在Wash Sale詳解一文中我們介紹了wash sale的基本規則。想必讀者已經熟悉以sale at loss去找對應的replacement share,然後調整cost basis和holding period的過程了。

本文我們介紹三種常見的wash sale錯誤。之所以叫錯誤,是因為這些wash sale不易發覺,或有略特殊的稅法規定。它們分別是dividend reinvestment, related party transaction以及IRA wash sale。

本文會分別介紹原理和應對方法。

Contents

Dividend Reinvestment

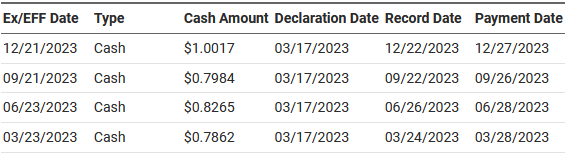

投資共同基金或EFT會產生dividend,這在指數基金中尤其常見。下表為vanguard的指數基金VTI在2023年的dividend payment

表中Ex Date/Record Date解讀可參考文章分紅稅務中的Holding Period與Qualified Dividends。

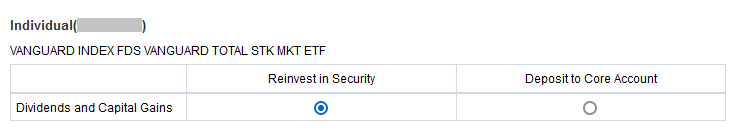

投資人如果長持該股,特別是buy and hold策略,則往往會選擇將dividend重新投資到該股中。為了省卻手動操作的麻煩,很多券商會提供automatic dividend reinvesement功能,例如下圖是Fidelity賬戶中Dividend reinvesement設置頁面:

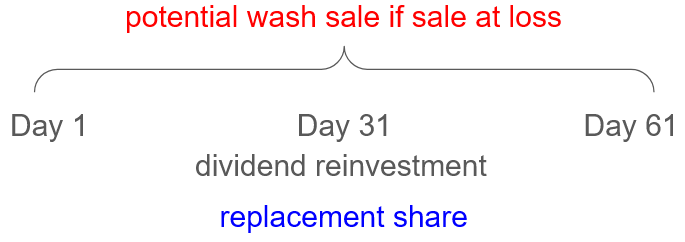

選擇Reinvest in Security,只要dividend在Payment date出現,就會立即買入同一投資品。如果在前後30天內有同一投資品賣出,那麼dividend reinvestment就會出現在這次買出的前後30天內,賣出變成wash sale,dividend reinvestment變成replacement share,需要調整cost basis。

Dividend通常佔比不大,但因為automatic reinvestment很容易忽視,讓投資人往往沒有意識到wash sale的存在。但正因為dividend數量少,由之引起的disallowed loss也少,只是若不在同一券商,報稅時這些不大的disallowed loss也要花時間尋找。

若想避免這個麻煩,我們建議

關閉dividend automatic investment,改成手動,用與其他投資一樣的方式避開wash sale。對於定投指數基金的策略,一年一次與一季度投一次收益差別很小。

或者在賣出、或者準備做tax loss harvesting時,關閉dividend automatic investment,過31天後再打開。

或者不同的券商買不同的投資品。

Related Party Transaction

第二種情況,是投資人利用related party(相關方)買下replacement share,以規避wash sale rule,但這同樣會造成disallowed loss,而且後果比wash sale更嚴重。

Related Party

根據publication 550,這裡的related party可以是家庭成員(包括直系親屬:兄弟姐妹,父母祖父母,子女)

Members of your family. This includes only your brothers and sisters, half-brothers and half-sisters, spouse, ancestors (parents, grandparents, etc.), and lineal descendants (children, grandchildren, etc.).

以及直接或間接控股50%以上的公司、公司合伙人等。

歷史上有這樣的失敗避稅案例。Shoenberg通過自己控制的公司Globe Investment Company購買replacement share,被法院判定loss disallowed(Shoenberg , 77 F.2d 446 (8th Cir. 1935))。McWilliams則是通過妻子購買replacement share而被最高法判定loss disallowed(McWilliams v. Commissioner, 331 U.S. 694 (1947))。

姻親(in-law)按定義不是related-party,但也要看州法律規定

In-laws are not related parties under Sec. 267, and, therefore, using an in-law to purchase stock or securities may accomplish a taxpayer』s goal of retaining control and recognizing the loss on the sale of the stock. In community property states, spouses generally each own half of marital property. In those states, using an in-law to avoid the wash-sale rules may be effective for only half of the loss.

Sec. 267

Related party transaction適用範圍不僅限於wash sale(IRC Sec. 1091)。其在IRC Sec. 267中另有Deduction for losses disallowed條款

(1) Deduction for losses disallowed

No deduction shall be allowed in respect of any loss from the sale or exchange of property, directly or indirectly, between persons specified in any of the paragraphs of subsection (b). The preceding sentence shall not apply to any loss of the distributing corporation (or the distributee) in the case of a distribution in complete liquidation.

與IRC Sec. 1091囊括的wash sale不同,Sec. 267首先不受時間61天的時間窗口限制,其次也沒有cost basis調整過程,只有最終賣出後有收益,才能抵掉前面的虧損:

you recognize the gain only to the extent that it is more than the loss previously disallowed to the related party

看publication 550的例子,

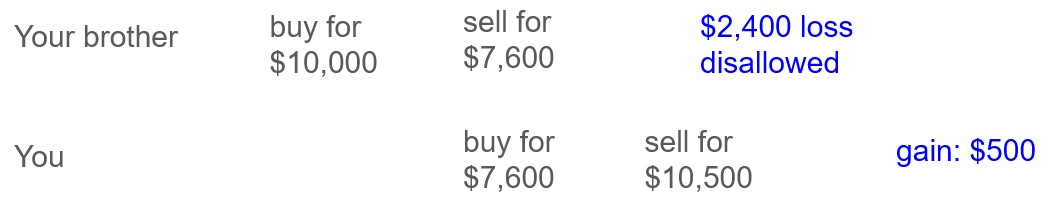

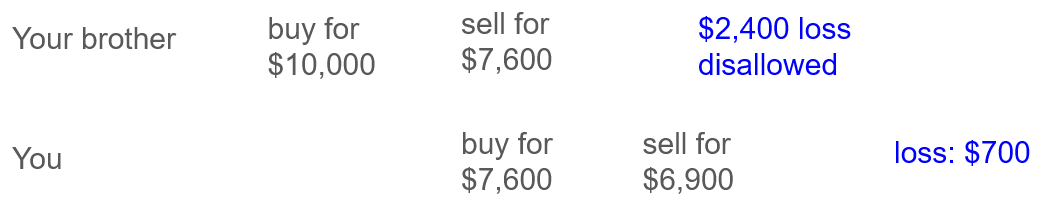

Example 1. Your brother sells you stock for $7,600. His cost basis is $10,000. Your brother cannot deduct the loss of $2,400. Later, you sell the same stock to an unrelated party for $10,500, realizing a gain of $2,900. Your reportable gain is $500 (the $2,900 gain minus the $2,400 loss not allowed to your brother).

(姑且認為是)哥哥的股票虧損2400,買給弟弟,由於是related-party transaction,哥哥無法將這2400算做loss抵稅。弟弟若最終盈利2900,則弟弟報稅時可以抵掉2400的損失,盈利變成500。

Example 2. If, in Example 1, you sold the stock for $6,900 instead of $10,500, your recognized loss is only $700 (your $7,600 basis minus $6,900). You cannot deduct the loss that was not allowed to your brother.

但若弟弟賣出時也是虧損700,那麼兄弟倆原來的2400損失就憑空消失了,弟弟不能將損失報成3100。

Prearranged plan

McWilliams , 331 U.S. 694 (1947)認為McWilliams的related party交易屬於預謀(prearrangement),不能抵稅。若純屬巧合也許可以豁免:

Indirect transactions. You cannot deduct your loss on the sale of stock through your broker if, under a prearranged plan, a related party buys the same stock you had owned. This does not apply to a trade between related parties through an exchange that is purely coincidental and is not prearranged.

Prearranged沒有標準界定。和法律中其他意圖判斷一樣,要看文本證據,具體的交易細節,IRS的監管力度,和法庭的風向等。

對於廣大讀者最常見的親人間交易來說,實控親人賬戶,交易時間間隔非常短,父母與小家庭經濟往來密切,那麼判為預謀的可能性大。 不同的household,沒有經濟往來的兄弟姐妹,則判為巧合的可能性大。Plus1s認為對於同一家庭的成員,定期交流投資計劃,避免related party transaction為好。或沒有家庭成員間很少往來(兄弟分家),也無需刻意打聽。

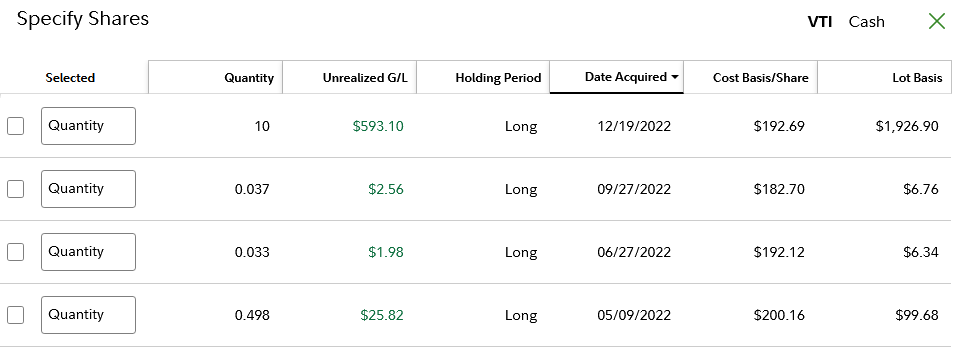

儘管很多券商會在IRA內也記錄每一項投資的cost basis,以及holding period,例如下圖是plus1s持有的HSA中VTI的tax lot:

但從IRA中取錢時,稅務計算與投資的cost basis/captial gain無關(參考tranditional IRA與Roth IRA介紹),所以wash sale的cost basis adjustment沒有效果。

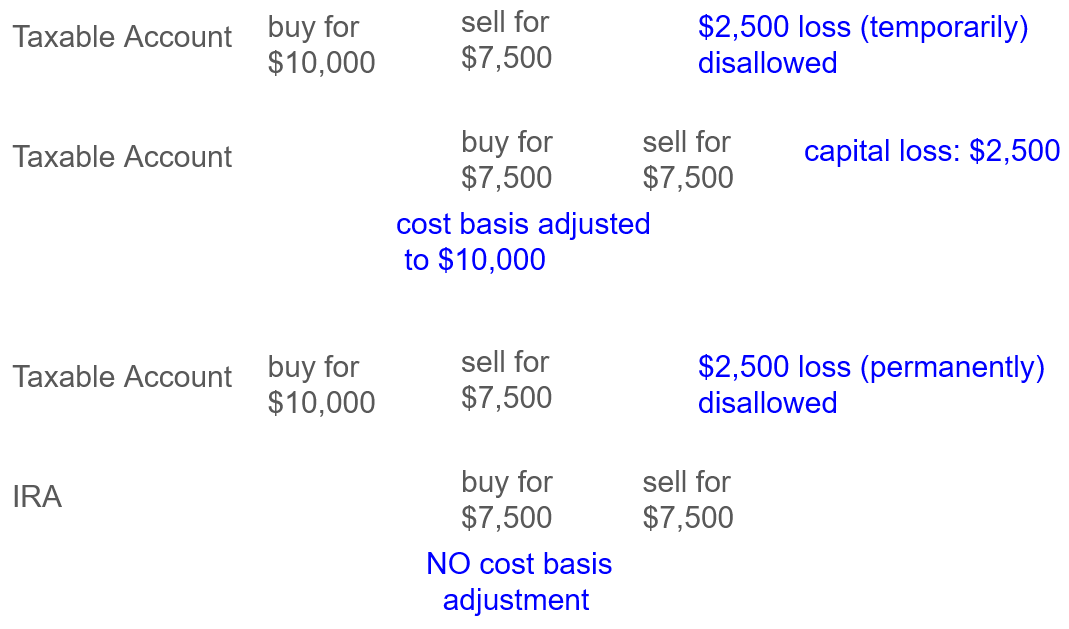

2007年底,IRS發布了關於涉及IRA wash sale的Rev. Rul. 2008-5,

- 它首先明確了在IRA中買回replacement share也是wash sale,不是漏洞。

- 其次IRA內cost basis adjustment無需調整。

- 其附帶結果為,disallowed loss不是延遲而是永久消失。

下圖的兩個例子展示了這一對比:

結合本文探討的第一種錯誤,當IRA內的投資開啟dividend reinvestment時,投資者可能不知不覺陷入了IRA wash sale的陷阱,dividend reinvestment對應部分的loss就永久失去了。為了避免,建議IRA的投資盡量與taxable account不同。

儘管沒有其他Revenue Ruling,其他諸如401(k), 457(b)的賬戶原理與IRA相同,其cost basis調整也沒有意義。有理由認為如果這些賬戶買入了replacement share,也會造成loss永久消失。

總結

本文介紹了三種常見的wash sale錯誤:dividend reinvestment, related party transaction以及IRA wash sale。但只要

- 關停dividend reinvestment或者賣出時檢查

- 與親近的家庭成員間互相知會重要交易的細節

- IRA以及其他退休賬戶與taxable account保持投資品類不同

即可規避。

參考資料:publication 550; Tradelog: IRS Wash Sale Rule; Fairmark: Wash Sale Rule;

The Tax Advisor: Preserving Tax Losses by Avoiding the Wash-Sale Rules

免責聲明:本文及其中任何文字均僅為一般性的介紹,絕不構成任何法律意見或建議,不得作為法律意見或建議以任何形式被依賴,我們對其不負擔任何形式的責任。我們強烈建議您,若有稅務問題,請立即諮詢專業的稅務律師或稅務顧問。

Disclaimer: This article and any content herein are general introduction for readers only, and shall not constitute nor be relied on as legal opinion or legal advice in any form. We assume no liability for anything herein. If you need help about tax, please talk to a tax, legal or accounting advisor immediately.