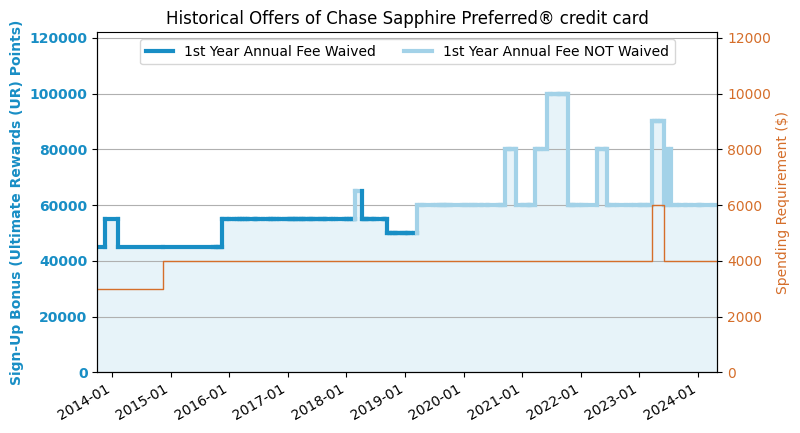

#:Chase Sapphire Preferred

75k

Offer

- The first year value is about $1,200.

- Sign-up bonus: 75,000 Ultimate Rewards (UR) Points.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 1.6 cents/point.

- $95 annual fee, waived for the first year.

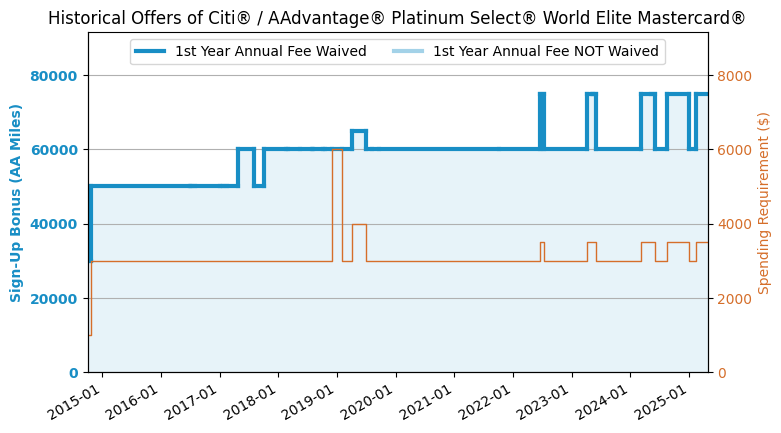

#:Citi AAdvantage Platinum Select

75k

Offer

- The first year value is about $1,125.

- Sign-up bonus: 75,000 AA Miles.

- Spending requirement: $3,500 in 4 months.

- The points are worth about 1.5 cents/point.

- $99 annual fee, waived for the first year.

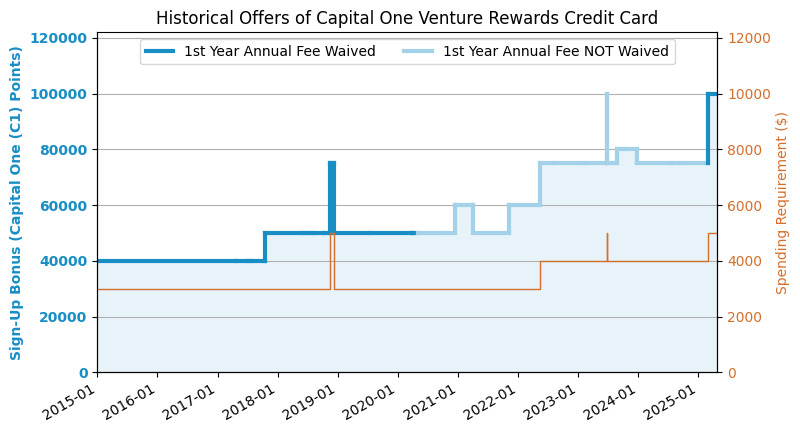

#:Capital One Venture

75k

Offer

- The first year value is about $1,105.

- Sign-up bonus: 75,000 Capital One (C1) Points.

- Spending requirement: $4,000 in 3 months.

- The points are worth about 1.6 cents/point.

- $95 annual fee, NOT waived for the first year.

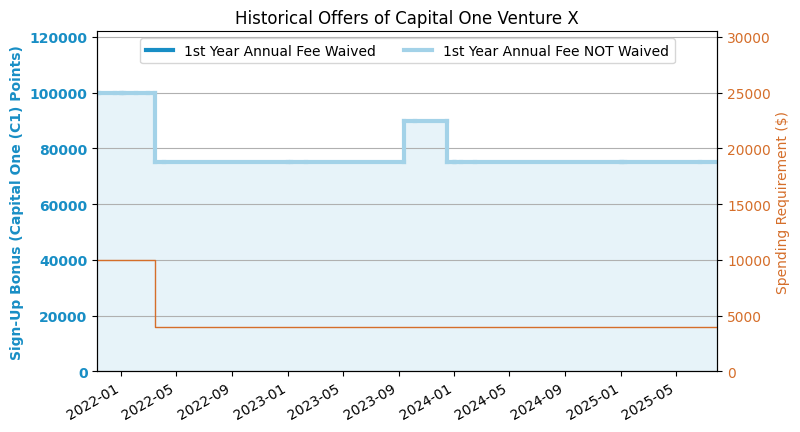

#:Capital One Venture X

75k

Offer

- The first year value is about $1,105.

- Sign-up bonus: 75,000 Capital One (C1) Points.

- Spending requirement: $4,000 in 3 months.

- The points are worth about 1.6 cents/point.

- You can get $300 Travel Credit once in the first year.

- $395 annual fee, NOT waived for the first year.

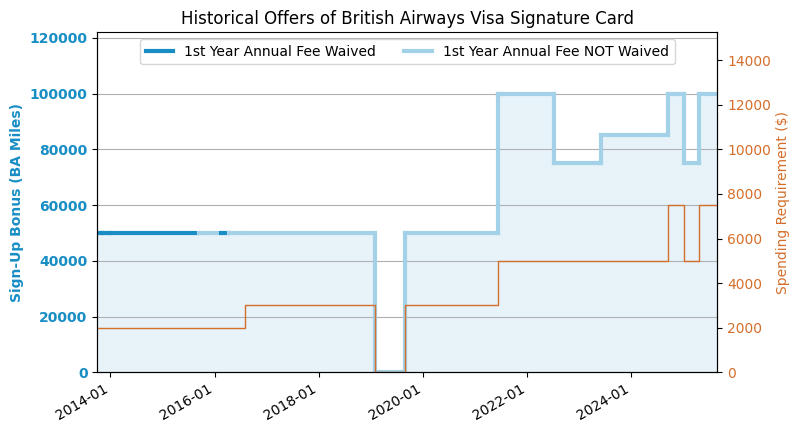

#:Chase British Airways

100k

Offer

- The first year value is about $1,105.

- Sign-up bonus: 100,000 BA Miles.

- Spending requirement: $7,500 in 6 months.

- The points are worth about 1.2 cents/point.

- $95 annual fee, NOT waived for the first year.

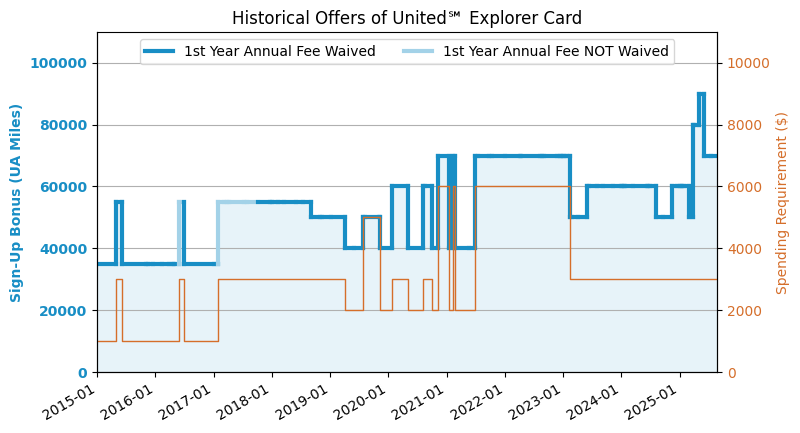

#:Chase United Explorer

75k

Offer

- The first year value is about $1,050.

- Sign-up bonus: 75,000 UA Miles.

- Spending requirement: $3,000 in 3 months.

- The points are worth about 1.4 cents/point.

- $150 annual fee, waived for the first year.

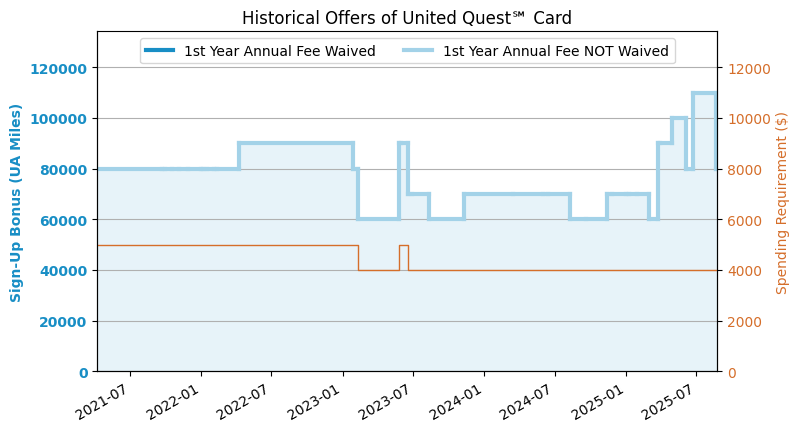

#:Chase United Quest

100k

Offer

- The first year value is about $1,050.

- Sign-up bonus: 100,000 UA Miles.

- Spending requirement: $4,000 in 3 months.

- The points are worth about 1.4 cents/point.

- $350 annual fee, NOT waived for the first year.

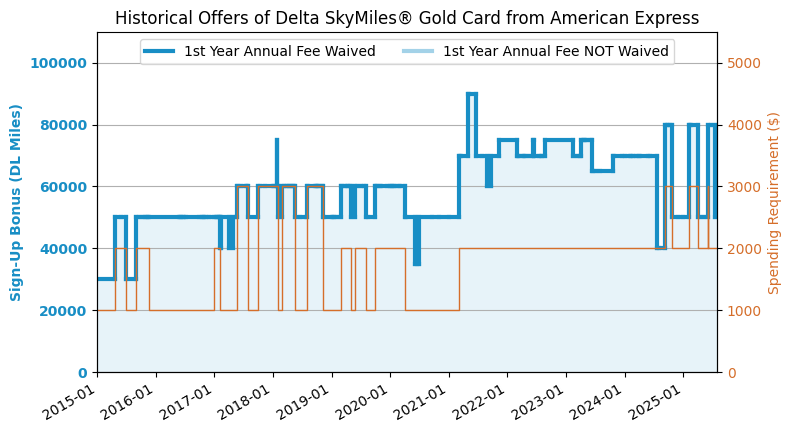

#:AmEx Delta SkyMiles Gold

80k

Offer

- The first year value is about $960.

- Sign-up bonus: 80,000 DL Miles.

- Spending requirement: $3,000 in 6 months.

- The points are worth about 1.2 cents/point.

- $150 annual fee, waived for the first year.

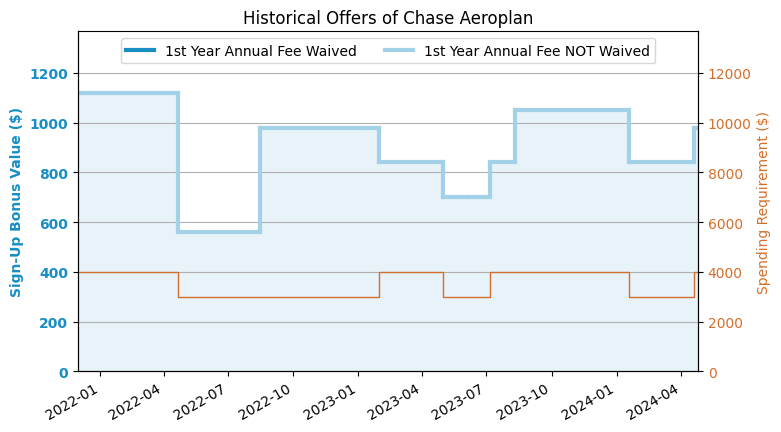

#:Chase Aeroplan

75k

Offer

- The first year value is about $955.

- Sign-up bonus: 75,000 AC Miles.

- Spending requirement: $4,000 in 3 months.

- The points are worth about 1.4 cents/point.

- $95 annual fee, NOT waived for the first year.

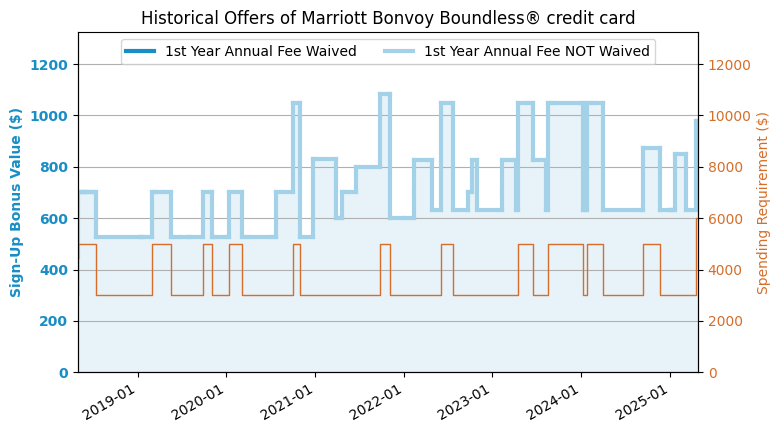

#:Chase Marriott Bonvoy Boundless

5FN Offer

- The first year value is about $955.

- Sign-up bonus: 5 Free Nights (up to 35k) which is worth about $1,050.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 0.7 cents/point.

- $95 annual fee, NOT waived for the first year.

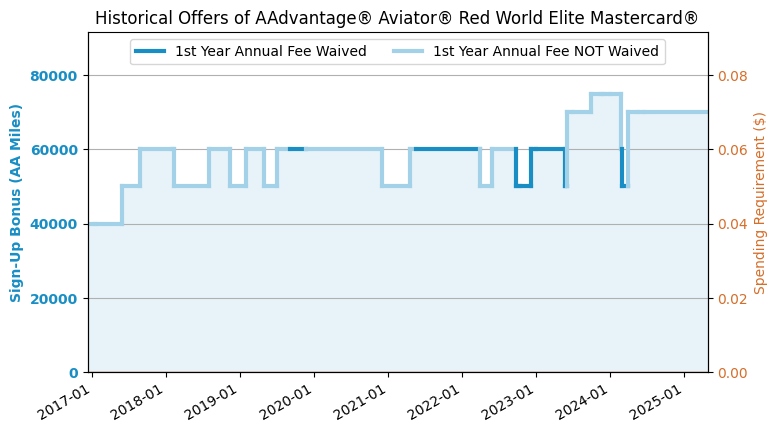

#:Barclays AAdvantage Aviator Red

70k

Offer

- The first year value is about $951.

- Sign-up bonus: 70,000 AA Miles.

- Spending requirement: one purchase in 3 months.

- The points are worth about 1.5 cents/point.

- $99 annual fee, NOT waived for the first year.

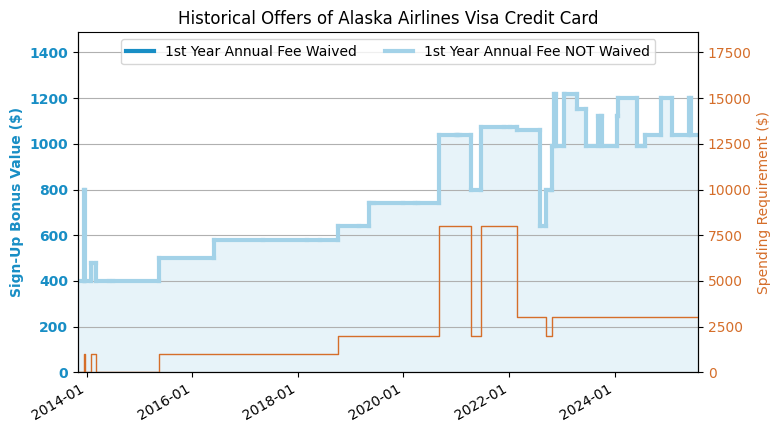

#:BoA Alaska

65k

Offer

- The first year value is about $945.

- Sign-up bonus: 65,000 AS Miles.

- Spending requirement: $3,000 in 3 months.

- The points are worth about 1.6 cents/point.

- $95 annual fee, NOT waived for the first year.

#:Barclays JetBlue Premier

70k

Offer

- The first year value is about $941.

- Sign-up bonus: 70,000 B6 Miles.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 1.2 cents/point.

- You can get $300 Paisly statement credits twice in the first year.

- $499 annual fee, NOT waived for the first year.

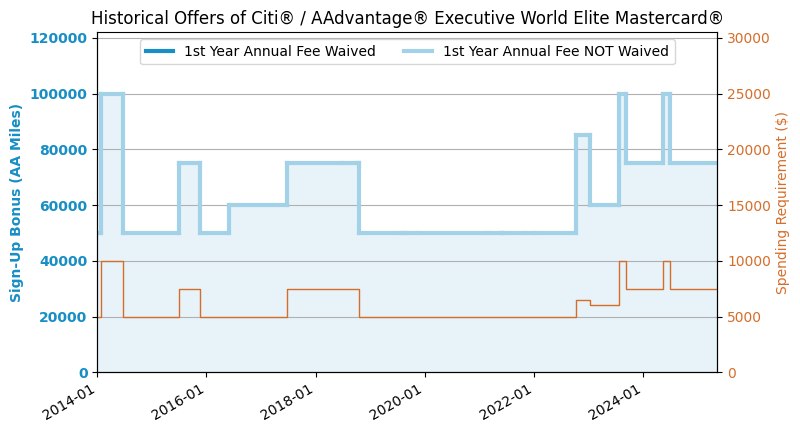

#:Citi AAdvantage Executive

100k

Offer

- The first year value is about $905.

- Sign-up bonus: 100,000 AA Miles.

- Spending requirement: $10,000 in 3 months.

- The points are worth about 1.5 cents/point.

- $595 annual fee, NOT waived for the first year.

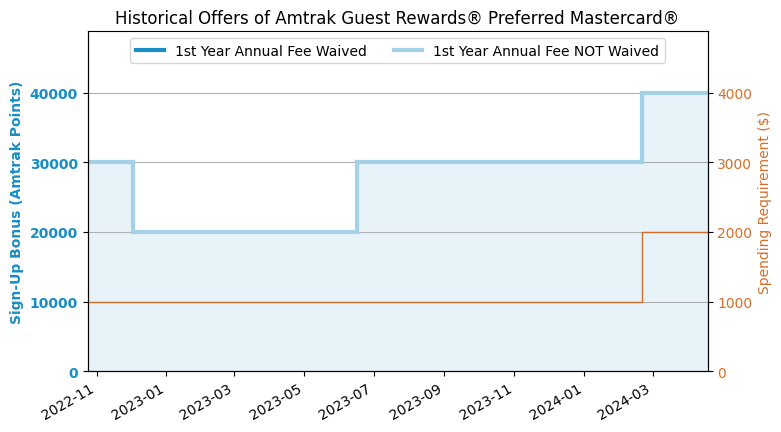

#:FNBO Amtrak Preferred

40k

Offer

- The first year value is about $901.

- Sign-up bonus: 40,000 Amtrak Points.

- Spending requirement: $2,000 in 3 months.

- The points are worth about 2.5 cents/point.

- $99 annual fee, NOT waived for the first year.

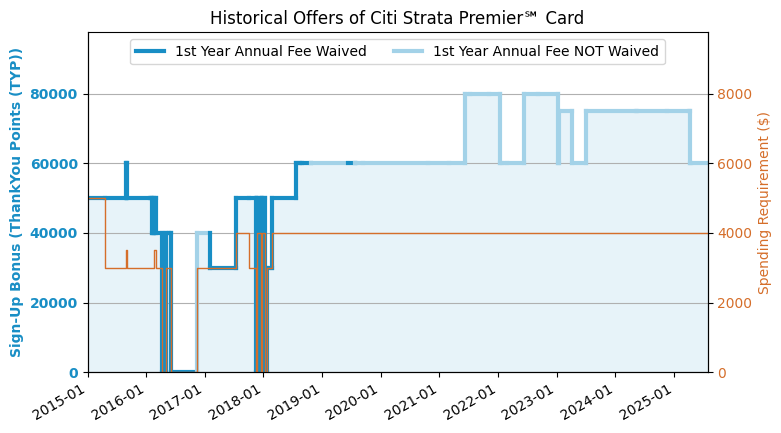

#:Citi Strata Premier

60k

Offer

- The first year value is about $865.

- Sign-up bonus: 60,000 ThankYou Points (TYP).

- Spending requirement: $4,000 in 3 months.

- The points are worth about 1.6 cents/point.

- $95 annual fee, NOT waived for the first year.

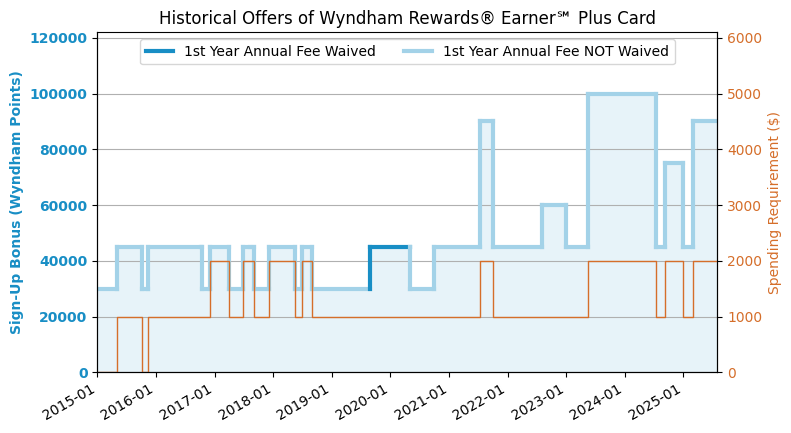

#:Barclays Wyndham Earner Plus

90k

Offer

- The first year value is about $831.

- Sign-up bonus: 90,000 Wyndham Points.

- Spending requirement: $2,000 in 3 months.

- The points are worth about 1 cents/point.

- $69 annual fee, NOT waived for the first year.

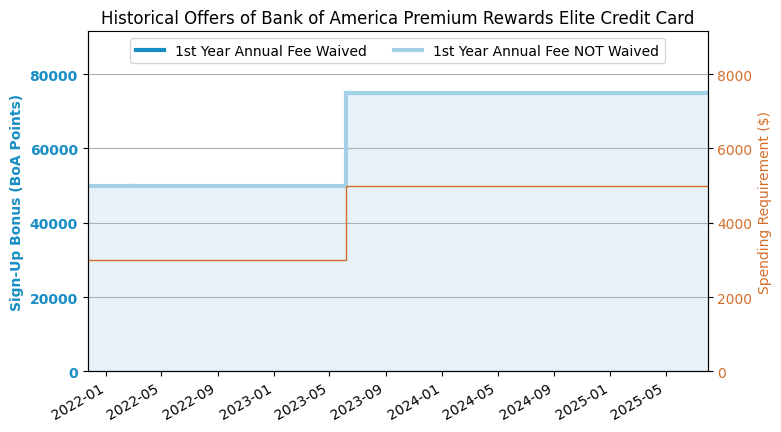

#:BoA Premium Rewards Elite

75k

Offer

- The first year value is about $830.

- Sign-up bonus: 75,000 BoA Points.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 1 cents/point.

- You can get $315 airline incidental fee credit and lifestyle credit (estimated value is 70% of face value) twice in the first year.

- $550 annual fee, NOT waived for the first year.

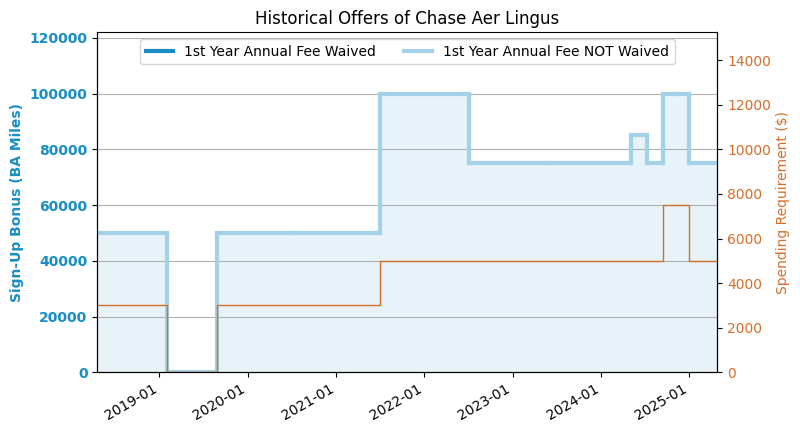

#:Chase Aer Lingus

75k

Offer

- The first year value is about $805.

- Sign-up bonus: 75,000 BA Miles.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 1.2 cents/point.

- $95 annual fee, NOT waived for the first year.

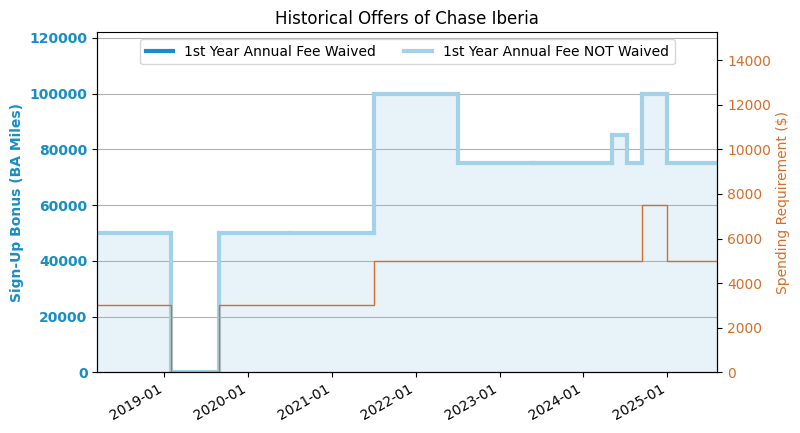

#:Chase Iberia

75k

Offer

- The first year value is about $805.

- Sign-up bonus: 75,000 BA Miles.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 1.2 cents/point.

- $95 annual fee, NOT waived for the first year.

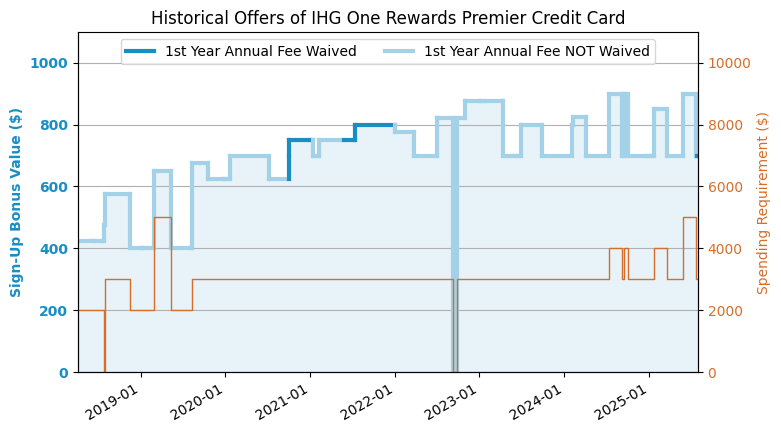

#:Chase IHG Premier

5FN Offer

- The first year value is about $801.

- Sign-up bonus: 5 Free Nights (up to 60k) which is worth about $900.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 0.5 cents/point.

- $99 annual fee, NOT waived for the first year.

#:Chase United Club

105k

Offer

- The first year value is about $775.

- Sign-up bonus: 105,000 UA Miles.

- Spending requirement: $5,000 in 3 months.

- The points are worth about 1.4 cents/point.

- $695 annual fee, NOT waived for the first year.

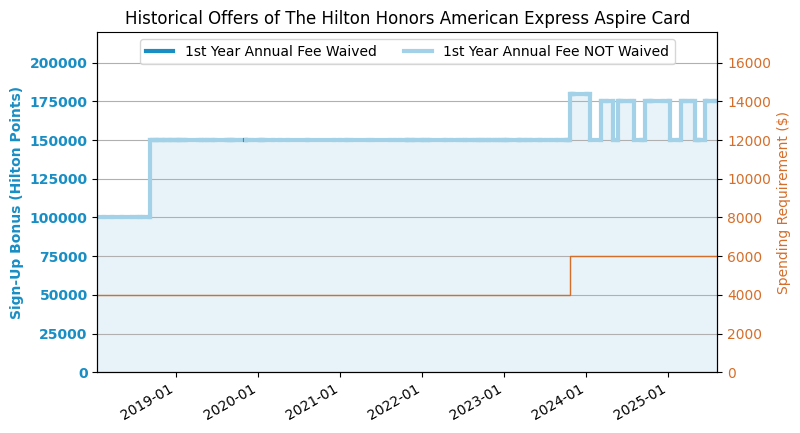

#:AmEx Hilton Aspire

175k

Offer

- The first year value is about $760.

- Sign-up bonus: 175,000 Hilton Points.

- Spending requirement: $6,000 in 6 months.

- The points are worth about 0.4 cents/point.

- You can get Weekend Free Night for the first year, worth about $250.

- You can get $360 (estimated value) of Air Credit plus Hilton resort credit ($200+$400 face value, and actual value is estimated by 60% of face value) once in the first year.

- $550 annual fee, NOT waived for the first year.

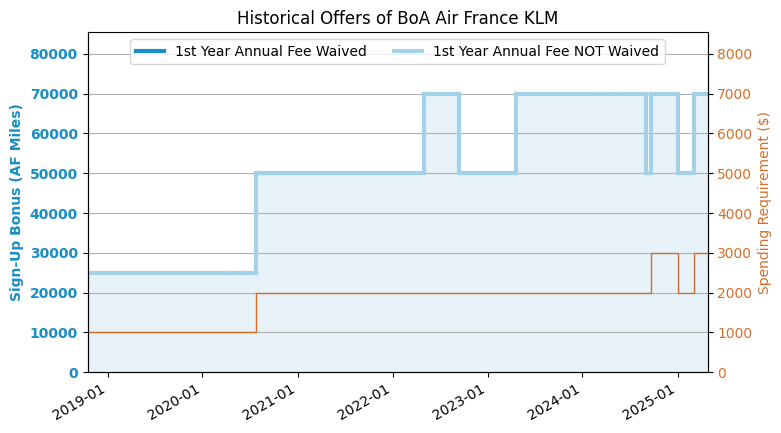

#:BoA Air France KLM

70k

Offer

- The first year value is about $751.

- Sign-up bonus: 70,000 AF Miles.

- Spending requirement: $3,000 in 3 months.

- The points are worth about 1.2 cents/point.

- $89 annual fee, NOT waived for the first year.

#:AmEx Delta SkyMiles Platinum

90k

Offer

- The first year value is about $730.

- Sign-up bonus: 90,000 DL Miles.

- Spending requirement: $4,000 in 6 months.

- The points are worth about 1.2 cents/point.

- $350 annual fee, NOT waived for the first year.

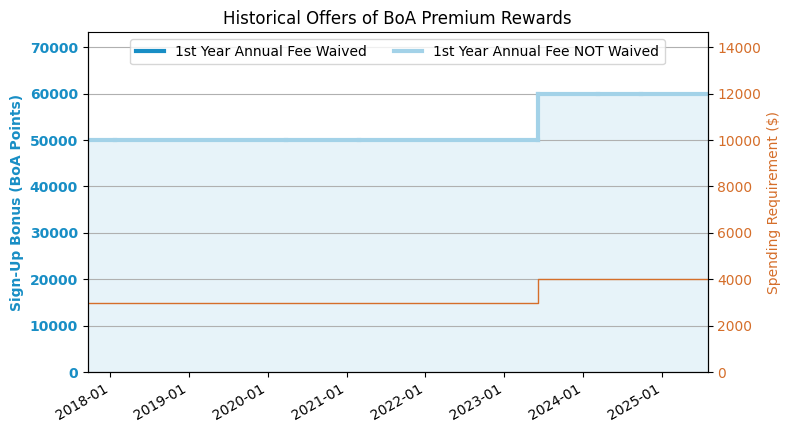

#:BoA Premium Rewards

60k

Offer

- The first year value is about $705.

- Sign-up bonus: 60,000 BoA Points.

- Spending requirement: $4,000 in 3 months.

- The points are worth about 1 cents/point.

- You can get $100 airline incidental fee credit twice in the first year.

- $95 annual fee, NOT waived for the first year.

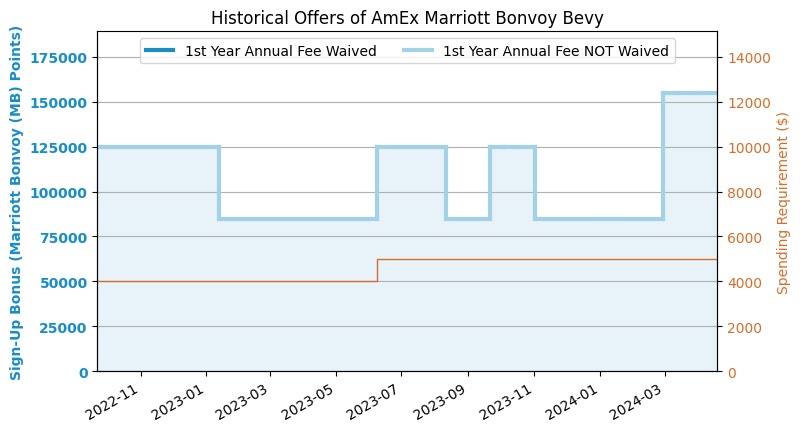

#:AmEx Marriott Bonvoy Bevy

135k

Offer

- The first year value is about $695.

- Sign-up bonus: 135,000 Marriott Bonvoy (MB) Points.

- Spending requirement: $7,000 in 6 months.

- The points are worth about 0.7 cents/point.

- $250 annual fee, NOT waived for the first year.

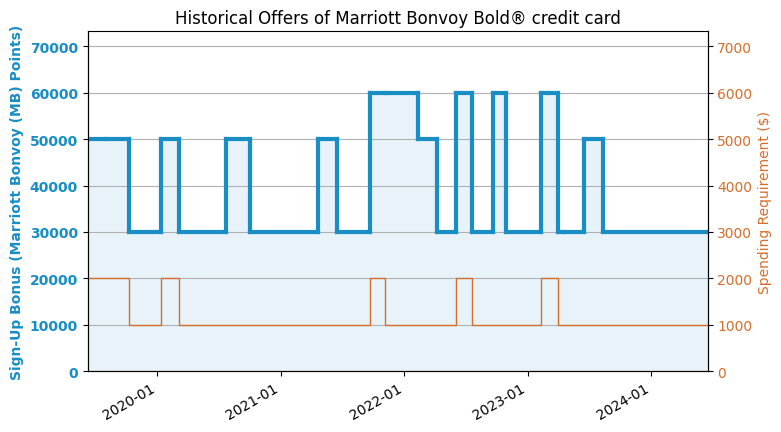

#:Chase Marriott Bonvoy Bold

60k

+$210 Offer

- The first year value is about $630.

- Sign-up bonus: 60,000 Marriott Bonvoy (MB) Points + $210.

- Spending requirement: $2,000 in 3 months.

- The points are worth about 0.7 cents/point.

- $0 annual fee.