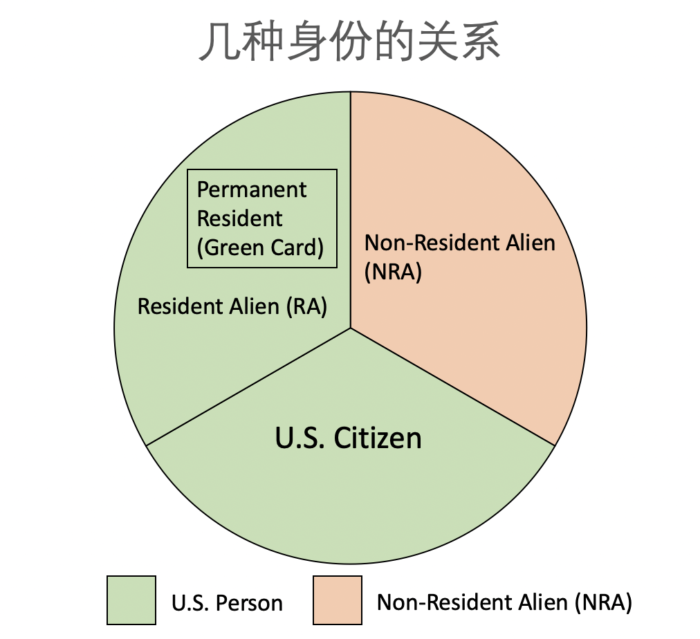

幾種身份的關係

在美國你可能會在處理稅務問題和申請銀行賬戶時碰到幾個關於身份的概念,這篇文章就來辨析一下他們之間的聯繫和區別:

- U.S. Citizen(美國公民)

- Permanent Resident (Green Card Holder)(綠卡持有者)

- Resident Alien (RA)

- Non-Resident Alien (NRA)

- U.S. Person(美國稅務居民)

Contents

1. 什麼是 U.S. Citizen(美國公民)

這個我想不太需要解釋,自己是否是美國公民大家應該都很清楚。需要強調的一點是,如果你並非美國公民,而在辦信用卡/銀行賬戶的時候勾選上了我是美國公民的選項,是嚴重的謊報身份,可能會影響到綠卡的申請,大家一定要謹慎。

2. 什麼是 Permanent Resident (Green Card Holder) (綠卡持有者)

Permanent Resident, Lawful Permanent Resident, 和 Green Card Holder 這幾個詞都是綠卡的意思,自己是否持有綠卡我想大家也都很清楚。

3. 什麼是 Resident Alien (RA) 和 Non-Resident Alien (NRA)

只要不是 U.S. Citizen(美國公民),你就是 Alien(外國人)。Alien(外國人)分為兩種:Resident Alien (RA) 和 Non-Resident Alien (NRA)。這二者最重要的區別在於交稅時會有不同的待遇。

這兩種身份的區分很重要但是有點複雜,需要詳細討論一下。RA 的判定標準有兩個,Green Card Test(綠卡測試)和 Substantial Presence Test(實際居住測試),只要滿足其中一個測試就一定是 RA。

3.1. Green Card Test(綠卡測試)

只要你是綠卡持有者,那麼你就是 Resident Alien (RA),不管你實際在美國居住了多少天。

3.2. Substantial Presence Test(實際居住測試)

只要你滿足 substantial presence test (實際居住測試),那麼你就是 Resident Alien (RA),不管你有沒有綠卡。實際居住測試分為兩條:31天測試和183天測試。你必須同時滿足31天測試和183天測試才算是滿足了實際居住測試。

3.2.1. 31天測試

本報稅年度在美國居住滿了31天。

3.2.2. 183天測試

在過去的3年中(包括本報稅年度和之前的兩年),按下式計算的日期數達到183天:

1*本報稅年度在美國居住的日子 + 1/3*上一年在美國居住的日子 + 1/6*上上一年在美國居住的日子

這個式子看起來有點複雜,但其實如果你一直住在美國上學工作或生活,那肯定能超過183天(大約半年)。

3.2.3. 重要例外情況

非常重要的一點是,上述183天測試要排除掉一些情況,與我們最相關的有:

- F1/F2 身份的學生前5年不在183天的計算範圍內,所以前5年一定是 Non-Resident Alien (NRA)!

- J1/J2 身份的訪問學者前2年不在183天的計算範圍內,所以前2年一定是 Non-Resident Alien (NRA)!

還有一個特殊情況是F1在5年過後也可以選擇繼續按NRA報稅,不過這個問題比較tricky,有這方面需求的話請移步《F1 超過五年還能按NRA報稅嗎》或諮詢會計師。

3.3. 配偶的身份

如果按上述標準,一個人是 U.S. Citizen 或 Resident Alien (RA),而其配偶是 Non-Resident Alien (NRA),那麼可以選擇(不是必須選擇)把配偶當做 Resident Alien (RA) 聯合報稅。如果這樣選擇,需要在第一次這樣報稅時附上一份聲明,具體的請參考IRS的這個頁面或諮詢會計師。

4. 什麼是 U.S. Person(美國稅務居民)

U.S. Person(美國稅務居民) 的定義是 U.S. Citizen + Resident Alien (RA)。不包括 Non-Resident Alien (NRA)!

5. 身份關係總結

不論你有沒有SSN、有沒有ITIN、有沒有美國收入,都不影響你的身份的區分,身份的區分標準全部都在上面列出了。

本文開頭的圖標總結了這幾種身份的關係。U.S. Person(美國稅務居民)和 Non-Resident Alien (NRA) 互為補集;U.S. Person 真包含 Resident Alien (RA);Resident Alien (RA) 真包含 Permanent Resident。

6. 為什麼身份的區分很重要

區分自己是 U.S. Person(包括 Resident Alien (RA))還是 Non-Resident Alien (NRA) 非常重要。主要原因如下。

6.1. 稅務

- Resident Alien (RA) 在稅務方面的待遇和 U.S. Citizen 是完全一樣的,美國的個人稅表只有給 U.S. Person 的和 Non-Resident Alien (NRA) 的這兩類。

- 如果你是 Non-Resident Alien (NRA),千萬不要用 TurboTax 等主流報稅軟體報稅!TurboTax 無法處理 NRA 的稅表,如果你用了它那麼一定就報錯稅了!一般情況下NRA推薦使用學校合作的專門給國際學生的報稅軟體(大概率是 Glacier)或 Sprintax。

- Standard deductible、itemized deductible 等:只適用於 U.S. Person,不適用於 Non-Resident Alien (NRA) 。大部分人從 Non-Resident Alien (NRA) 變成 U.S. Person 之後需要交的稅都會因此變少一點。

- 全球徵稅:美國的全球徵稅政策對所有 U.S. Person 都適用,所以理論上來說哪怕你連綠卡都還沒有,僅僅是滿足了實際居住測試,你也要把包括在中國在內的全球收入都向美國報稅交稅。這是成為 U.S. Person 的主要壞處之一,所以在美國之外收入很多的人對此要慎重。

- FICA (Social Security and Medicare Tax):在美國合法工作的 Non-Resident Alien (NRA) 學生/訪問學者,是不需要交 FICA 的。變成 U.S. Person 之後就需要交了(仍然受雇於學校的除外)。這裡稍微有點tricky,詳情請移步《被扣了 FICA (Social Security and Medicare Tax) 怎麼辦》或諮詢會計師。

- 資本利得稅:在美國居住183天以內的(和上面那個實際居住測試的183天測試不一樣)Non-Resident Alien (NRA) 的股票收入資本利得稅為0,如果變成 U.S. Person 就沒有這個優惠政策了。所以有一些大量持有美國股票的國內大佬會數著日子維持NRA身份。但是住滿了183天的NRA(例如F1的前五年)資本利得是要交30%的固定稅率的,這裡稍微有點tricky。詳情請移步《留學生股票收入報稅指南》、《回國之後如何投資美股?稅率如何?應該用哪家券商?》或諮詢會計師。

- 稅務方面的區別其實還有很多很多,畢竟美國的稅法實在是太複雜了,這裡就不一一列舉了。

6.2. 銀行賬戶

- 在申請Checking/Savings/Brokerage賬戶的時候,往往網頁上會需要你確認你是 U.S. Person:”Under penalties of perjury, I certify that: I am a U.S. citizen or other U.S. person.”。一般來說,因為反洗錢的緣故,銀行普遍都會規定 Non-Resident Alien (NRA) 需要去實體店申請,只有 U.S. Person 可以網申。不過現在倒是也有些例外了。

- 申請銀行賬戶時,U.S. Person 填寫的稅表是 W-9;而 Non-Resident Alien (NRA) 填寫的稅表是 W-8BEN。之後在銀行賺到的利息也是會收到稅表的,U.S. Person 收到的將是 1099-INT;而 NRA 則收到的將是 1042-S。

6.3. 一些福利

- 2020年因為疫情,美國政府決定給所有滿足一定收入要求的 U.S. Person 發錢,每人$1,200。如果說平時搞不清自己是RA還是NRA還無所謂,在這次發錢政策中,RA還是NRA的區別就是有沒有資格收到救助的重大區別了。也許以後還有類似的福利,區分標準也是RA還是NRA。

7. 搞錯身份有什麼後果?

建議大家都在報稅和申請銀行賬戶前搞清楚自己究竟是 Resident Alien (RA) / U.S. Person 還是 Non-Resident Alien (NRA),這樣就不會填錯表格了。但是經常有人問,已經填錯了會有什麼後果?我對此的回答是:不知道。其實搞錯了自己身份報錯稅的人非常多,最常見的例子就是剛來美國的F1學生/J1訪問學者在不知情的情況下本來是NRA卻用TurboTax報稅了。另一種常見例子是,銀行的banker天天打交道的基本都是美國人很少遇到外國人,很多時候banker自己就搞不清楚客戶究竟是 Resident Alien (RA) / U.S. Person 還是 Non-Resident Alien (NRA),所以很多人在不明不白之下就在banker的指引下填錯表格了。搞錯了的人實在是太多了,但我至今還沒聽說過因為選錯 Resident Alien (RA) / U.S. Person 造成什麼後果的實例,所以如果你之前無意中犯了錯,不必太過擔心。不過是否是 U.S. Citizen(美國公民)這一條正常人是絕不會搞錯的,如果你不小心填錯了,建議立刻聯繫銀行更正!

希望這篇文章能夠解答你關於身份的疑惑!如果有疑問歡迎留言討論。