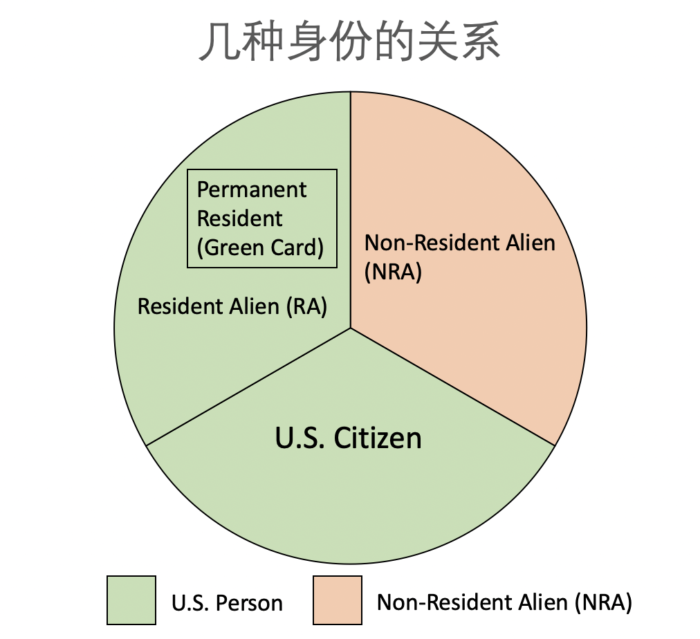

几种身份的关系

在美国你可能会在处理税务问题和申请银行账户时碰到几个关于身份的概念,这篇文章就来辨析一下他们之间的联系和区别:

- U.S. Citizen(美国公民)

- Permanent Resident (Green Card Holder)(绿卡持有者)

- Resident Alien (RA)

- Non-Resident Alien (NRA)

- U.S. Person(美国税务居民)

Contents

1. 什么是 U.S. Citizen(美国公民)

这个我想不太需要解释,自己是否是美国公民大家应该都很清楚。需要强调的一点是,如果你并非美国公民,而在办信用卡/银行账户的时候勾选上了我是美国公民的选项,是严重的谎报身份,可能会影响到绿卡的申请,大家一定要谨慎。

2. 什么是 Permanent Resident (Green Card Holder) (绿卡持有者)

Permanent Resident, Lawful Permanent Resident, 和 Green Card Holder 这几个词都是绿卡的意思,自己是否持有绿卡我想大家也都很清楚。

3. 什么是 Resident Alien (RA) 和 Non-Resident Alien (NRA)

只要不是 U.S. Citizen(美国公民),你就是 Alien(外国人)。Alien(外国人)分为两种:Resident Alien (RA) 和 Non-Resident Alien (NRA)。这二者最重要的区别在于交税时会有不同的待遇。

这两种身份的区分很重要但是有点复杂,需要详细讨论一下。RA 的判定标准有两个,Green Card Test(绿卡测试)和 Substantial Presence Test(实际居住测试),只要满足其中一个测试就一定是 RA。

3.1. Green Card Test(绿卡测试)

只要你是绿卡持有者,那么你就是 Resident Alien (RA),不管你实际在美国居住了多少天。

3.2. Substantial Presence Test(实际居住测试)

只要你满足 substantial presence test (实际居住测试),那么你就是 Resident Alien (RA),不管你有没有绿卡。实际居住测试分为两条:31天测试和183天测试。你必须同时满足31天测试和183天测试才算是满足了实际居住测试。

3.2.1. 31天测试

本报税年度在美国居住满了31天。

3.2.2. 183天测试

在过去的3年中(包括本报税年度和之前的两年),按下式计算的日期数达到183天:

1*本报税年度在美国居住的日子 + 1/3*上一年在美国居住的日子 + 1/6*上上一年在美国居住的日子

这个式子看起来有点复杂,但其实如果你一直住在美国上学工作或生活,那肯定能超过183天(大约半年)。

3.2.3. 重要例外情况

非常重要的一点是,上述183天测试要排除掉一些情况,与我们最相关的有:

- F1/F2 身份的学生前5年不在183天的计算范围内,所以前5年一定是 Non-Resident Alien (NRA)!

- J1/J2 身份的访问学者前2年不在183天的计算范围内,所以前2年一定是 Non-Resident Alien (NRA)!

还有一个特殊情况是F1在5年过后也可以选择继续按NRA报税,不过这个问题比较tricky,有这方面需求的话请移步《F1 超过五年还能按NRA报税吗》或咨询会计师。

3.3. 配偶的身份

如果按上述标准,一个人是 U.S. Citizen 或 Resident Alien (RA),而其配偶是 Non-Resident Alien (NRA),那么可以选择(不是必须选择)把配偶当做 Resident Alien (RA) 联合报税。如果这样选择,需要在第一次这样报税时附上一份声明,具体的请参考IRS的这个页面或咨询会计师。

4. 什么是 U.S. Person(美国税务居民)

U.S. Person(美国税务居民) 的定义是 U.S. Citizen + Resident Alien (RA)。不包括 Non-Resident Alien (NRA)!

5. 身份关系总结

不论你有没有SSN、有没有ITIN、有没有美国收入,都不影响你的身份的区分,身份的区分标准全部都在上面列出了。

本文开头的图标总结了这几种身份的关系。U.S. Person(美国税务居民)和 Non-Resident Alien (NRA) 互为补集;U.S. Person 真包含 Resident Alien (RA);Resident Alien (RA) 真包含 Permanent Resident。

6. 为什么身份的区分很重要

区分自己是 U.S. Person(包括 Resident Alien (RA))还是 Non-Resident Alien (NRA) 非常重要。主要原因如下。

6.1. 税务

- Resident Alien (RA) 在税务方面的待遇和 U.S. Citizen 是完全一样的,美国的个人税表只有给 U.S. Person 的和 Non-Resident Alien (NRA) 的这两类。

- 如果你是 Non-Resident Alien (NRA),千万不要用 TurboTax 等主流报税软件报税!TurboTax 无法处理 NRA 的税表,如果你用了它那么一定就报错税了!一般情况下NRA推荐使用学校合作的专门给国际学生的报税软件(大概率是 Glacier)或 Sprintax。

- Standard deductible、itemized deductible 等:只适用于 U.S. Person,不适用于 Non-Resident Alien (NRA) 。大部分人从 Non-Resident Alien (NRA) 变成 U.S. Person 之后需要交的税都会因此变少一点。

- 全球征税:美国的全球征税政策对所有 U.S. Person 都适用,所以理论上来说哪怕你连绿卡都还没有,仅仅是满足了实际居住测试,你也要把包括在中国在内的全球收入都向美国报税交税。这是成为 U.S. Person 的主要坏处之一,所以在美国之外收入很多的人对此要慎重。

- FICA (Social Security and Medicare Tax):在美国合法工作的 Non-Resident Alien (NRA) 学生/访问学者,是不需要交 FICA 的。变成 U.S. Person 之后就需要交了(仍然受雇于学校的除外)。这里稍微有点tricky,详情请移步《被扣了 FICA (Social Security and Medicare Tax) 怎么办》或咨询会计师。

- 资本利得税:在美国居住183天以内的(和上面那个实际居住测试的183天测试不一样)Non-Resident Alien (NRA) 的股票收入资本利得税为0,如果变成 U.S. Person 就没有这个优惠政策了。所以有一些大量持有美国股票的国内大佬会数着日子维持NRA身份。但是住满了183天的NRA(例如F1的前五年)资本利得是要交30%的固定税率的,这里稍微有点tricky。详情请移步《留学生股票收入报税指南》、《回国之后如何投资美股?税率如何?应该用哪家券商?》或咨询会计师。

- 税务方面的区别其实还有很多很多,毕竟美国的税法实在是太复杂了,这里就不一一列举了。

6.2. 银行账户

- 在申请Checking/Savings/Brokerage账户的时候,往往网页上会需要你确认你是 U.S. Person:”Under penalties of perjury, I certify that: I am a U.S. citizen or other U.S. person.”。一般来说,因为反洗钱的缘故,银行普遍都会规定 Non-Resident Alien (NRA) 需要去实体店申请,只有 U.S. Person 可以网申。不过现在倒是也有些例外了。

- 申请银行账户时,U.S. Person 填写的税表是 W-9;而 Non-Resident Alien (NRA) 填写的税表是 W-8BEN。之后在银行赚到的利息也是会收到税表的,U.S. Person 收到的将是 1099-INT;而 NRA 则收到的将是 1042-S。

6.3. 一些福利

- 2020年因为疫情,美国政府决定给所有满足一定收入要求的 U.S. Person 发钱,每人$1,200。如果说平时搞不清自己是RA还是NRA还无所谓,在这次发钱政策中,RA还是NRA的区别就是有没有资格收到救助的重大区别了。也许以后还有类似的福利,区分标准也是RA还是NRA。

7. 搞错身份有什么后果?

建议大家都在报税和申请银行账户前搞清楚自己究竟是 Resident Alien (RA) / U.S. Person 还是 Non-Resident Alien (NRA),这样就不会填错表格了。但是经常有人问,已经填错了会有什么后果?我对此的回答是:不知道。其实搞错了自己身份报错税的人非常多,最常见的例子就是刚来美国的F1学生/J1访问学者在不知情的情况下本来是NRA却用TurboTax报税了。另一种常见例子是,银行的banker天天打交道的基本都是美国人很少遇到外国人,很多时候banker自己就搞不清楚客户究竟是 Resident Alien (RA) / U.S. Person 还是 Non-Resident Alien (NRA),所以很多人在不明不白之下就在banker的指引下填错表格了。搞错了的人实在是太多了,但我至今还没听说过因为选错 Resident Alien (RA) / U.S. Person 造成什么后果的实例,所以如果你之前无意中犯了错,不必太过担心。不过是否是 U.S. Citizen(美国公民)这一条正常人是绝不会搞错的,如果你不小心填错了,建议立刻联系银行更正!

希望这篇文章能够解答你关于身份的疑惑!如果有疑问欢迎留言讨论。