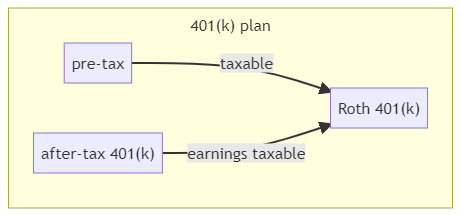

In-plan roth rollover始于2010年,指同一个401(k)plan中pre-tax 401(k)或者after-tax 401(k)向Roth 401(k) rollover的操作。根据本博之前的介绍,这些都是在同一个401(k) plan中的子账户,所以是”In-plan” rollover。

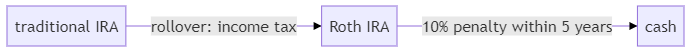

这个rollover操作是traditional IRA -> Roth IRA 在 401k 中的等价形式。复杂的地方在于它的取出规则(distribution rule)。取出涉及到recapture penalty,因此Roth 401(k)也设置了对应的5年规则,再考虑与Roth IRA的账本合并就十分复杂了。

In-plan Roth rollover是Mega backdoor一个变种的必要操作(after-tax 401(k)->Roth 401(k)),通过Roth 401(k)做Mega backdoor的读者可参考。

本文主要参考IRS关于in-plan Roth rollover的Notice 2010-84和Notice 2013-74。因细节琐碎,参考这两个Notice以Q&A形式组织。

Contents

- Q: 什么是in-plan Roth Rollover?

- Q: 做in-plan Roth rollover需要满足什么条件?

- Q: In-plan Roth rollover是否影响Roth 401(k)的5-taxable-year period of participation

- Q: In-plan Roth rollover是否像Roth IRA一样有另一个五年规则?

- Q: Roth 401(k)是否有ordering rule? 有多条in-plan Roth rollover怎么办?

- Q: 完成Roth 401(k) -> Roth IRA rollover之后,还有recapture penalty吗?如何兼容Roth IRA的ordering rule?

- Q: In-plan Roth rollover在进入Roth IRA rollover之后,其recapture penalty的5年计时从何时开始?

- Q: 搞这么清楚有什么用?

Q: 什么是in-plan Roth Rollover?

A: [Notice 2010-84 A1]的解答原文:

An “in-plan Roth rollover” is a distribution from an individual’s plan account, other than a designated Roth account, that is rolled over to the individual’s designated Roth account in the same plan, pursuant to new § 402A(c)(4) of the Code.

读者若熟悉博客401(k)系列文章介绍的术语,应该能将之翻译成俗话:in-plan Roth rollover是同一个401(k) plan中,非Roth 401(k)账户向Roth 401(k) 的rollover。这样in-plan Roth rolloer这一词汇中,in-plan指同一个401(k) plan,Roth指目的地为Roth 401(k)。

根据401(k)综述,只有两种主题图中的两种情况,即

pre-tax 401(k) -> Roth 401(k)

after-tax 401(k) -> Roth 401(k)

读者可以将之类比为

traditional IRA -> Roth IRA

在401(k)中的表现形式,其中after-tax 401(k)可以理解为traditional IRA中的non-deductible contribution以及earning。

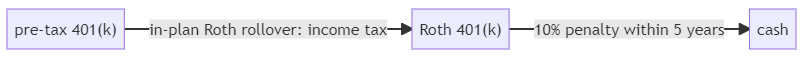

因此在该rollover发生的当年,移入金额中的pre-tax部分会计入收入,但因为rollover不属于early distribution,所以没有罚金。Pre-tax部分包括pre-tax 401(k)的全部,以及after-tax 401(k)中的earning。

Q: 做in-plan Roth rollover需要满足什么条件?

A: 目前的规定是只要401 (k) plan允许, vested部分都就可以转[Notice 2013-74 A-1, A-2]。

Roth 401(k)中会区分转入的金额中的otherwise distributable amount以及otherwise non-distributable amount。所谓otherwise distributable amount是指如果不转入Roth 401(k),plan允许取出(但有可能有税和10%的罚金)。例如允许in-service distribution的after-tax 401(k)内的资金。而otherwise non-distributable amount即如果不转入Roth 401(k),plan不允许取出,例如在职时pre-tax 401(k)的elective deferral。

Otherwise non-distributable会维持non-distributable这个状态,不然如下两步操作将事实上造成pre-tax 401(k) elective deferral的in-service distribution:

pre-tax 401(k) -> Roth 401(k)

Roth 401(k) -> cash

评论提问:关于otherwise non-distributable amount,做了Roth 401(k)-> Roth 401(k)后可以取出吗?

A: 根据26 CFR § 1.402A-1 Q-9中的加粗部分文字

Q–9. Can an employee have more than one separate contract for designated Roth contributions under a plan qualified under section 401(a) or a section 403(b) plan?

A–9. (a) Except as otherwise provided in paragraph (b) of this A–9, for purposes of section 72, there is only one separate contract for an employee with respect to the designated Roth contributions under a plan. Thus, if a plan maintains one separate account for designated Roth contributions made under the plan and another separate account for rollover contributions received from a designated Roth account under another plan (so that the rollover account is not required to be subject to the distribution restrictions otherwise applicable to the account consisting of designated Roth contributions made under the plan), both separate accounts are considered to be one contract for purposes of applying section 72 to the distributions from either account.

关于

old Roth 401(k) -> new Roth 401(k)

new Roth 401(k)的券商可以在内部设立一个单独的rollover account管理rollover过来的钱以及未来的盈利。这个rollover account内的钱根据税法是distributable的,因为在离职的时候,old Roth 401(k)变成了distributable。

但以上只是说税法规定可以是distributable,new 401(k) plan也可以选择简化管理让它在实际操作中成为non-distributable。

old Roth 401(k) -> new Roth 401(k)的过程中需要移交的记录有old Roth 401(k)的第一笔存入时间(因为涉及五年规则),每一笔IRR的金额、时间,是否taxable。假如new Roth 401(k) plan有取出,则涉及到所有这些账户的pro rata rule,十分复杂。一些plan为了节约管理成本会规定地更严格,额外规定plan的取出限制。

Q: In-plan Roth rollover是否影响Roth 401(k)的5-taxable-year period of participation

A: [Notice 2013-74 A-8]: 如果in-plan Roth rollover是该Roth 401(k)的第一笔存入,则5-taxable-year period of participation从这一笔存入开始计时。

【注:Roth IRA对应的5-year non-exclusion period计时开始时间只能是第一笔regular contribution所在的tax year,而不能是第一笔traditional IRA -> Roth IRA rollover】

Q: In-plan Roth rollover是否像Roth IRA一样有另一个五年规则?

A: [Notice 2010-84 A12]:

Yes, pursuant to §402A(c)(4)(D) and 408A(d)(3)(F), if an amount allocable to the taxable amount of an in-plan Roth rollover is distributed within the 5-taxable-year period beginning with the first day of the participant’s taxable year in which the rollover was made, the amount distributed is treated as includible in gross income for the purpose of applying §72(t) to the distribution.

有,而且设计意图与方法(通过引用Sec. 72(t))与Roth IRA完全相同。

不满足qualified distribution条件,直接从traditional IRA取钱有收入税以及额外的10% penalty。资金如果先rollover到Roth IRA,则当年只交收入税;只有在5年内从Roth IRA取出(按照ordering rule),才会recapture 10% penalty。

In-plan Roth rollover类似,如果5年内取出其中的taxable portion,则会recapture 10% penalty

Q: Roth 401(k)是否有ordering rule? 有多条in-plan Roth rollover怎么办?

A: Roth 401(k)的取钱规则依然是pro-rata rule,但在分配给in-plan Roth rollover部分时,是仿照Roth IRA的规则,先进先出,同一年taxable的部分先分配。

这个规则来自于[Notice 2010-84 A-13]的例子,我们取一个简化版本: Peter 2020年时做了一笔100k的in-plan Roth rollover,其中10k是non-taxable的。2020年年底时,Peter的Roth 401(k)账目是

| Roth 401(k) funds | amount |

| designated Roth contribution | 80k |

| in-plan Roth rollover (taxable) | 90k |

| in-plan Roth rollover (non-taxable) | 10k |

| earning | 20k |

Peter不满59.5岁,若2020年年底从Roth 401(k)中取出50k,其税务应如何计算?

- 首先按照pro-rata rule,计算出basis与earning的比例

earning: 50k * 20k / ( 80k + 90k + 10k + 20k ) = 5k

basis: 50k – 5k = 45k

也即earning占10%,basis占90%。

- 计算ordinary income

earning + taxable in-plan Roth rollover this year = 5k + 90k = 95k

这95k计入2020年的收入,要缴收入税

- 计算五年规则的罚金

- 取出的5k earning有10%的罚金,即需缴0.5k

- 假如Peter取出的50k为in-service distribution。而elective deferral不允许这样取,所以basis的45k全部分配给in-plan Roth rollover中的taxable portion(Notice 2010-84 A-13的例子是这样计算的)。因为不满5年,有10%的罚金,即需缴4.5k

- 假如Peter是离职后取出的50k,那么可以要求将这45k全部分配给designated Roth contribution,因为elective deferral在离职后可以取出。这样45k这部分没有罚金。

当有多笔in-plan Roth rollover时,根据Publication 575,每一年的in-plan Roth rollover有单独的5年规则计时

You must generally pay the 10% additional tax on any amount attributable to the part of the in-plan Roth rollover that you had to include in income (recapture amount). A separate 5-year period applies to each in-plan Roth rollover.

Publication 575关于in-plan Roth rollover的Recapture Allocation Chart要求从前往后逐年填入1040中in-plan Roth rollover的taxable和non-taxable部分,因此可以在各年in-plan Roth rollover的分配是先进先出,而且taxable part优先。

所以总结一下,当Roth 401(k)的账目中同时存在designated Roth contribution, in-plan Roth rollover (taxable), in-plan Roth rollover (non-taxable)以及earning四个部分时,其取出规则为

- 先按pro-rata rule分配earning的份额

- 离职后可以先分配给designated Roth contribution

- 剩余的in-plan Roth rollover按照Roth IRA对于rollover的ordering rule处理

Q: 完成Roth 401(k) -> Roth IRA rollover之后,还有recapture penalty吗?如何兼容Roth IRA的ordering rule?

A: 首先根据[Notice 2010-84 A-12]:

The 5-year recapture rule in this Q&A-12 does not apply to a distribution that is rolled over to another designated Roth account of the participant or to a Roth IRA owned by the participant; however, the rule does apply to subsequent distributions made from such other designated Roth account or Roth IRA within the 5-taxable-year period.

recapture penalty 在Roth 401(k) -> Roth IRA之后还是适用的。

其次我们注意到Roth IRA与Roth 401(k)账目的平行结构:

| Roth 401(k) | –> | Roth IRA |

| designated Roth contribution | –> | regular contribution |

| in-plan Roth rollover (taxable) | –> | taxable conversion |

| in-plan Roth rollover (non-taxable) | –> | non-taxable conversion |

| Roth 401 (k) earning | –> | Roth IRA earning |

正如这个结构所暗示的,Roth 401(k) -> Roth IRA之后只要将同类的项目合并即可。这样in-plan Roth rollover会在Roth IRA等效的看成ordering rule中的conversion来处理。

这其中, designated Roth contribution以及Roth 401(k)在Roth IRA中的对应关系已由CFR Sec. 408A-10 Q3 A3明确解答。

In-plan Roth rollover的归属存在一定争议。在Form 8606 Line 24,记录Roth IRA taxable conversion的这一行,instruction写道:

Don’t include amounts rolled in from a designated Roth account since these amounts are included on line 22.

而Line 22记录的则是Roth IRA的(regular) basis。

但是根据Publication 590B Appendix C的Recapture Allocation Chart,Roth IRA中的taxable/non-taxable rollover从前往后排的数字来自于1040中记录retirement account中nontaxable/taxable rollover这一项,而这一项是包含了in-plan Roth rollover的。所以实际上in-plan Roth rollover是与Roth IRA的其他conversion合并在了一起。

总结:Roth 401(k) -> Roth IRA按表格将同类账目合并。

Q: In-plan Roth rollover在进入Roth IRA rollover之后,其recapture penalty的5年计时从何时开始?

A: 计时从in-plan Roth rollover发生时,而不是Roth 401(k) -> Roth IRA rollover时开始。

理由仍然是Publication 590B Appendix C的Recapture Allocation Chart。在这里所有Roth IRA的taxable/non-taxable rolloer是根据报税的年份列出。In-plan Roth rollover,无论是否taxable,都只会出现在进入Roth 401(k)那一年的税表,而不(一定)是Roth 401(k) -> Roth IRA,因为in-plan Roth rollover进入Roth IRA的过程是没有收入税的。

例子:假设Peter在2015年做了pre-tax 401(k) -> Roth 401(k) rollover。2020年,Peter将Roth 401(k)中的资金全部移入Roth IRA。这样2015年的这笔in-plan Roth rollover在2015年是taxable的,2020年进入Roth IRA时已是第六个tax year,因此可以按照ordering rule,随时无税无罚地取出。

Q: 搞这么清楚有什么用?

In-plan Roth rollover主要有两大用途

在税率低的年份,将一部分pre-tax 401(k)转入Roth 401(k),调整pre-tax/Roth比例。

通过

after-tax 401(k) -> Roth 401(k) -(after separation of service)-> Roth IRA

实现mega backdoor的一个变种。搞清楚recapture penalty的五年规则后,我们可以理解与一般的mega backdoor

after-tax 401(k) -> Roth IRA

在取钱顺序上几乎没有区别。

参考资料:Notice 2010-84, Notice 2013-74, CFR Sec. 402A-1, Federal Register, CFR Sec. 408 A-10: Coordination between designated Roth accounts and Roth IRAs, Publication 575, Publication 590-B

免责声明:本文及其中任何文字均仅为一般性的介绍,绝不构成任何法律意见或建议,不得作为法律意见或建议以任何形式被依赖,我们对其不负担任何形式的责任。我们强烈建议您,若有税务问题,请立即咨询专业的税务律师或税务顾问。

Disclaimer: This article and any content herein are general introduction for readers only, and shall not constitute nor be relied on as legal opinion or legal advice in any form. We assume no liability for anything herein. If you need help about tax, please talk to a tax, legal or accounting advisor immediately.