【2017.11 更新】此账户已经不再接受新的申请。老用户的福利暂时不变。R.I.P. HT: DoC.

【2017.6 更新】NorthPointe 更新了使用条款,上面明确写出,他们期待的是让大家日常消费就使用这张卡,如果他们觉得你是为了5%利率专门做消费,很可能会把你的账户转成另一种账户或者直接关卡。看起来这个5%是很难撸了。HT: DoC.

Purpose and Expected Use of Ultimate Checking Account

The Ultimate Checking account is intended to be the accountholder’s primary checking account in which payroll transactions and day-to-day spending activities including but not limited to grocery, gasoline, apparel, shopping, dining, sporting and entertainment transactions are posted and settled. We expect the account’s debit card to be used frequently throughout each month and for transaction amounts to reflect a wide dollar range. Small debit card transactions conducted on the same day at a single merchant and/or multiple transactions made during a condensed period of time, particularly near the end of a statement cycle are not considered normal, day-to-day spending behavior. These types of behaviors appear to be conducted with the sole purposes of qualifying for the account’s rewards, and thus will be deemed inappropriate transactions and will not count towards earning the account’s rewards.

Northpointe Bank reserves the right to determine if the account is being maintained for a purpose other than primary, dayto-day use. Accountholders who persist in making debit card transactions in a calculated and limited fashion in order to meet their monthly qualifications may have their account converted to a different checking account or closed altogether. We also reserve the right to convert the account to a different checking account if the Ultimate Checking account does not have consistent, active use of three (3) consecutive statement cycles.

We have the right to close this account at any time, with proper notice. Our decision to close the account will not affect your existing obligations to us, including any obligations to pay fees or charges incurred prior to termination. No deposits will be accepted and no checks will be paid after the account is closed. Upon termination of your Ultimate Checking account, any optional add-on products or services associated with this account will also be terminated at the same time.

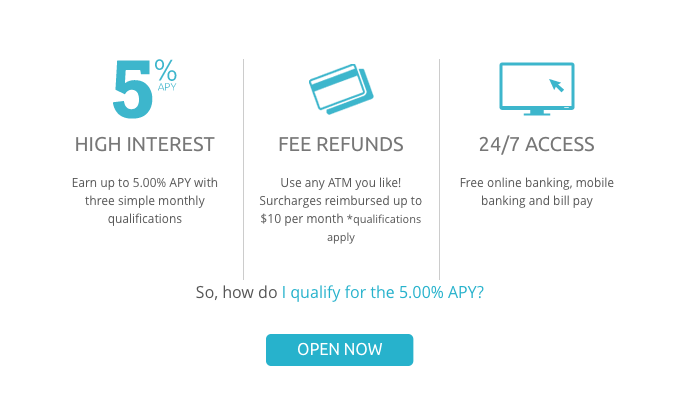

提到 5% 年利率的储蓄账户,大家对大名鼎鼎的 Netspend 系列应该耳熟能详。现在 Netspend 一下削弱了八成,仅存的类似产品还有 Mango,就连新秀 Insight 也因为换银行而需要在7月1日之前换卡。我们今天再来介绍一款替代产品,Northpointe 的5%利率支票账户,它的上限是$10000,且维持起来并不算太麻烦。

简介

Northpointe 从卡到支票账户再到网页界面看上去和 Netspend 又很像。APY(年收益)高达5%,上限 $10000。该卡是由 Northpointe Bank 自家发行,FDIC,所以不用担心钱会遗失,最多是过半年神马福利又被腰斩了。但我考古了一下,这个产品从2014/12/19至今已经存在了两年多了,而且它的利率 terms 一直在改进中,所以还比较乐观。

这个支票账户没有月费,刷卡消费也没有费用。只有一些支票账户的比较标准的收费项目,见这里。我们要做的就是申卡,把卡丢在抽屉里,注意做到每个周期完成下述事项,就可以免费坐拿 5% 的利息啦。

5%利率要求

税务方面,网上银行一般会有 US Person 的要求,考虑到网上银行貌似都没有提供提交 W8-BEN 的选项,都是默认的 W9,所以年底会默认发 1099-INT 让你去报利息税。F-1前五年利息免税,所以 1099-INT 可以报但不需要为此报税。

想要维持 5% 的高年利率,目前需要做到三件事情。如果 terms 发生改变,我们会及时来更新此帖。

- 需要注册电子账单;

- 每个账单周期(statement period:不是自然月,我还没有开户,猜测由于是支票账户,可能就是账单月)需要完成15笔呆逼卡交易(debit card purchases),金额没有下限。我们可以通过 Amazon Gift Card load 0.5 刀来完成这件事情。请注意在这篇文章里提到,Amazon 刷呆逼卡默认是 Pin-less debit,但有的同学万一以前操作过改成 credit,那就需要改回去。

- 每个自然月需要有一笔至少 $100 的 withdrawal 或者 direct deposit。注意是“或者”就可以了,譬如给信用卡还款,或者从别的银行(譬如 Discover 八成可以)转账进去。

有关第二点,该行的工作人员在 DoC 的帖子下面有回复说强烈建议不要使用 Amazon 的办法完成,我们把 TA 的原话贴在这里,还请小伙伴们自行斟酌:

I strong recommend against doing this or anything similar. This offer isn’t sustainable based on that type of debit activity. The terms of the account do not prohibit this but folks shouldn’t be surprised if a spike in this type of activity results in a change to the terms of the account (lower rate, lower balance cap and/or minimum debit requirement). If you don’t plan to use this as a primary spending account, it’s best not to open it.

其他有什么限制,我们实际操作过后会来进行补充。这个支票账户看上去还是比较无脑的,有兴趣的小伙伴们可以考虑入。

申请链接

- 5%APY 的账户已绝版

注意要开 UltimateAccount。开户时需要现存 $100,可以通过 ACH 从你的别的支票或储蓄账户转账,也可以用信用卡充 $100,我们当然建议后者。据 DoC 的情报,Citi 家的 AA 和 DC 是算作消费的,其他银行的卡尚不清楚。每个 SSN / ITIN 可以开一个,同地址无限制。