2021.8 Update: Data points are starting to trickle in on Reddit and DoC showing that fixed APR applications are no longer bypassing the Chase 5/24 rule. This includes Green Star/Black Star “Selected for You” and Pre-approved/Pre-qualified offers that would show up on the Chase app and website. The result of submitting an application is immediate denial and no evidence of bypassing this by calling in. It is currently unknown whether in-branch pre-approvals still bypass the 5/24 rule. This is a very recent change, as these offers worked for me within the past month. It was a good run.

Chase is one of our favorite banks because of their great credit card sign-up bonuses and benefits. For that reason, many people are eager to get additional Chase cards. Unfortunately, Chase implemented the following rule in May 2015:

if you have 5 or more new credit card accounts in the past 24 months, you will get automatically rejected, no matter how good your credit score is. This policy is called the 5/24 rule.

Note that many Chase employees don’t know this policy, and our readers have provided many data points of dealing with ignorant bankers. So before applying for a Chase credit card, you really need to learn details about the exact meaning and the solution for the 5/24 rule.

Contents

1. Which cards are affected by the 5/24 rule?

After 2018.11, all Chase cards are now affected by Chase 5/24 rule.

2. What is the exact meaning of 5 new accounts?

- New accounts include ALL credit cards that appear in your credit report as opened within the last 24 months. Credit cards and charge cards issued by other banks are included. The rule does not only apply to new Chase cards!

- New accounts that haven’t been added to your credit report do not count. If you receive a hard pull on your credit report but the account does not appear, it will not count. For example,

AmEx new accounts are usually reported to the credit bureaus after 2 statements[2021.5 Update] AmEx new accounts are reported to the credit bureaus after the first statement is generated. So if you have less than 5 new accounts on your credit report but have opened new AmEx cards, you should hurry up and apply for a Chase card before the AmEx accounts appear. This doesn’t work for new cards approved by Chase itself, since Chase can trace your new card in their internal system. Also note that Barclaycard will report the new account as soon as you get approved. - Closed cards, if they are opened within 24 months, also count.

- Business credit cards need some special discussion. Since Chase uses the data from your personal credit report to count towards 5/24 when you apply for Chase personal cards, if some business credit cards are not reported on your personal credit report, then they won’t be counted. Among the popular banks: AmEx, Barclays, BoA, Chase, Citi, US Bank will NOT report business credit cards to your personal credit report; Capital One, Discover WILL report business credit cards to your personal credit report, thus count towards 5/24.

- Authorized user counts toward the 5 new accounts limit. Generally speaking, authorized users can make purchases with a card without assuming payment liability, but Chase does indeed count this as a new account. Sometimes adding an authorized user does not require an SSN, but the credit bureau is still able to locate you based on name, birthday and other information, and add the information of authorized user to your credit report. So if someone has added you as authorized user, remember to check your credit report before applying for a new card of Chase. If you get a rejection, call the reconsideration department and ask the customer service representative to drop your authorized user accounts when counting the number of new accounts.

- Store credit cards are excluded from the definition of “new” credit card accounts here, because they are labeled differently in the credit report.

The exact definition of 24 months: Chase won’t tell us how they count months, so we can only guess based on available data points. If Experian is the only credit report Chase pulls in your area, then the data points on DoC show that 24 months actually means calendar months. For example, let’s assume a simple situation: if I got 5 cards on Feb 20, 2015, and no new accounts thereafter, I would be under 5/24 on Feb 1, 2017. I don’t need to wait until Feb 21, 2017 to get approved! In fact, if you obtain your credit report from Experian, you will find your account always starts on the 1st of the month you get approved, not the exact date.[2020.7 Update] Now Experian show exact date for account opening dates, not the 1st day of the month any longer. Therefore it’s highly likely that Chase also count cards based on exact date.

3. The ways to bypass the 5/24 rule

3.1. “Selected For You” [Expired]

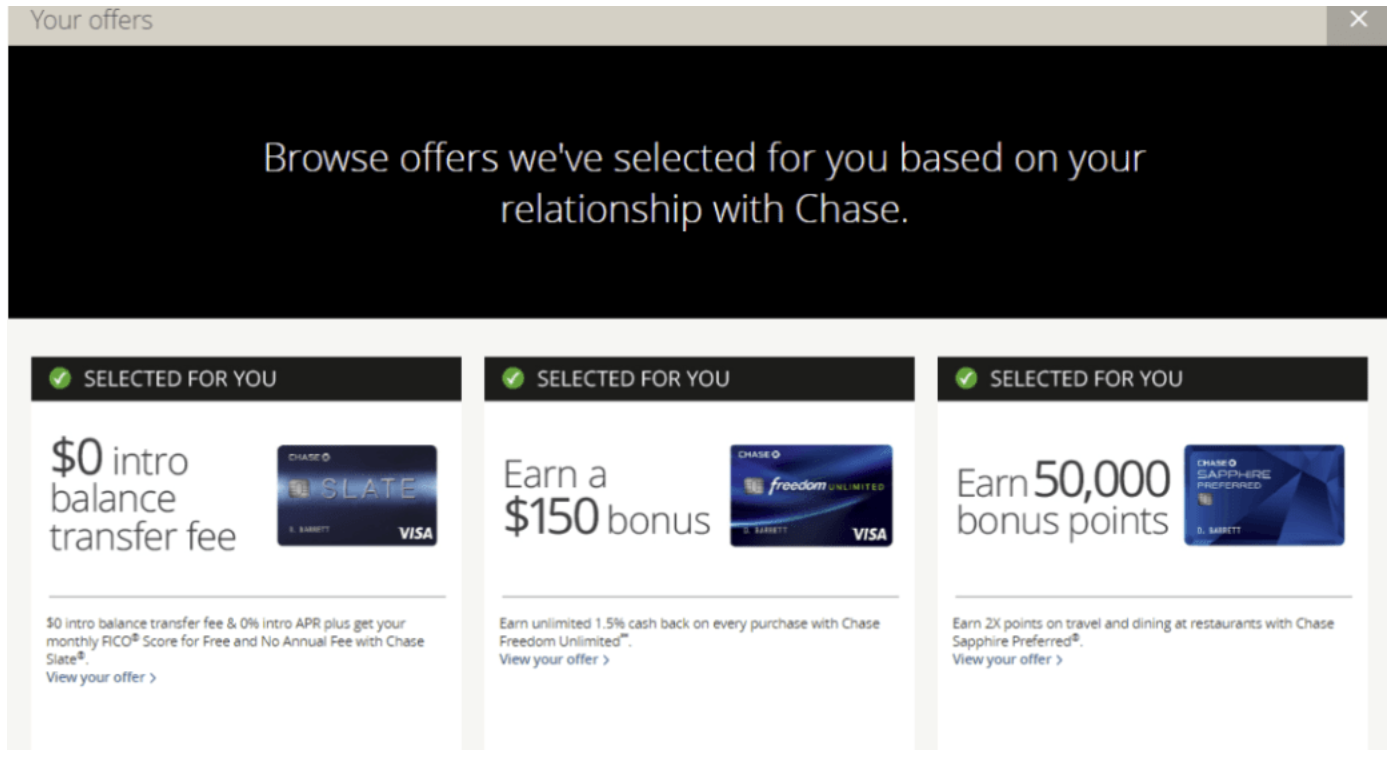

Go to Chase official website, click Main Menu – “Just for you”. If you can see “SELECTED FOR YOU” with green check mark, then you can bypass the 5/24 rule with these links! Other words don’t count, even with a green check mark. Remember to check whether you can see a fixed APR (explained later) in your terms to verify you can indeed bypass the 5/24 rule.

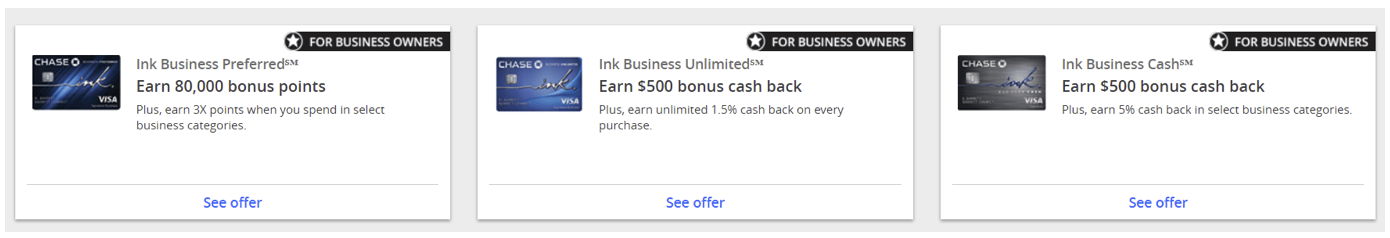

For business owners, the offers you are looking for are with words “FOR BUSINESS OWNERS” with black stars.

3.2. “You’re Already Approved” or “You’re Prequalified” [Expired]

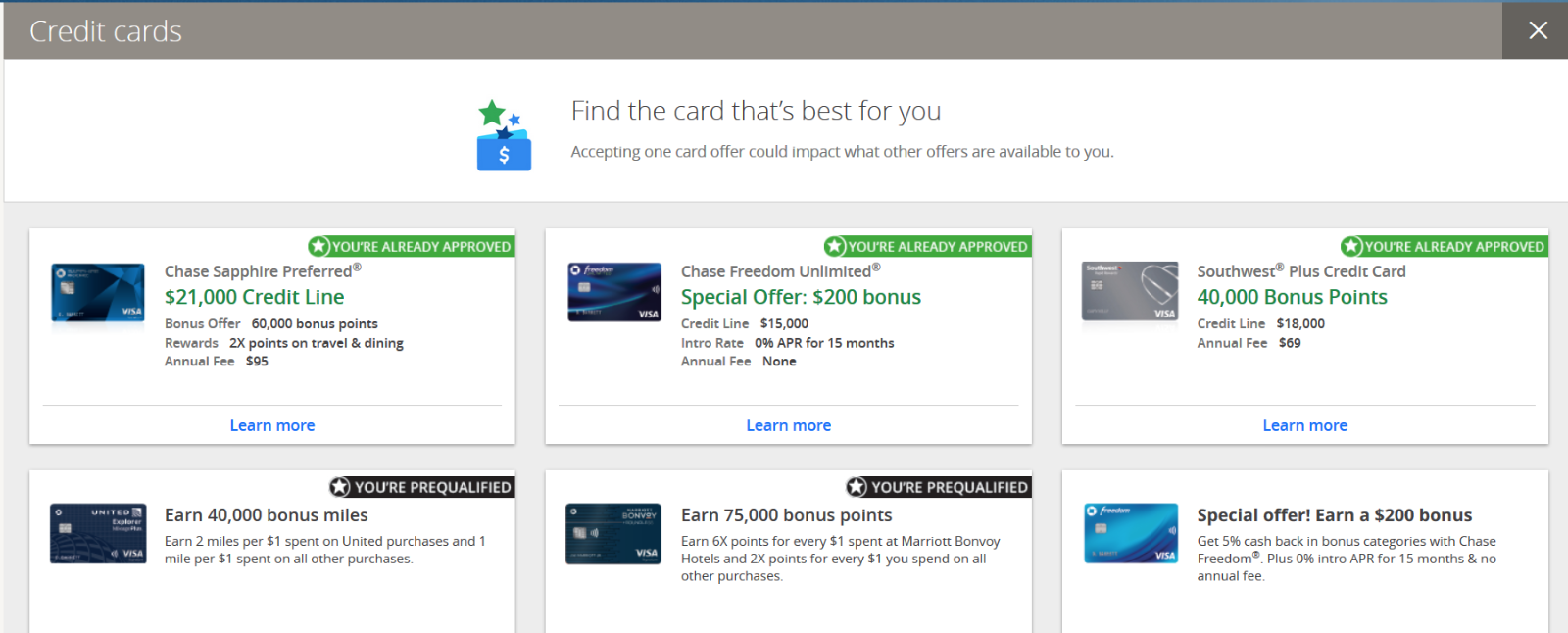

Go to Chase official website, click Main Menu – “Credit cards”. The offers with words “YOU’RE ALREADY APPROVED” or “YOU’RE PREQUALIFIED” can help you bypass the 5/24 rule. Again, remember to check whether you can see a fixed APR (explained later) in your terms to verify you can indeed bypass the 5/24 rule.

3.3. United APP Prequalified Offer [Expired]

Apart from Chase, there’s now another place to possibly see special targeted prequalified offers: in the United Airlines APP. In the homepage of the United APP, you should be able to see an ad about one of the UA credit cards, either business card or personal card. Click it, and check whether you can see “YOU’RE PREQUALIFIED” on the top. If your offer does not show these words, then that’s just a regular advertisement, not the special offer that can help you bypass the Chase 5/24 rule. As always, remember to check whether you can see a fixed APR (explained later) in your terms to verify you can indeed bypass the 5/24 rule.

Image Credit: FM.

3.4. In Branch Pre-approval Offer

This used to be the most effective way to bypass the 5/24 rule before the online methods appeared. Note that online prequalified offers and in branch pre-approval offers are different, online prequalified offers (also not the same as “Selected for you” offers) are not useful. Before your application in branch, let the banker search for pre-approval offers for you. If you get a pre-approval offer, you have to use that link to apply!

3.5. Mail Invitation

A mail offer with a RSVP code can bypass the 5/24 rule for UR cards. Note that RSVP codes dont work for the co-branded cards such as United, Hyatt, Marriott, Southwest, etc.

3.6. Business Relationship Manager

For business credit cards, you can ask a BRM (Business Relationship Manager) to file a paper application in branch to bypass 5/24.

3.7. Remember to Check whether you see a fixed APR! [Expired]

There is a general criteria for you to know whether you will bypass the 5/24 rule before submitting an application. If in the the deal terms you see a fixed APR, then it’s highly likely you have a true offer than ca bypass 5/24. If you see an APR range, then your offer will not bypass 5/24.

A fixed APR term is stated like this:

“0% fixed Intro APR for the first 12 months that your Account is open. After that, 14.74%. This APR will vary with the market based on the Prime Rate.”

An APR range term is stated like this:

“0% fixed Intro APR for the first 12 months that your Account is open. After that, 14.74% to 20.74%, based on your creditworthiness. These APRs will vary with the market based on the Prime Rate.”

4. Strategies towards 5/24

Based on this information, our recommended strategies include:

- For newbies, apply for the cards that are affected by 5/24 first, especially UR-earning cards like the Freedom/CFU/CSP/CSR.

- If you have 5 or more new accounts in the past 2 years including authorized user accounts, but less than 5 new accounts excluding the authorized user accounts, then call the reconsideration line after being declined and have them remove the authorized user accounts from their tally.

- If you have 5 or more new accounts in the past 2 years, you should try the bypass methods listed above. If you can not see any in branch pre-approval offers, you should wait to apply until 1) you can see those offers, which are frequently updated, or 2) you are under 5/24.

- Just move on if you don’t care about the Chase UR system. Both Amex Membership Rewards (MR) and Citi ThankYou Point (TYP) are points systems with a lot of value. Take redeeming points for a round-trip ticket between US and China as an example. You can transfer AmEx points for reward flights on ANA and Air Canada, which are Star Alliance members with United Airlines and Air China. This means you can use ANA or Air Canada miles to book reward flights with United or Air China. In this example, ANA even costs less points than booking directly with United miles.

- For those who can apply for business credit cards, since some banks such as AmEx does not report business credit cards to your personal credit report, you can apply for these business credit cards while waiting to go under 5/24.