Chase Freedom Flex℠ Credit Card Review

2025.7 Update: This card is in a strange state now: in this Freedom cards official webpage, this card has no application button; in this Chase all credit cards list official webpage, this card disappeared. However, referral links still work fine. The application link below on our site is the referral links that are working fine. Some customer representative said that this card is pulled for the month of Jul, and will be available again in Aug. We don’t know whether this card will be refreshed or discontinued in the near future.

2024.4 Update: The $200+5% on grocery&gas offer is expired. The current offer is $200.

2023.7 Update: There is a new $200+5% on grocery&gas offer. Screenshot. [2023.9 Update] Expired. The current offer is $200.

Contents

Offer Link

Benefits

- $200 offer: earn $200 cash back after spending $500 in the first 3 months.The recent best offer is $200+5% on grocery&gas.

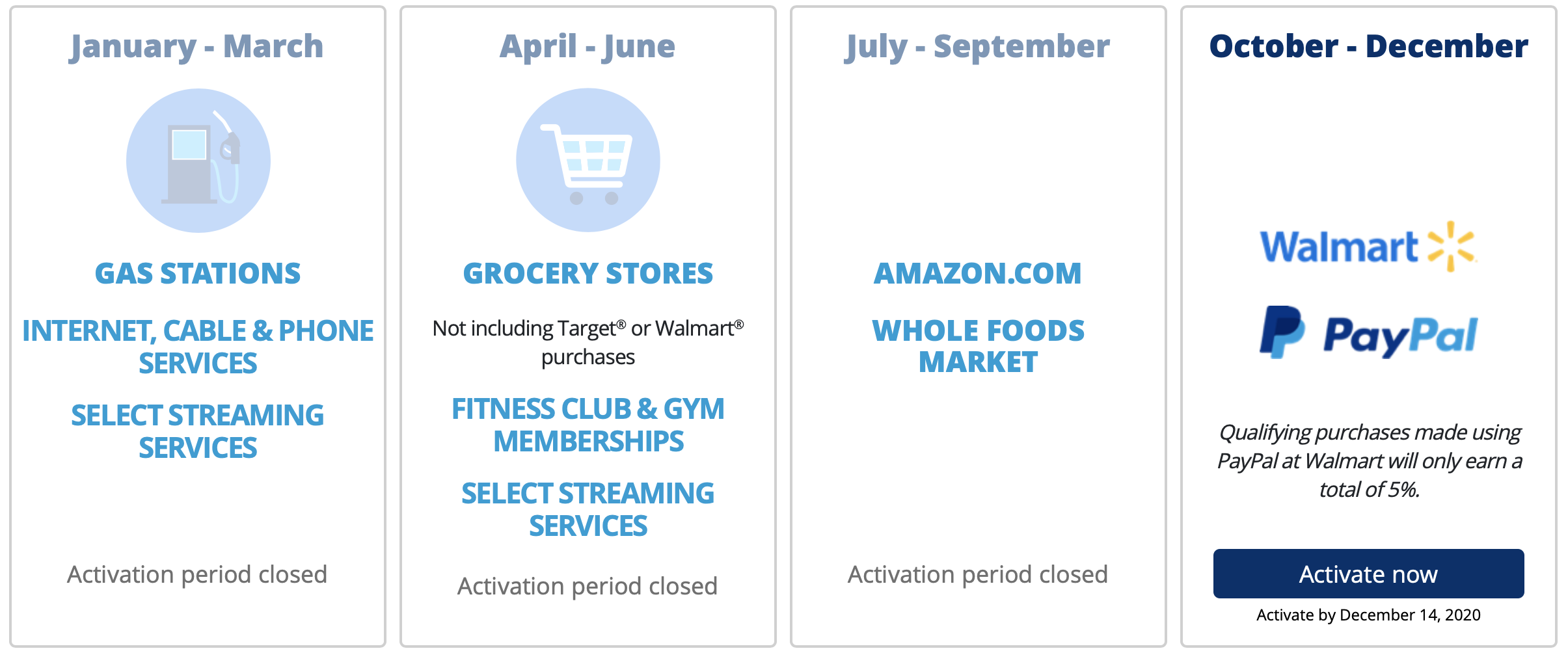

- Earn 5% cash back in each quarter’s bonus categories, 1% cash back on all other purchases. You need to activate beforehand, and the deadline is the 14th of the last month of each quarter, it won’t be activated automatically for a new card. For example, here is the bonus category calendar for 2020:

- Earn 5% cash back on travel purchased through Chase Ultimate Rewards, earn 3% cash back on dining (restaurants & delivery) and drugstore, and earn 1% cash back on all other purchases.

- Although this card is advertised as a cash back card, it actually earns Ultimate Rewards (UR) points: i.e. the $200 sign-up bonus is actually 20k UR points sign-up bonus, and the 5% cash back rate is actually 5x UR points earning rate. We estimate that UR points are worth about 1.6 cents/point, see below for a brief introduction. So the 20k sign-up bonus could be worth about $320, and the 5x UR points earning rate on bonus categories could be worth about 8%!

- Cell phone protection: get up to $800 per claim and $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill when you pay it with your eligible credit card. Deductible $50.

- Refer a friend: You can earn 10,000 bonus UR points for every approved account you refer, up to a maximum of 5 approved referrals (50,000 UR points) per calendar year.

- No annual fee.

Disadvantages

- You have a $1,500 cap in 5% bonus categories per quarter, which means you can earn up to 7.5k points per bonus category each quarter. After that, you earn 1 point per dollar spent.

- It has foreign transaction fee, so it's not a good choice outside the US.

Introduction to UR Points

- You can earn UR points with Chase Freedom Student, Chase Freedom, Chase Freedom Unlimited (CFU), Chase Sapphire Preferred (CSP), Chase Sapphire Reserve (CSR), Chase Ink Cash (Business), Chase Ink Unlimited (Business), Chase Ink Preferred (Business), etc.

- You can move your UR points from one UR card to another at any time.

- UR points never expire. You will lose the UR points on one card if you close the account, but you can prevent losing your UR points by moving the points to another UR card beforehand.

- If you have Chase Sapphire Preferred (CSP), Chase Sapphire Reserve (CSR), or Chase Ink Preferred (Business), UR points can be transferred to some hotel points. One of the best way to use UR points is to 1:1 transfer to Hyatt points. UR points can also be transferred to some airline miles. One of the most common and best way to use UR points is to 1:1 transfer them to United Airlines (UA) miles (Star Alliance), and combine them with the UA miles earned from the UA card. Other good options are: Southwest (WN) (Non-alliance), British Airways (BA) (Oneworld), Virgin Atlantic (VS) (Non-alliance), etc. If you use UR points in this way, the value is about 1.6 cents/point.

- If you have Chase Sapphire Reserve (CSR), you can redeem your UR points for up to 2.0 cents/point towards air tickets or hotels on Chase Travel with the "Points Boost" feature; if you have Chase Sapphire Preferred (CSP) or Chase Ink Preferred (Business), the value is up to 1.5 cpp (or 1.75 cpp for premium cabin).

- If you have any of the UR cards, you can redeem your UR points at a fixed rate 1 cent/point towards cash.

- In summary, we estimate that UR points are worth about 1.6 cents/point.

- For more information about UR points, see Maximize the Credit Card Points Values (overview), and Introduction to UR: How to Earn and Introduction to UR: How to Use (very detailed).

Recommended Application Time

- [5/24 Rule] If you have 5 or more new accounts opened in the past 24 months, Chase will not approve your application on this card, no matter how high your credit score is. The number of new accounts includes all credit card accounts, not only Chase accounts. See this post for details about how to possibly bypass this rule.

- This product is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months. Note that what matters here is the time you got the sign-up bonus, not the time you open the account or close the account.

- Don’t apply for more than 2 Chase credit cards within 30 days, or it’s highly likely that you will get rejected.

If you have more than $10,000 deposits in Chase checking, you can get this card even with no credit history at all. You can go to a branch and find a banker to apply for this credit card directly through Special Consideration.Special Consideration is no longer available.- We recommend you to apply for this card after you have a credit history for more than 8~9 months.

Note that you can not have more than one Freedom Flex card at the same time, therefore you can not increase its 5% bonus categories spending limit by holding multiple cards.[Update] Actual data points show that you can still get multiple of this card by product change.

Summary

This Chase Freedom Flex (CFF) card is an upgrade from the old Chase Freedom card. Pretty like the old Freedom card, you can mainly use it on the 3x (~4.8%) and 5x (~8%) bonus categories. After you accumulate enough UR points, you can apply for a CSP/CSR and then transfer these UR points to airline miles/hotel points to get maximum value out of your points. The old Freedom card is already a fantastic card, and this upgraded CFF card is even better! This card makes a lot of other dining credit cards less attractive. Everyone should have one!

You can apply directly for this card if under 5/24, otherwise you can do a product change (from other Freedom cards or Sapphire cards) to obtain it.

Related Credit Cards

- Chase Freedom Flex (CFF) (this post)

- Chase Freedom Unlimited (CFU)

- Old Chase Freedom

After Applying

- Call 800-436-7927 to check Chase application status. This is an automated telephone line, and the information has the following meanings: Receive decision in 2 weeks means your application is probably approved; Receive decision in 7-10 days means your application is probably rejected; Receive decision in 30 days simply means your application requires further review and there’s nothing to tell you for now.

- Chase reconsideration backdoor number: 888-270-2127 or 888-609-7805. Call it if you didn’t get approve immediately. Your personal information will be acquired and they will then review it. You seldom answer questions, instead, just enjoy the music and then you get approved or rejected, or further information is needed to be hand in to the branch or faxed.

Historical Offers Chart

Note that sometimes there is a $200 + 5% on grocery in the first year offer, and the latter part is not shown in the plot.

Offer Link

Editorial disclosure: Opinions express here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.