在美国,投资盈利后需要缴纳资本利得税(captial gain tax)。有盈利(captial gain)就有损失(captial loss),captial loss可以抵税。许多投资者听说过wash sale,知道此时captial loss不可以抵税,但不明白其中的细节,因而都很怕触犯这条规定。

本文通过分析典型的wash sale范例,让投资者明确这条规则的适用境况,其所谓disallowed loss的规则。这将有助于你看懂Form 1099-B上的数字。本文还会介绍wash sale报税的方法,以及避免wash sale麻烦的方式。看懂本文只需要大致知道capital gain tax即可。

Wash Sale 的例子

Publication 550 Glossary部分有wash sale的一个简短定义:

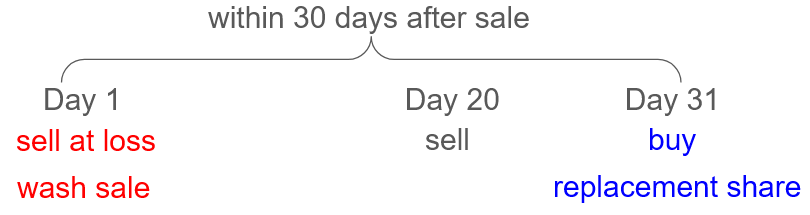

A sale of stock or securities at a loss within 30 days before or after you buy or acquire in a fully taxable trade, or acquire a contract or option to buy, substantially identical stock or securities.

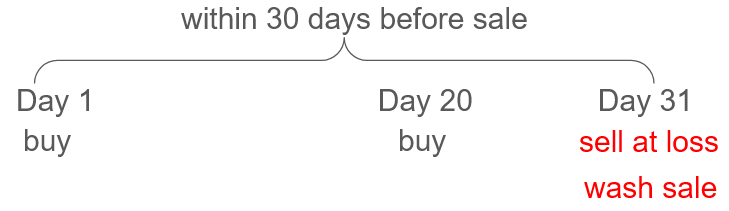

可以看出,只要满足几个条件

- 卖出时亏损

- 观察前后的30天内,即一共61天的窗口期

- 如果有买入substantially identical stock

就可以判定为wash sale。

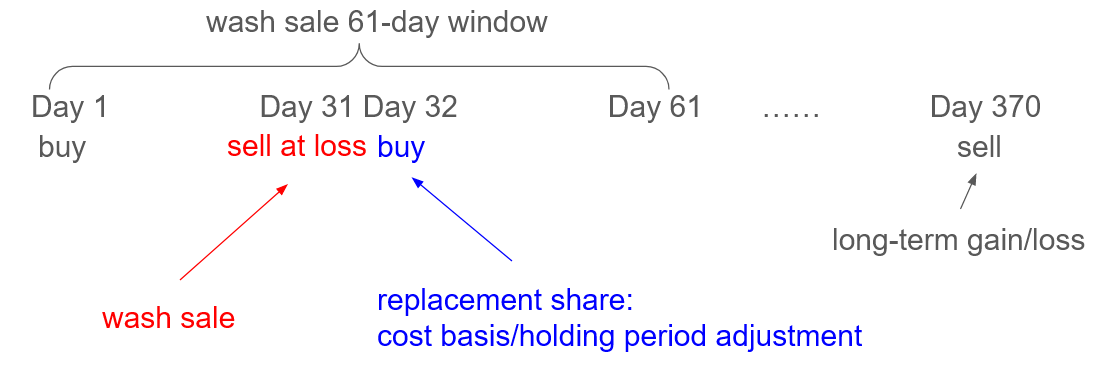

例1[理想案例]:Watson在Day 1以100每股的价格买入100股S,在Day 31股票S跌到80时将其全部卖出。在Day 32,Watson立即又以80每股的价格买入100股S。他在Day 370以125的价格全部卖出,总盈利2500。

根据上述规则,我们观察Watson在Day 31的卖出行为,发现在卖出后的第31天(即Day 32)有买入行为。买入的是identical stock S,于是Watson在Day 31的卖出行为属于wash sale。

Watson为何会在Day 31选择亏损买入,而第二天(Day 32)又重新买入呢?投资的角度有多种可能性,但在税务角度上,亏损卖出再以同一个价格买入会导致浮亏(unrealized gain)变成实亏(realized gain)。根据captial gain tax的基本规则,realized gain会产生captail gain tax,而realized loss可以抵税。于是对于一个可以长持的股票,将浮亏变成实亏的实质是先抵税,在交税,对于投资人是有利的。广义上这种延税行为可以称之为tax loss harvesting。

Wash Sale后果

Wash sale并不违法,只是会使上述tax loss harvesting策略会失效。在例1中,它有两个税务后果:

- disallowed loss

Watson在Day 31产生的2000 loss属于disallowed loss。他在Day 32买入的100股S,属于replacement share。其cost basis要加上2000 disallowed loss。

- holding period

Watson在Day 32买入Day 370卖出的S,holding period看似不足365天(370-32+1<365),但因wash sale规则应再补上Day 31卖掉的那100股的holding peroid,总计370天,因此总盈利$2500属于long term capital gain。

这样调整以后的效果,在holding period与capital gain的计算上与Watson从Day 1一直持有到Day 370卖出完全一致。也就是Day 31到Day 32出现的S股价格维持80的无风险税务套利机会被wash sale机制消除。这也是wash sale规则应有的作用。

我们发现,disallowance of loss一定对投资者不利的,因为本可以抵税的loss被延迟了(loss deferred);holding period相加则有利有弊:若默认long capital gain税率比short term低,则short term gain变成long term gain有利(例1情况),而short term loss变成long term loss则有弊。

例1是wash sale规则在理想情况下消除tax loss harvesting的工作机制,但投资人如果短线操作多,可能会无意识触发wash sale,因此有必要了解一下多次买卖情况下wash sale如何识别,最主要的是认定replacement share是哪一部分。

根据前文的定义,我们应对每一笔交易,寻找其前后30天的范围内是否有买入replacement share,然而实际情况会更复杂一下。

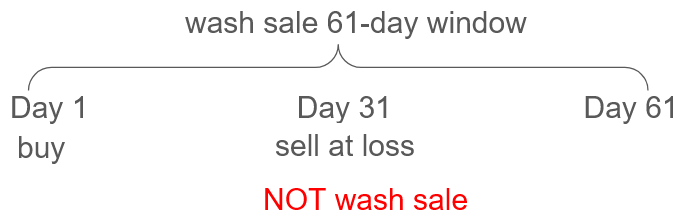

例2[正常买卖]:Watson在Day 1以100每股的价格买入100股S,在Day 31股票S跌到80时将其全部卖出。

如果按照wash sale的文字定义,Day 31卖出行为在前后30日内的确有一笔买入——正是Day 1的买入,那么Day 1的买入是否构成wash sale呢?

这当然不是wash sale,因为不然所有的sale就都是wash sale!实际操作中,Day 1买入的100股不是replacement share,无法按前述规则调整cost basis,也无法按前述规则调整holding period。下一个例子IRS以Revenue Ruling形式回答了这个问题。

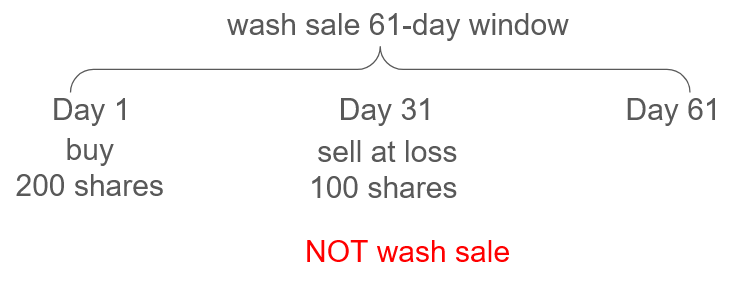

例2′[卖出一半]:Watson在Day 1以100每股的价格买入200股S,在Day 31股票S跌到80时卖出100股。

这个例子和上一个例子一样,如果200股是同时买入的,显然也没有税务套利的机会。Rev. Rul. 56-602指出,1921年制定的wash sale条款IRC Sec. 1091是为了防止上述典型情形中harvest loss的行为,国会讨论的纪要表明,这一规则并不是为了防止真实的卖出(bona fide sale of securities)

Subsequent Congressional discussions and reports refer consistently to the

new acquisition' and torepurchasing’ and `buying back’ stock or securities. These terms indicate an intent on the part of Congress to prevent a taxpayer’s taking losses for tax purposes while giving up his position in a security for only a few days or not at all. However, they do not indicate an intent to disallow a loss sustained in a bona fide sale of securities made to deduce the taxpayer’s holdings, even though the sale is made within 30 days after the securities were purchased.

在ruling末尾IRS举的例子正是例2’,所以例2和例2’均不是wash sale。

例3[多笔买入]:Watson在Day 1以100每股的价格买入100股S,在Day 20又以90每股的价格买入100股,在Day 31以80每股的价格卖出100股。

这个例子要分析必须搞清楚Day 31卖出的100股到底是Day 1买入的那100股,还是属于Day 20买入的那100股?

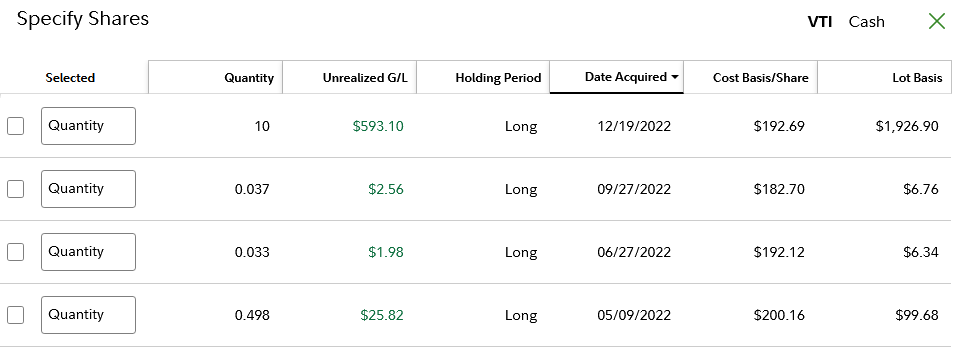

很多券商在卖出股票时支持specific share,例如fidelity:

The Specific Shares feature allows you to specify tax lot shares to trade as part of an order.

在卖出时可以选择tax lot

我们建议卖出时选择specific share。

这样有三种情况可以分析

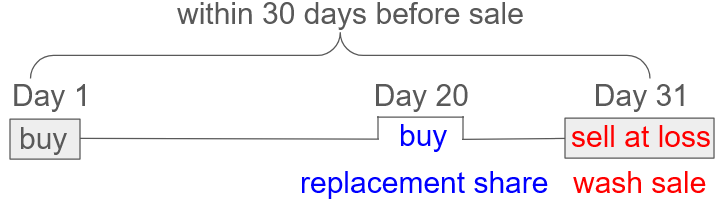

3.1:Watson以specific share方式卖出Day 1买入的那100股。

Wash sale的replacement share可以向前追溯30天,Day 20的买入是replacement share,其cost basis应调整为

90 * 100 + 20 * 100 = 11,000

即每股$110。这里的逻辑是在wash sale之前买入(Day 20),假如价格与wash sale时价格类似的话,正如本例那样依然可以tax loss harvesting,所以wash sale规则也允许向前追溯。

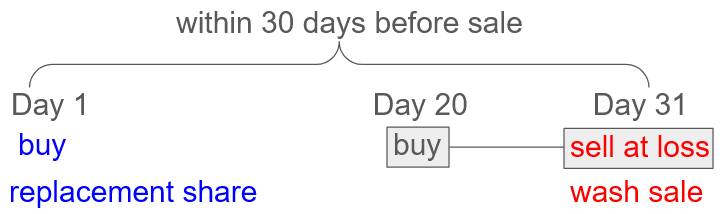

3.2:Watson以specific share方式卖出Day 20买入的那100股,是否构成wash sale呢?

与3.1的情形不同,Day 20到Day 31这笔买入卖出可能赚可能亏,但这一对交易与其他交易一样是正常的投资收益,无法对Day 1这笔还未结束的交易的浮亏做税务套利。

但IRS不这么认为,在Rev. Rul. 71-316的末尾,IRS给了一个类似3.2的例子,只不过中间的那笔交易用了margin:

The above is illustrated by the following example. On July 1, 1970, a taxpayer purchased 100x shares of M company stock for cash. On July 15, 1970, the taxpayer purchased 100x shares of M company stock on margin. On July 29, 1970, he sold the 100x shares of M company stock purchased on margin at a loss. Section 1091 of the Code precludes the taxpayer from deducting the loss since he acquired substantially identical stock within a period beginning 30 days before the date of the sale resulting in a loss.

也就是说,对于3.2情形属于wash sale,Day 1的买入的100股要进行cost basis调整。

3.3:Watson在Day 31的卖出没有指定specific share。那么根据CFR Sec. 1.1091-1(c)(d),默认的match顺序是从前往后:3.3情况便于3.1相同。

The stock or securities acquired will be matched in accordance with the order of their acquisition (beginning with the earliest acquisition) with an equal number of the shares of stock or securities sold or otherwise disposed of.

Matching Rule

Wash sale的规则要点在于先确认哪一笔卖出是wash sale,以及哪一笔对应的卖入要调整cost basis和holding period。

当有多笔卖出和买入时,法律条文(IRC Sec. 1091)将细节的认定交给财政部,于是CFR Sec. 1.1091-1(c)(d)规定了默认按买/卖的时间顺序考虑,前面的先算。

The stock or securities sold or otherwise disposed of will be matched with an equal number of the shares of stock or securities acquired in accordance with the order of acquisition (beginning with the earliest acquisition) of the stock or securities acquired.

例4[多笔卖出]: Watson长持1000股S超过1年,在Day 1以卖出100股S,亏损2000。在Day 20又卖出100股,亏损3000。在Day 31以80每股的价格买入100股。在Day 51及之前没有其他交易。

因为Day 31买入的存在,Day 1与Day 20都可以作为wash sale。按CFR Sec. 1.1091-1(c)(d)先到先算的规定,应先考虑Day 1作为wash sale,与Day 31的卖出匹配,调整其cost basis。剩下的Day 20卖出在前后30天的窗口没有其他交易匹配,因此不是wash sale。

例5[多笔买入]: Watson长持150股S超过1年,Watson在Day 1以卖出150股,亏损3000。在Day 20以90美股买入100股。在Day 31又以80每股买入100股。

Day 1的卖出是wash sale,在其后的30天内,有两笔交易可以匹配。按CFR Sec. 1.1091-1(c)(d)先到先算的规定,按时间顺序应调整,先在Day 20买入的股票中每股cost basis增加3000/150 = 20。在Day 31的100股,按matched with an equal number of the shares的文字,前50股每股cost basis也增加20,后50股不变。虽然Day 31买入的100股只有一个tax lot,券商对cost basis的调整是在股票卖出的时候进行,即closed position。即使Day 31的100股只先卖了20股,这20股的cost basis也可以单独调整。欢迎各位朋友提供此类情况的Form 1099B实例。

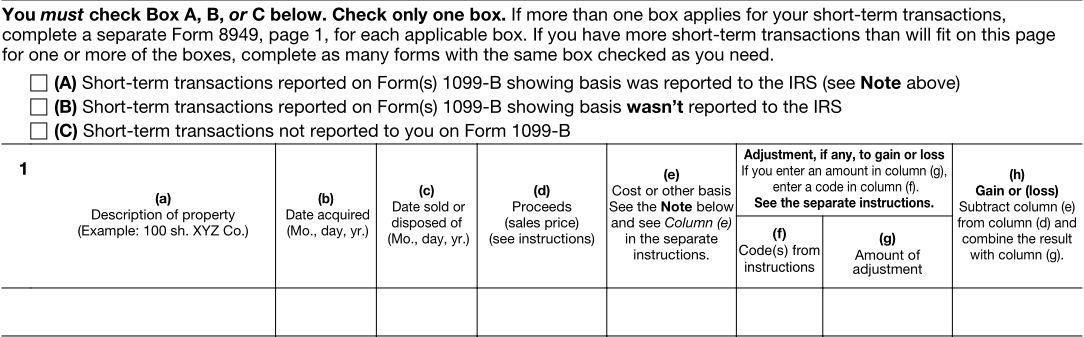

Wash Sale如何报税

首先无论券商是否汇报,投资人若有sale at loss,则有义务检查是否有wash sale,报告正确的disallowed loss以及正确调整cost basis。手工报税的方法是填写Form 8949,报告卖出的资产明细,计算出captial gain/loss之后再填回Schedule D。

对于频繁交易的朋友,这实在太麻烦了。好在IRS给出了免填Form 8949的例外: Exception 1

Form 8949 isn’t required for certain transactions. You may be able to aggregate those transactions and report them directly on either line 1a (for short-term transactions) or line 8a (for long-term transactions) of Schedule D. This option applies only to transactions (other than sales of collectibles) for which:

- You received a Form 1099-B (or substitute statement) that shows basis was reported to the IRS and doesn’t show any adjustments in box 1f or 1g;

- The Ordinary box in box 2 isn’t checked;

- You don’t need to make any adjustments to the basis or type of gain (or loss) reported on Form 1099-B (or substitute statement), or to your gain (or loss); and

- You aren’t electing to defer income due to an investment in a QOF and aren’t terminating deferral from an investment in a QOF.

也就是说如果券商已经准备了1099-B,且已在1099-B上完成了wash sale的adjustment,那么纳税人自己就无需再调整cost basis,也就无需再填写Form 8949。

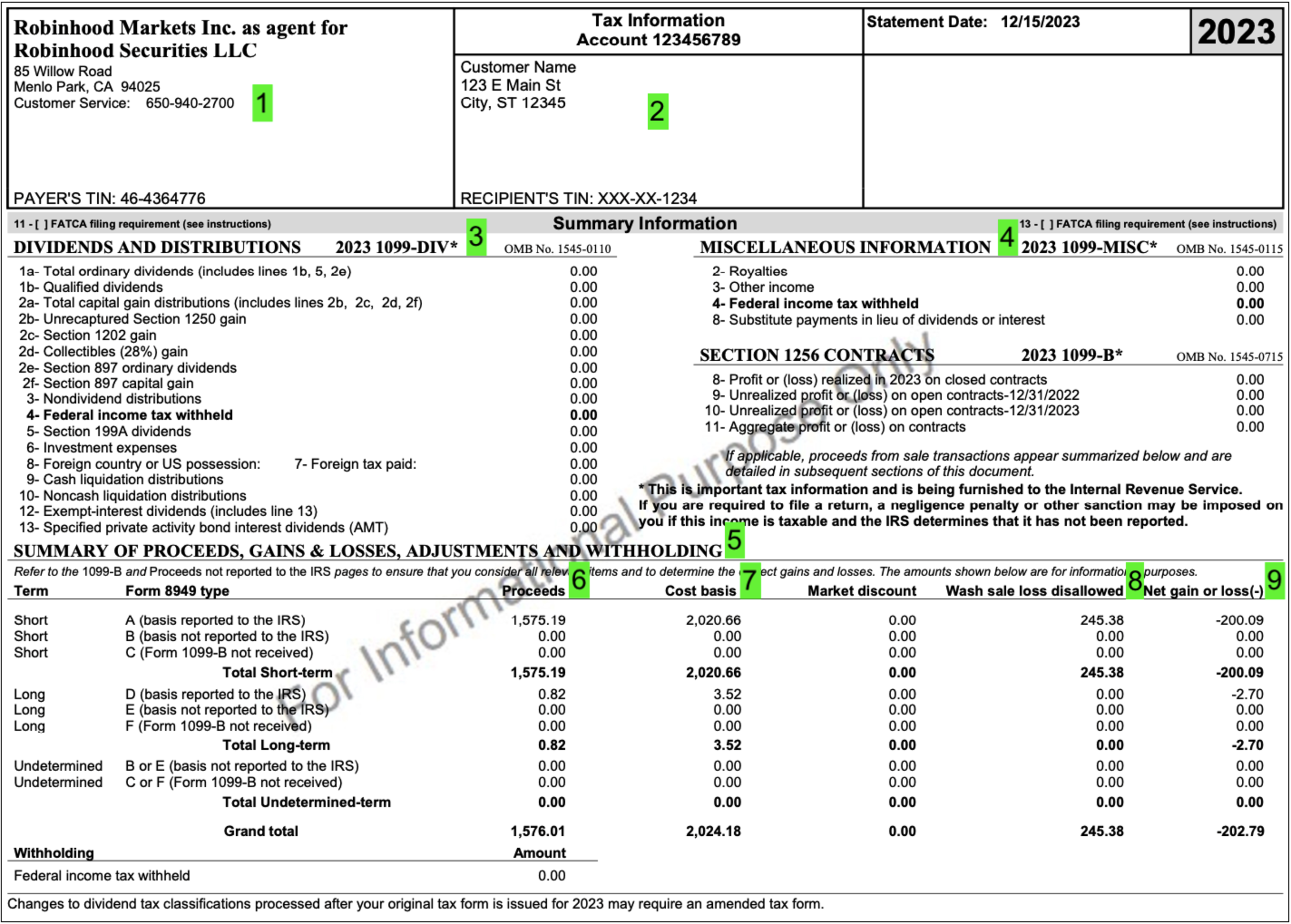

对于covered security,券商有义务以1099-B的形式向IRS准确报告basis, gain/loss等信息

a covered security is one for the sale of which the broker must report, to the Internal Revenue Service, the customer’s basis and information on whether the sale results in a short-term or long-term gain or loss.

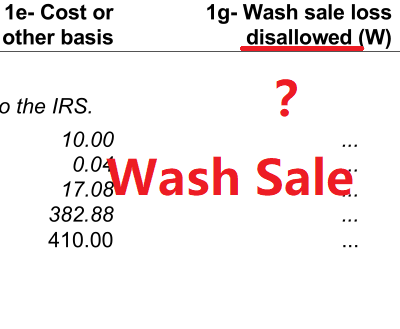

Covered security具体包括哪些,可以看Form 8949 Instruction中的定义,笼统地说2015年之后购买的股、债及衍生品皆是,这也就覆盖了普通投资人投资的绝大部分品类。券商拥有该账户的全部交易记录,可以很容易根据前面的replacement share matching rule计算出wash sale所需要调整的disallowed loss,并汇集到Form 1099-B,下图是券商Robinhood的一个例子,注意看标记8:

若用软件报税,且只有单一券商,导入1099-B即可。软件会根据1099-B提供的信息考虑wash sale,计算准确的captial gain填入schedule D。

但若投资人有多个不同的券商,则任何单个券商无法知道投资人在其他券商处的交易,也就无法完全准确的标记出wash sale,此时只有掌握全部交易信息的投资人才可以做出wash sale调整了。

如何避免Wash Sale的麻烦

至此,读者应已了然,wash sale并没有违法,只是税务上disallowed loss不利,以及要花额外的时间查找记录disallowed loss。以下方法可以减少或避免wash sale的麻烦:

完全避开wash sale。找到某股票的最后一个买入日期,等31天,再考虑卖出。买股票前,看31天之内是否曾卖出过该股票,如有等到第31天再买。

完全避开wash sale的税务影响。Disallowed loss如果在同一年仍然变成了realized loss,那么税务上完全没有影响,所以税务上考虑只需看十二月的操作。如果十二月卖出了亏损的股票,那么注意次年1月如果还在31天内不要买回来。如果年末某股票带有因wash sale导致的cost basis adjustment,卖掉该股票可以消除wash sale的影响。以上操作皆是税务规定影响了投资决策,投资角度是否值得应通盘考虑。

不避开wash sale,但将所有交易集中在一个券商中。虽然有wash sale,但券商会自动调整,报税只需导入1099-B,不麻烦。但无法避开wash sale defer loss的税务后果。

不避开wash sale,使用多个券商,但不同券商投资的股票完全不同。分析与第3点相同。

总结

本文举例介绍了wash sale的基本规则及后果,还给出了报税方法以及避免wash sale麻烦的几条建议。

根据Publication 550 ,除了买回substantially identical stock以外,

- Buy substantially identical stock or securities,

- Acquire substantially identical stock or securities in a fully taxable trade,

- Acquire a contract or option to buy substantially identical stock or securities, or

- Acquire substantially identical stock for your individual retirement arrangement (IRA) or Roth IRA.

期权、期货等衍生品交易也可以产生wash sale。能做空以及买卖这些衍生品的,想必是有经验的投资者,本文不赘述。

IRA的例外情况,以及tax loss harvesting的策略将在今后的文章中叙述。

参考资料:publication 550; Tradelog: IRS Wash Sale Rule; Fairmark: Wash Sale Rule;

The Tax Advisor: Preserving Tax Losses by Avoiding the Wash-Sale Rules

免责声明:本文及其中任何文字均仅为一般性的介绍,绝不构成任何法律意见或建议,不得作为法律意见或建议以任何形式被依赖,我们对其不负担任何形式的责任。我们强烈建议您,若有税务问题,请立即咨询专业的税务律师或税务顾问。

Disclaimer: This article and any content herein are general introduction for readers only, and shall not constitute nor be relied on as legal opinion or legal advice in any form. We assume no liability for anything herein. If you need help about tax, please talk to a tax, legal or accounting advisor immediately.