海外汇款是华人社区中非常普遍的现象,一个常见问题是

这笔钱需要在美国交税吗?需要申报吗?

赠与可分为三种情况,要求各有不同:

NRA赠与NRA: 这种情况与美国税务通常无关,美国既不征税,也无需申报。

NRA赠与U.S. Person(RA或US citizen): 对于收款的U.S. Person而言,不需要缴income tax。但是,如果收到的赠与金额超过限额,则有申报义务,需要file Form 3520。

U.S. Person赠与U.S. Person: 这种情况涉及到美国国内的赠与税(U.S. gift tax),通常由赠与方(donor)承担申报和可能的纳税义务。我们将另文详细阐述。

本文重点讨论第二种情况,即U.S. Person收到来自海外(通常是 NRA 亲友)的大额赠与。举个常见的例子,如果你在美国留学(例如F1签证持有超过5个日历年后可能成为税务居民RA)或工作(例如H1B签证持有者通常是RA),你的父母从国内给你汇来一笔资金用于买房或生活,如果这笔资金在一年内累计超过10万美元,那么作为收款放的你就需要申报Form 3520。

注意:Form 3520是一个申报表,礼金本身不用交税。然而,未及时或未正确申报所面临的罚款却很高。例如,对于未申报的海外赠与,罚款可能是每月赠与金额的5%,累计最高可达赠与总额的25%。因此,有相关情况的朋友务必仔细了解Form 3520的申报要求。

Contents

为何需要申报 Form 3520?

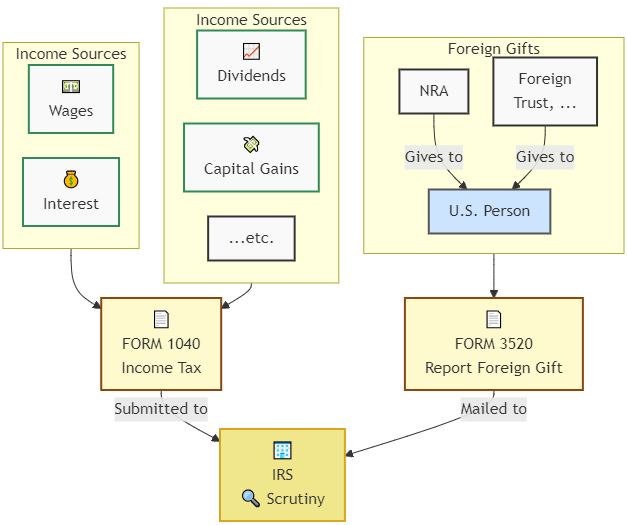

报税的核心在于纳税人主动将其收入按性质分类。诸如dividend, interest, wage, tips, capital gain等收入,在Form 1040上均有其特定的申报位置。当IRS与纳税人就收入性质达成一致后,应缴税款便可依据相应税率计算得出。

NRA赠与给U.S. person的gift,本身不构成U.S. person的taxable income。然而,若无申报机制,IRS难以主动区分大额海外资金流入的真实性质。将本应是taxable income的款项伪装成gift,是一种显而易见的逃税方式。IRS通过Form 3520的申报程序可以审查大额海外赠与和foreign trust交易,以确保合规,并起到反洗钱监管作用。

对于U.S. person而言,Form 3520可以理解为美国监控跨境资本流动的一种手段,其申报义务之所以落在U.S. person身上,原因在于赠与方NRA通常不在美国赠与税的直接管辖下。当U.S. person之间发生赠与时,申报赠与税(Form 709)的义务但美国礼物税的规则在赠与方 donor。

申报3520的条件及方法

申报条件

IRS 在其官方网页上有明确说明:

If you are a U.S. person (…) who received a large gift or bequest from a foreign person, you may need to complete Part IV of Form 3520, Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, and file the form by the 15th day of the fourth month following the end of your income tax year (generally, April 15th for individuals), subject to any extension of time to file that may apply.

- 收款人必须是 U.S. person,判别方式参考税法身份辨析。

For gifts or bequests from a nonresident alien or foreign estate, you are required to report the receipt of such gifts or bequests only if the aggregate amount received from that nonresident alien or foreign estate exceeds $100,000 during the taxable year. If the gifts or bequests exceed $100,000, you must separately identify each gift in excess of $5,000.

- 从同一个外国人或外国信托(及其related parties,例如亲戚,见下文详述)

- 如果总额超过10万美元,那么每一笔超过5k的 gift 都需要在 Form 3520 上单独列出(qualified transfer(教育与医疗开支)符合条件不计入10万额度,见下文详述)。

下面解释细则:

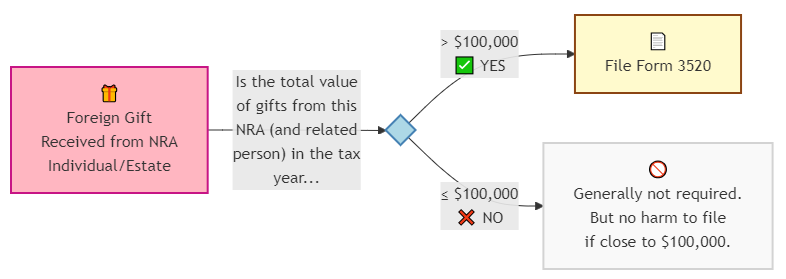

申报限额:Exceeds $100,000

如果总额没有超过(exceed)$100,000,则无需申报Form 3520 Part IV。

那么如果不多不少刚好10万呢?IRS 官方网站和税法原文 IRC Sec. 6039F的措辞,均明确使用了“more than $100,000”或“exceeds $100,000”。因此,理论上如果收到的总额正好是$100,000,则不触发申报要求(not required to be reported),参考TurboTax论坛上的一篇讨论帖子。

但实际操作中,汇率波动可能导致换算时超过10万,因此虽非法律强制,接近10万为保险起见不如选择申报,避免未申报的风险。

05/29/2025 评论区提问:joint file限额如何计算?

简答:分开计算。

根据Form 3520的官方说明:

Joint Returns

If you and your spouse are filing a joint income tax return for the current tax year, and you are both transferors, grantors, or beneficiaries of the same foreign trust, then you may file a joint Form 3520 for the same tax year. If you and your spouse are filing a joint Form 3520, check the box on line 1i on page 1.

也就是说,只有在同时满足以下两个条件时,夫妻才可以联名提交Form 3520:

- 当年以joint filing身份申报联邦所得税;

- 且夫妻双方均为同一个foreign trust的受益人(Beneficiary),或同为委托人(Grantor/Settlor)、转让人(Transferor)。

因此,如果只是收到一位foreign individual的赠与,即便夫妻共同收款,也不得联合提交Form 3520,而应按个人分别申报。

再看有关申报门槛的描述,官方用语为:

If you are a U.S. person (…) who received a large gift, …

可见,法律将Form 3520的申报义务明确归属于“个人”(individual)。这可能出于制度设计上的考虑,joint filing是美国国内税务身份的安排,而Form 3520属于国际税务监管范畴,立法者倾向于分开处理,避免制度混淆。

综合而言,结论如下:如果夫妻二人分别收到的foreign gift金额各自未超过10万美元,即便合计超过,亦不触发申报义务。

不过,实践中仍需注意证据链的完整性。例如,如果对方将18万美元一次性打入夫妻共同账户(joint account),应尽量在汇款附言、备忘录、或后续解释中明确区分每人所占份额。否则,在缺乏佐证的情况下,IRS有可能假设某一方收到超过门槛金额,触发审查或audit。例如,若IRS认为实际分配为12万与6万,则前者需要单独申报;而若明确为9万+9万,各自则均无需申报。为了避免不必要的麻烦,在款项汇入前明确书面说明受款人分配,是稳妥做法。

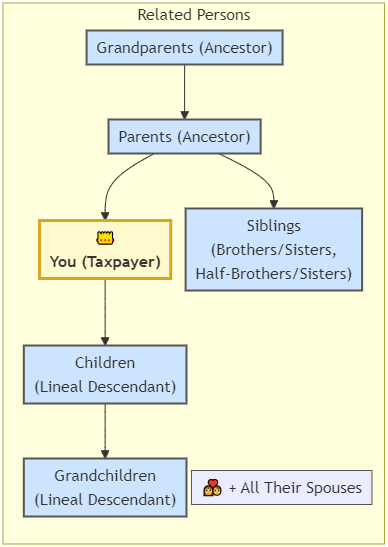

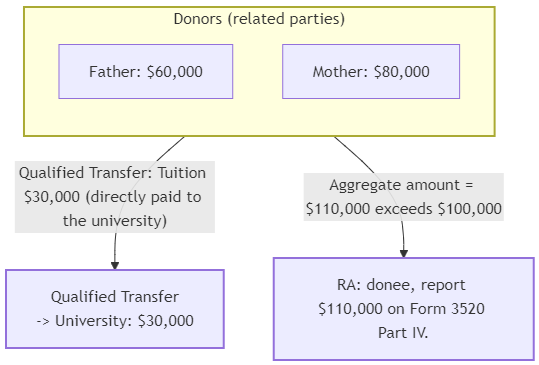

Related Person 规则与金额合计

虽然IRS的对申报限额的描述使用单数形式,如”from a nonresident alien”或”from a foreign person”,但related person必须合并计算。

3520 Instruction Line 54对此有明确解释:

To calculate the threshold amount ($100,000), you must aggregate gifts from different foreign nonresident aliens and foreign estates if you know (or have reason to know) that those persons are related to each other (see Related Person , earlier) or one is acting as a nominee or intermediary for the other.

如果RA知道(或有理由知道,例如姑姑和姑父)不同的赠与方之间存在关联,或者其中一方实质上是另一方的中间人,那么这些金额要合计。

一个常见的应用场景是为规避外汇管制,国内亲人可能通过蚂蚁搬家方式,发动多个亲属向一个身在美国的RA汇款。当他们是related person时,例如父母兄弟的分别赠与,其金额需要合并考虑。

Form 3520 Instructions给出了related person的定义,分别是Sec 267(c)定义的亲属关系

(4) The family of an individual shall include only his brothers and sisters (whether by the whole or half blood), spouse, ancestors, and lineal descendants;

具体是:

A member of your family—your brothers and sisters, half-brothers and half-sisters, spouse, ancestors (parents, grandparents, etc.), lineal descendants (children, grandchildren, etc.), and the spouses of any of these persons;

以及Sec. 707(b)定义的超过50%占股的情况

(A) a partnership and a person owning, directly or indirectly, more than 50 percent of the capital interest, or the profits interest, in such partnership,

如果赠与方之间并非 related person,那么不需要合计。Loeb & Loeb 律所在其一篇文章在讲述这个规则的时候举了French uncle和Australian aunt的例子说明:

The obligation to report occurs once the aggregate value of all gifts from a single transferor exceeds the stated amount. However, you must also aggregate gifts from different foreign persons if you know (or have reason to know) that those persons are related to each other. For example, a U.S. person could receive a $99,000 gift from each of his French uncle and his Australian aunt during the tax year without triggering a Form 3520 reporting obligation if the French uncle and Australian aunt are unrelated. Conversely, if the French uncle and Australian aunt are related to each other, the reporting obligation would be triggered because the U.S. person received more than $100,000 from related persons.

注意:uncle/aunt与niece/nephew并不是我们前面定义的related person。但是这里考察的是赠与方(donors)之间的关系,而不是赠与方与受赠U.S. person之间的关系。在这个例子中,只要考察French uncle与Australian aunt是否是related即可。

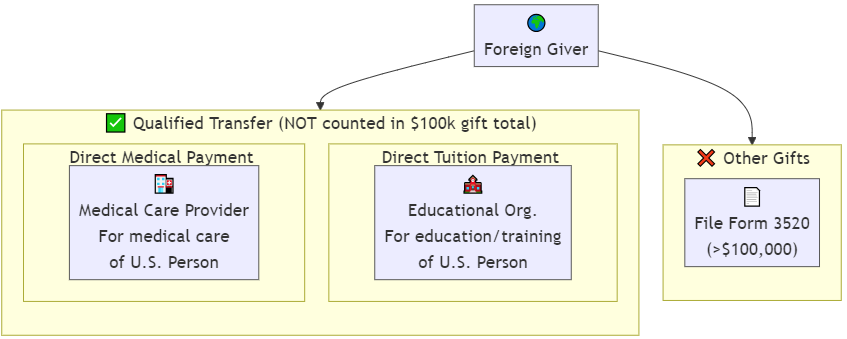

Qualified Transfers: Medical and Tuition Payments

与美国国内赠与税规则类似,一些qualified transfer不计入10万的额度,根据Sec. 2503(e)(2),qualified transfer包括学费和医疗费:

(A) as tuition to an educational organization described in section 170(b)(1)(A)(ii) for the education or training of such individual, or

(B) to any person who provides medical care (as defined in section 213(d)) with respect to such individual as payment for such medical care.

但注意,这些费用必须是直接支付给提供教育或医疗服务的机构或个人,而不是先支付给U.S. Person再由其转付。

Money Stackexchange讨论了一个日本学生的例子,有回复指出:

Had they paid directly to the institution, you wouldn’t need to count it as income/gift to you because you didn’t actually receive the money (so no income) and it went directly to cover your qualified education expenses (so no gift), but this is not the case in your situation.

Plus1s同意这个说法。因为money is fungible,学生的学费指出可以来自于之前的存款或其他收入,父母的10万以上汇款也可以理解为用于生活开销等其他目的。只有直接支付才能无疑义地从gift中剥离这部分资金。

另:生活费不属于Qualified Transfer。税务律所Golding & Golding在其介绍文章中举例说明了:

Gift From Parents for Living Expenses

The taxpayer receives a gift of $150,000 to help subsidize his living expenses while attending school in Los Angeles and living off-campus. While Taxpayer’s parents pay tuition directly to the university, his living expenses and other incidentals are ancillary to the exception of gifts for medical and tuition — and therefore reportable on Form 3520.

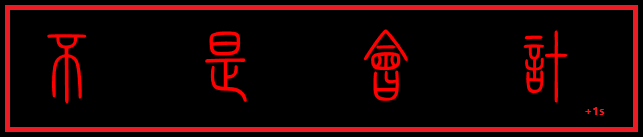

下图的例子总结了以上几条规则:

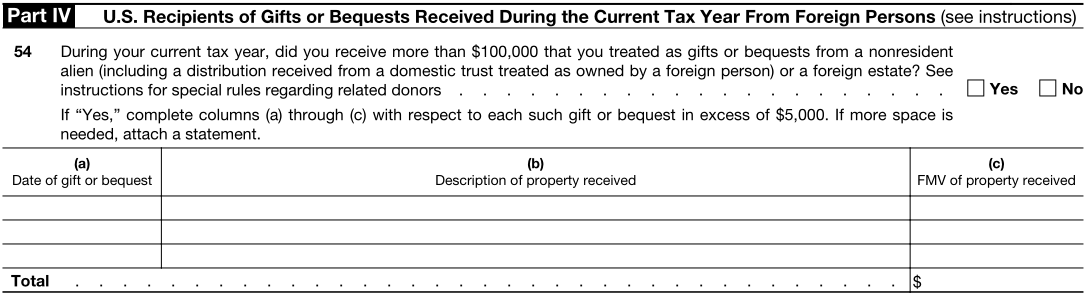

填写 Form 3520 Part IV

对于RA收到NRA汇款的情况,通常只需要填Form 3520第一页,以及Part IV

单人(包括related person)赠与总额超过10万,需要填写Line 54。每一笔金额超过5k的 gift 都需要单独列出。如果空间不足,可以附上额外的 attachment 进行说明。

这里的捐赠人姓名(name of foreign donor)可以不披露,例如description可以填”gift from mother for house down payment”。

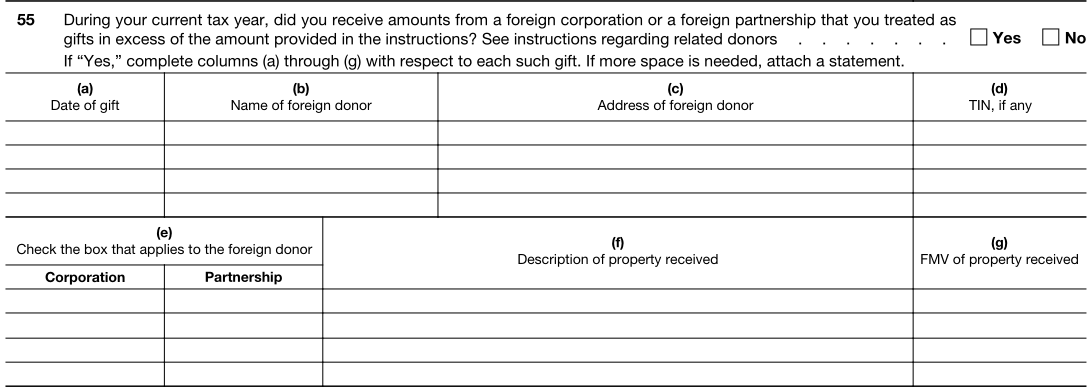

如果是公司汇款,申报限额和规则有所不同。此时应填写Line 55,要求披露捐赠人的名字

选择公司而不是个人汇款,在有些国家是因为外汇管制,公司作为实体更方便。IRS对此说明如下

For purported gifts from foreign corporations or foreign partnerships, you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities exceeds $18,567 for 2023 and $19,570 for 2024 (adjusted annually for inflation). You must separately identify each gift and the identity of the donor. Note that the IRS may recharacterize purported gifts from foreign corporations or foreign partnerships.

可见限额在2024年只有$19,570。IRS还有权对这类”purported gifts”的性质进行重新认定 (recharacterize)。例如,IRS可能会认为这笔款项并非gift,而是dividend, compensation, 或者loan。

邮寄3520

Form 3520的申报截止日期通常是每年的4月15日。如果提交Form 4868报税延期,那么Form 3520的截止日期也相应延至10月15日。

但Form 3520 是单独提交,截至本文写作时,Form 3520尚不能e-file,必须打印出来,签名后邮寄。根据3520 Instruction(请查看申报时的最新版本),邮寄地址是

Internal Revenue Service Center

P.O. Box 409101

Ogden, UT 84409

建议使用certified mail,保留邮寄凭证。

未申报罚金

根据 IRC Sec. 6039F(c)(1)(B),对于未申报的 foreign gifts:

“…such United States person shall pay (upon notice and demand by the Secretary and in the same manner as tax) an amount equal to 5 percent of the amount of such foreign gift for each month for which the failure continues (not to exceed 25 percent of such amount in the aggregate).”

罚金按月计算,为未申报金额的5% per month,累计最高可达赠与总额的25%。

IRS可根据纳税人提交的reasonable cause(Sec. 6039F(c)(2)),在不是有意犯错的情况下酌情减免。申报本身不产生收入税,而未申报的后果却如此严重,所以若超过10万限额请及时申报。

关于Form 3520的迟报以及罚款的实际执行情况,我们将在后续文章中详述。

总结

本文讨论了NRA给RA大额赠与的情况。如果年度总额超过10万(需考虑 related parties,可排除qualified transfers),则被赠与的RA有义务申报Form 3520 Part IV。

由于申报Form 3520本身通常不直接产生所得税负担,而未申报的罚款却相当严厉,plus1s认为应该

掌握、控制每年收款金额

如果金额明确超过10万,及时申报

如果金额非常接近10万,或者对是否需要申报存疑,谨慎的做法是选择申报,或找专业人士咨询。

目前Form 3520(截至本文写作时)只能通过邮寄提交,不要错过4月15的截止日期。

参考资料:3520 Instruction, Sec. 6039F, IRS: gifts from foreign person

免责声明:本文及其中任何文字均仅为一般性的介绍,绝不构成任何法律意见或建议,不得作为法律意见或建议以任何形式被依赖,我们对其不负担任何形式的责任。我们强烈建议您,若有税务问题,请立即咨询专业的税务律师或税务顾问。

Disclaimer: This article and any content herein are general introduction for readers only, and shall not constitute nor be relied on as legal opinion or legal advice in any form. We assume no liability for anything herein. If you need help about tax, please talk to a tax, legal or accounting advisor immediately.