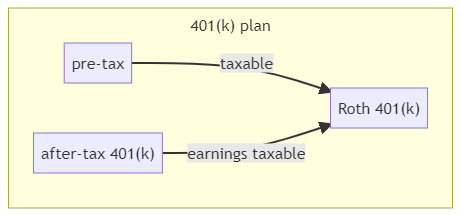

In-plan roth rollover始於2010年,指同一個401(k)plan中pre-tax 401(k)或者after-tax 401(k)向Roth 401(k) rollover的操作。根據本博之前的介紹,這些都是在同一個401(k) plan中的子賬戶,所以是”In-plan” rollover。

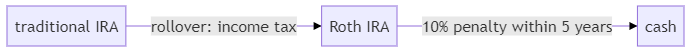

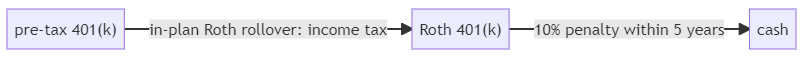

這個rollover操作是traditional IRA -> Roth IRA 在 401k 中的等價形式。複雜的地方在於它的取出規則(distribution rule)。取出涉及到recapture penalty,因此Roth 401(k)也設置了對應的5年規則,再考慮與Roth IRA的賬本合併就十分複雜了。

In-plan Roth rollover是Mega backdoor一個變種的必要操作(after-tax 401(k)->Roth 401(k)),通過Roth 401(k)做Mega backdoor的讀者可參考。

本文主要參考IRS關於in-plan Roth rollover的Notice 2010-84和Notice 2013-74。因細節瑣碎,參考這兩個Notice以Q&A形式組織。

Contents

- Q: 什麼是in-plan Roth Rollover?

- Q: 做in-plan Roth rollover需要滿足什麼條件?

- Q: In-plan Roth rollover是否影響Roth 401(k)的5-taxable-year period of participation

- Q: In-plan Roth rollover是否像Roth IRA一樣有另一個五年規則?

- Q: Roth 401(k)是否有ordering rule? 有多條in-plan Roth rollover怎麼辦?

- Q: 完成Roth 401(k) -> Roth IRA rollover之後,還有recapture penalty嗎?如何兼容Roth IRA的ordering rule?

- Q: In-plan Roth rollover在進入Roth IRA rollover之後,其recapture penalty的5年計時從何時開始?

- Q: 搞這麼清楚有什麼用?

Q: 什麼是in-plan Roth Rollover?

A: [Notice 2010-84 A1]的解答原文:

An “in-plan Roth rollover” is a distribution from an individual’s plan account, other than a designated Roth account, that is rolled over to the individual』s designated Roth account in the same plan, pursuant to new § 402A(c)(4) of the Code.

讀者若熟悉博客401(k)系列文章介紹的術語,應該能將之翻譯成俗話:in-plan Roth rollover是同一個401(k) plan中,非Roth 401(k)賬戶向Roth 401(k) 的rollover。這樣in-plan Roth rolloer這一詞彙中,in-plan指同一個401(k) plan,Roth指目的地為Roth 401(k)。

根據401(k)綜述,只有兩種主題圖中的兩種情況,即

pre-tax 401(k) -> Roth 401(k)

after-tax 401(k) -> Roth 401(k)

讀者可以將之類比為

traditional IRA -> Roth IRA

在401(k)中的表現形式,其中after-tax 401(k)可以理解為traditional IRA中的non-deductible contribution以及earning。

因此在該rollover發生的當年,移入金額中的pre-tax部分會計入收入,但因為rollover不屬於early distribution,所以沒有罰金。Pre-tax部分包括pre-tax 401(k)的全部,以及after-tax 401(k)中的earning。

Q: 做in-plan Roth rollover需要滿足什麼條件?

A: 目前的規定是只要401 (k) plan允許, vested部分都就可以轉[Notice 2013-74 A-1, A-2]。

Roth 401(k)中會區分轉入的金額中的otherwise distributable amount以及otherwise non-distributable amount。所謂otherwise distributable amount是指如果不轉入Roth 401(k),plan允許取出(但有可能有稅和10%的罰金)。例如允許in-service distribution的after-tax 401(k)內的資金。而otherwise non-distributable amount即如果不轉入Roth 401(k),plan不允許取出,例如在職時pre-tax 401(k)的elective deferral。

Otherwise non-distributable會維持non-distributable這個狀態,不然如下兩步操作將事實上造成pre-tax 401(k) elective deferral的in-service distribution:

pre-tax 401(k) -> Roth 401(k)

Roth 401(k) -> cash

評論提問:關於otherwise non-distributable amount,做了Roth 401(k)-> Roth 401(k)後可以取出嗎?

A: 根據26 CFR § 1.402A-1 Q-9中的加粗部分文字

Q–9. Can an employee have more than one separate contract for designated Roth contributions under a plan qualified under section 401(a) or a section 403(b) plan?

A–9. (a) Except as otherwise provided in paragraph (b) of this A–9, for purposes of section 72, there is only one separate contract for an employee with respect to the designated Roth contributions under a plan. Thus, if a plan maintains one separate account for designated Roth contributions made under the plan and another separate account for rollover contributions received from a designated Roth account under another plan (so that the rollover account is not required to be subject to the distribution restrictions otherwise applicable to the account consisting of designated Roth contributions made under the plan), both separate accounts are considered to be one contract for purposes of applying section 72 to the distributions from either account.

關於

old Roth 401(k) -> new Roth 401(k)

new Roth 401(k)的券商可以在內部設立一個單獨的rollover account管理rollover過來的錢以及未來的盈利。這個rollover account內的錢根據稅法是distributable的,因為在離職的時候,old Roth 401(k)變成了distributable。

但以上只是說稅法規定可以是distributable,new 401(k) plan也可以選擇簡化管理讓它在實際操作中成為non-distributable。

old Roth 401(k) -> new Roth 401(k)的過程中需要移交的記錄有old Roth 401(k)的第一筆存入時間(因為涉及五年規則),每一筆IRR的金額、時間,是否taxable。假如new Roth 401(k) plan有取出,則涉及到所有這些賬戶的pro rata rule,十分複雜。一些plan為了節約管理成本會規定地更嚴格,額外規定plan的取出限制。

Q: In-plan Roth rollover是否影響Roth 401(k)的5-taxable-year period of participation

A: [Notice 2013-74 A-8]: 如果in-plan Roth rollover是該Roth 401(k)的第一筆存入,則5-taxable-year period of participation從這一筆存入開始計時。

【註:Roth IRA對應的5-year non-exclusion period計時開始時間只能是第一筆regular contribution所在的tax year,而不能是第一筆traditional IRA -> Roth IRA rollover】

Q: In-plan Roth rollover是否像Roth IRA一樣有另一個五年規則?

A: [Notice 2010-84 A12]:

Yes, pursuant to §402A(c)(4)(D) and 408A(d)(3)(F), if an amount allocable to the taxable amount of an in-plan Roth rollover is distributed within the 5-taxable-year period beginning with the first day of the participant』s taxable year in which the rollover was made, the amount distributed is treated as includible in gross income for the purpose of applying §72(t) to the distribution.

有,而且設計意圖與方法(通過引用Sec. 72(t))與Roth IRA完全相同。

不滿足qualified distribution條件,直接從traditional IRA取錢有收入稅以及額外的10% penalty。資金如果先rollover到Roth IRA,則當年只交收入稅;只有在5年內從Roth IRA取出(按照ordering rule),才會recapture 10% penalty。

In-plan Roth rollover類似,如果5年內取出其中的taxable portion,則會recapture 10% penalty

Q: Roth 401(k)是否有ordering rule? 有多條in-plan Roth rollover怎麼辦?

A: Roth 401(k)的取錢規則依然是pro-rata rule,但在分配給in-plan Roth rollover部分時,是仿照Roth IRA的規則,先進先出,同一年taxable的部分先分配。

這個規則來自於[Notice 2010-84 A-13]的例子,我們取一個簡化版本: Peter 2020年時做了一筆100k的in-plan Roth rollover,其中10k是non-taxable的。2020年年底時,Peter的Roth 401(k)賬目是

| Roth 401(k) funds | amount |

| designated Roth contribution | 80k |

| in-plan Roth rollover (taxable) | 90k |

| in-plan Roth rollover (non-taxable) | 10k |

| earning | 20k |

Peter不滿59.5歲,若2020年年底從Roth 401(k)中取出50k,其稅務應如何計算?

- 首先按照pro-rata rule,計算出basis與earning的比例

earning: 50k * 20k / ( 80k + 90k + 10k + 20k ) = 5k

basis: 50k – 5k = 45k

也即earning佔10%,basis佔90%。

- 計算ordinary income

earning + taxable in-plan Roth rollover this year = 5k + 90k = 95k

這95k計入2020年的收入,要繳收入稅

- 計算五年規則的罰金

- 取出的5k earning有10%的罰金,即需繳0.5k

- 假如Peter取出的50k為in-service distribution。而elective deferral不允許這樣取,所以basis的45k全部分配給in-plan Roth rollover中的taxable portion(Notice 2010-84 A-13的例子是這樣計算的)。因為不滿5年,有10%的罰金,即需繳4.5k

- 假如Peter是離職後取出的50k,那麼可以要求將這45k全部分配給designated Roth contribution,因為elective deferral在離職後可以取出。這樣45k這部分沒有罰金。

當有多筆in-plan Roth rollover時,根據Publication 575,每一年的in-plan Roth rollover有單獨的5年規則計時

You must generally pay the 10% additional tax on any amount attributable to the part of the in-plan Roth rollover that you had to include in income (recapture amount). A separate 5-year period applies to each in-plan Roth rollover.

Publication 575關於in-plan Roth rollover的Recapture Allocation Chart要求從前往後逐年填入1040中in-plan Roth rollover的taxable和non-taxable部分,因此可以在各年in-plan Roth rollover的分配是先進先出,而且taxable part優先。

所以總結一下,當Roth 401(k)的賬目中同時存在designated Roth contribution, in-plan Roth rollover (taxable), in-plan Roth rollover (non-taxable)以及earning四個部分時,其取出規則為

- 先按pro-rata rule分配earning的份額

- 離職後可以先分配給designated Roth contribution

- 剩餘的in-plan Roth rollover按照Roth IRA對於rollover的ordering rule處理

Q: 完成Roth 401(k) -> Roth IRA rollover之後,還有recapture penalty嗎?如何兼容Roth IRA的ordering rule?

A: 首先根據[Notice 2010-84 A-12]:

The 5-year recapture rule in this Q&A-12 does not apply to a distribution that is rolled over to another designated Roth account of the participant or to a Roth IRA owned by the participant; however, the rule does apply to subsequent distributions made from such other designated Roth account or Roth IRA within the 5-taxable-year period.

recapture penalty 在Roth 401(k) -> Roth IRA之後還是適用的。

其次我們注意到Roth IRA與Roth 401(k)賬目的平行結構:

| Roth 401(k) | –> | Roth IRA |

| designated Roth contribution | –> | regular contribution |

| in-plan Roth rollover (taxable) | –> | taxable conversion |

| in-plan Roth rollover (non-taxable) | –> | non-taxable conversion |

| Roth 401 (k) earning | –> | Roth IRA earning |

正如這個結構所暗示的,Roth 401(k) -> Roth IRA之後只要將同類的項目合併即可。這樣in-plan Roth rollover會在Roth IRA等效的看成ordering rule中的conversion來處理。

這其中, designated Roth contribution以及Roth 401(k)在Roth IRA中的對應關係已由CFR Sec. 408A-10 Q3 A3明確解答。

In-plan Roth rollover的歸屬存在一定爭議。在Form 8606 Line 24,記錄Roth IRA taxable conversion的這一行,instruction寫道:

Don』t include amounts rolled in from a designated Roth account since these amounts are included on line 22.

而Line 22記錄的則是Roth IRA的(regular) basis。

但是根據Publication 590B Appendix C的Recapture Allocation Chart,Roth IRA中的taxable/non-taxable rollover從前往後排的數字來自於1040中記錄retirement account中nontaxable/taxable rollover這一項,而這一項是包含了in-plan Roth rollover的。所以實際上in-plan Roth rollover是與Roth IRA的其他conversion合併在了一起。

總結:Roth 401(k) -> Roth IRA按表格將同類賬目合併。

Q: In-plan Roth rollover在進入Roth IRA rollover之後,其recapture penalty的5年計時從何時開始?

A: 計時從in-plan Roth rollover發生時,而不是Roth 401(k) -> Roth IRA rollover時開始。

理由仍然是Publication 590B Appendix C的Recapture Allocation Chart。在這裡所有Roth IRA的taxable/non-taxable rolloer是根據報稅的年份列出。In-plan Roth rollover,無論是否taxable,都只會出現在進入Roth 401(k)那一年的稅表,而不(一定)是Roth 401(k) -> Roth IRA,因為in-plan Roth rollover進入Roth IRA的過程是沒有收入稅的。

例子:假設Peter在2015年做了pre-tax 401(k) -> Roth 401(k) rollover。2020年,Peter將Roth 401(k)中的資金全部移入Roth IRA。這樣2015年的這筆in-plan Roth rollover在2015年是taxable的,2020年進入Roth IRA時已是第六個tax year,因此可以按照ordering rule,隨時無稅無罰地取出。

Q: 搞這麼清楚有什麼用?

In-plan Roth rollover主要有兩大用途

在稅率低的年份,將一部分pre-tax 401(k)轉入Roth 401(k),調整pre-tax/Roth比例。

通過

after-tax 401(k) -> Roth 401(k) -(after separation of service)-> Roth IRA

實現mega backdoor的一個變種。搞清楚recapture penalty的五年規則後,我們可以理解與一般的mega backdoor

after-tax 401(k) -> Roth IRA

在取錢順序上幾乎沒有區別。

參考資料:Notice 2010-84, Notice 2013-74, CFR Sec. 402A-1, Federal Register, CFR Sec. 408 A-10: Coordination between designated Roth accounts and Roth IRAs, Publication 575, Publication 590-B

免責聲明:本文及其中任何文字均僅為一般性的介紹,絕不構成任何法律意見或建議,不得作為法律意見或建議以任何形式被依賴,我們對其不負擔任何形式的責任。我們強烈建議您,若有稅務問題,請立即諮詢專業的稅務律師或稅務顧問。

Disclaimer: This article and any content herein are general introduction for readers only, and shall not constitute nor be relied on as legal opinion or legal advice in any form. We assume no liability for anything herein. If you need help about tax, please talk to a tax, legal or accounting advisor immediately.