Experian’s official app gives you free credit reports and alerts!

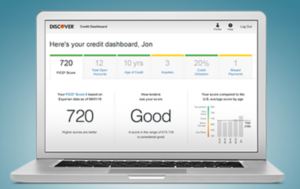

The Experian (EX) official app now gives you free credit reports and alerts! When you change your address, get a new hard pull, get a new account, etc., it will notify you immediately! The only drawback is that you can not see the FICO credit score for free ($9.99/month). But you can actually see the EX FICO score in the…

Read more