【2021.3更新】 我们文中介绍了目前联邦关于1099K的发放标准:累计数额超过$20k且转账超过200笔。目前几个州将标准下调到$600或$1000不等,所以很多读者收到了1099-K。但日前通过的第三轮新冠救助法案 Section 9674将联邦标准下调至$600:全美国自2022年1月1日起,第三方支付累计收款超过$600就会收到1099-K税表,见法案原文(HT: DoC)。

这不改变本文结论,朋友之间结算饭钱、返利网返现、偶尔卖二手货所得收入仍然是non-reportable, non-taxable,也可按本文方式报税。联邦标准下调意图可能是想掌握Uber/Lyft司机这些人的收入,但这给收到小额non-taxable income的人造成了报税的麻烦。即使是有business income的人,从Paypal transaction中分离出这些non-taxable income也是额外的负担。虽然新规2022年才开始执行,也不排除Paypal在2021年想更多的州推广。如果想要避免这些麻烦,我们建议从现在开始尽量不要使用PayPal(以及同类产品)收取上述这些non-taxable income。

最近有不少读者收到了Paypal的1099-K税表,在论坛和评论区询问如何报税。

长期做生意并使用Paypal收款的读者应该对1099-K不陌生,按照正常的business income报税就可以。

但本博读者大多数的情况是使用Paypal接收了一些诸如cash back之类的免税收入,金额不大,却收到了1099-K税表。博客作者以及论坛讨论的结论是,1099-K的收入,如果不涉及business income,则本身不影响F1以及H1B签证。

本文集合了一些网上搜集的报税意见,供大家参考。

Contents

为何会收到1099-K

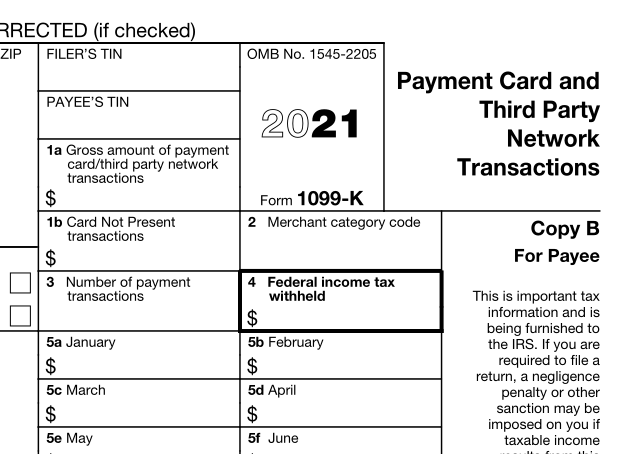

根据IRS的介绍, Form 1099-K是关于信用卡及第三方支付支付的税单。个人从这些机构收到转账,可能是一笔应税收入,故而第三方支付机构(例如Paypal)会将该收入以1099-K形式报告给个人以及IRS。

对于Paypal这样的第三方转账机构,发放1099-K的要求是同时满足

- 支付总额超过$20000

- 超过200笔交易

一般情况下,个人在ebay上少量买卖二手物品以及使用Paypal收cashback很难同时满足这两个条件。然而有几个州和DC特区下调了限额和交易次数:

AR: $2500 and 0 Transactions DC: $600 and 0 Transactions IL: $1000 and 4 Transactions MA: $600 and 0 Transactions MS: $600 and 0 Transactions MD: $600 and 0 Transactions VT: $600 and 0 Transactions MO: $1200 and 0 Transactions NJ: $1000 and 0 Transactions VA: $600 and 0 Transactions

在这些州,数额超过一个远小于联邦限额的值就可能触发1099-K。

据称,该1099-K不仅用于州税的申报,Paypal会同时寄送给IRS,影响到联邦报税。

1099-K中的cash back/garage sell/reimbursement需要缴税吗?

个人的收入有reportable, non-reportable,taxable和non-taxable的区别。

1099-K税表是第三方支付机构为协助个人报税准备的税表。第三方支付机构没有能力替纳税人解释税表内的数据哪一部分是reportable的,哪一部分是taxable的,他们只是满足IRS或州的要求向政府及个人提供数据。个人则有义务以报税形式向IRS解释1099-K表内数据的意义,并以相应程序纳税。

IRS对1099-K的说明指出了一些收入,虽然经过了第三方网络,但是属于non-reportable:

The gross amount of a reportable payment does not include any adjustments for credits, cash equivalents, discount amounts, fees, refunded amounts or any other amounts.

例如同学一起出去吃饭,其中一人付款,其他人对他转账,则转账收入是non-reportable,non-taxable。麻省的Department of Revenue有一个关于1099-K的FAQ网页,专门举了一个这种reimbursement收入的例子

Molly goes to dinner with her 14 graduate school classmates to celebrate the end of the term. She pays for a $1,500 meal on her credit card and her classmates reimburse her for the expense via a peer-to-peer payment system, totaling $1,400. That $1,400 IS NOT subject to tax or any reporting as it was not payment for goods or services, but simply reimbursement.

同样,卖二手物品产生的收入也是non-reportable,non-taxable,因为卖出物品的价格一般比买入低(否则可能是收藏品collectible,需要缴税),见麻省DOR的另一个例子

Meghan is downsizing her home and sells furniture on an auction site for $5,000. The original purchase price of the furniture was $9,000. The $5,000 IS NOT subject to tax or any reporting as it is a function of selling personal items at a loss.

2010年IRS出过一个letter ruling,确认了cash back被视为rebate,仅仅降低了商品的价格,而不能算入应税收入。使用Paypal接收cash back并未改变其rebate的实质,因此也是non-reportable,non-taxable。

综上,这些“收入”都是免税的。

如何报税

前文说了道理,实际的报税还要考虑其他成本与风险。

下面讨论理论上免税的cash back/garage sell/reimbursement。

(1)不在1040上报这笔收入

第一种方式是不在1040上报这笔收入,因为前文分析,这是non-reportable的。但IRS发现1099-K的税表与1040对不上时,可能会出发notice。报税软件HR-block的1099-K介绍文章也指出了这种可能性

Splitting rent with your roommate is not generally a taxable transaction, but the IRS will probably send you a notice if you’re issued a Form 1099-K and that amount does not appear anywhere on your return.

Plus1s遇到这种情况,不会报1099-K中的免税收入,但会在tax return中附上相关材料,包括一份申明陈述1099-K表中部分收入是属于cash back/garage sell/reimbursement,因此是non-reportable, non-taxable,以及相应的票据。例如cash back可以放cash back网站的statement、paypal转账记录,garage sell可以放买入该物品时的收据等等。也可以准备好这些申明和票据,等IRS寄来notice之后,再寄回这些文件。在tax return中附带statement是允许的,但是如果不是对Form 1040某一行的注释之类的writing in information,则可能只能mail return,参考这个回答;但有的软件似乎可以输入这种statement。

(2)填两笔Other income,一笔正数作为收入,手动加一笔负数作为支出

第一种方式或多或少需要和IRS打交道,而有的人希望在报税问题上尽量低调。那么能不能在1040上找到一个位置报这笔收入呢?Turbotax 的互助论坛上有人提供了针对garage sell的填法:

It is not taxable. You can use the cost of the clothes as a deduction and you will have no net income to pay taxes on. If the IRS questions it, then show them your documentation. Print out or screenshot from Paypal something showing that what you sold was used personal items.

Do it this way, it will zero out and not be taxed: Enter it under Wages & Income, Your 2017 Income Summary, scroll down click on Start next to Miscellaneous Income, then choose Other reportable income, answer Yes to “Any Other Taxable Income?” Under Description put “Sales of Personal Property 1099-K” and enter the amount from the 1099-K in the next box, click continue, click on “add another income item”, Under Description put “Cost of Personal Property 1099-K” and enter the same amount as a negative. On the Other Miscellaneous Income Summary make sure you see the 2 items, one positive and one negative and Total is $0.

这个回答针对rebate, coupon的填法:

Per the IRS, cash rebates from a dealer or manufacturer for an item you buy generally not taxable. If you received a 1099-K, it reflects gross income received for this activity and needs to be reported since the IRS has received the document also.

You should enter the 1099-K in TurboTax (see below) and add a separate line item with a negative amount that represents the rebate and coupon income that is included on the 1099-K. You can essentially enter 2 line items in the ”Additional Income” section, one as a positive number for the full amount and below it an offsetting negative amount for the total of the manufacturer incentives received.

总结起来,第二种方法是填两笔Other income,一笔是收入,一笔是支出,抵消后不缴税。这个Turbotax论坛回答也建议对于免税的1099-MISC收入填写一笔负的Other income抵消。

卖出行为中”sporadic activity and hobby”不属于business,见IRS说明。这种买卖的特点不是以盈利为目的,比如偶尔的有盈利的garage sell。将之归类为Other income可以免去self-empolyment tax,见这个帖子的详细资料。什么行为属于”sporadic activity and hobby”没有明确定义,要看具体情形分析,IRS也曾今输过诉讼。

(3)在Schedule C按business income报税

另外,1099-K一般是business income,IRS会期待在Schedule C上见到这笔收入。博客作者中也有建议报在Schedule C上,让income和cost相抵,从而达到报告但不缴税的目的。

F1, H1-B签证不允许有business income。这一类读者填写Schedule C,须意识到之后移民转换身份时的风险。 Plus1s认为只要不是真正的business income,总是能找到证据为自己辩护,方法仍然是提交一些收据、statement证明这不是真正的business income。

总结

1099-K税表本身不直接说明违反了F1,H1-B签证的规定。一些本来免税的收入,以1099-K形式出现依然是免税的。但报税过程可能会有一些麻烦。本文提供了一些网上搜集的报上方式。

不放心的读者请咨询会计师等专业人士。读者有疑问欢迎去论坛讨论。

参考资料:IRS 1099K,MA-DOR,HR-block

免责声明:本文及其中任何文字均仅为一般性的介绍,绝不构成任何法律意见或建议,不得作为法律意见或建议以任何形式被依赖,我们对其不负担任何形式的责任。我们强烈建议您,若有税务问题,请立即咨询专业的税务律师或税务顾问。

Disclaimer: This article and any content herein are general introduction for readers only, and shall not constitute nor be relied on as legal opinion or legal advice in any form. We assume no liability for anything herein. If you need help about tax, please talk to a tax, legal or accounting advisor immediately.