Update: 更新留學生的特殊Closer Connection Exception,不再有183天的限制。感謝讀者chenyuetian提供的鏈接:

https://www.irs.gov/individuals/international-taxpayers/the-closer-connection-exception-to-the-substantial-presence-test-for-foreign-students

根據此鏈接,作者也去對應法規Internal Revenue Code section 7701(b)(5)(D) and (E) and in Treas. Reg. § 301.7701(b)-3(b)(7)(iii) 查閱了一番,對於留學生這個群體,有另一種特殊的exception:

- does not intend to reside permanently in the United States; 容易證明

- has substantially complied with the immigration laws and requirements relating to his student nonimmigrant status; 容易證明

- has not taken any steps to change his nonimmigrant status in the United States toward becoming a permanent resident of the United States; and 容易證明

- has a closer connection to a foreign country than to the United States as evidenced by the factors listed in Treasury Regulation 301.7701(b)-2(d)(1). 主觀性強

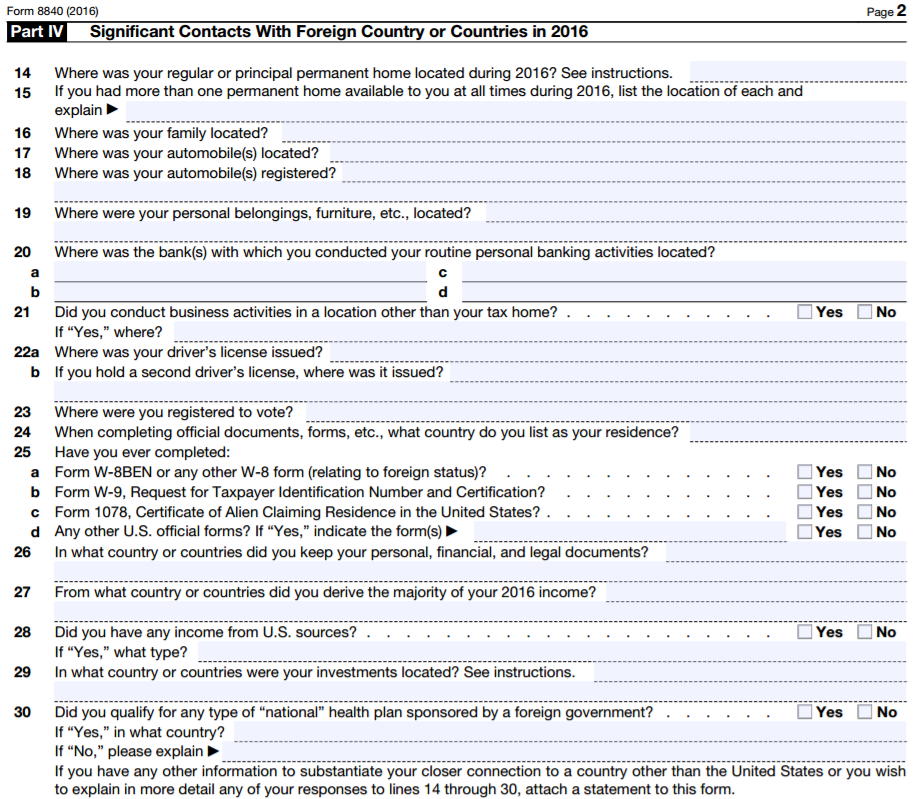

文末也提到:The burden of proof is on the student to prove these four factors. 證明滿足所有條件的義務在學生自己,而不在IRS。8843表的Line 12有要求附上一份statement來解釋超過5年的情況。關於第四點的factors在正文有提到,大家也可以參考Form 8840的Part IV Significant Contacts With Foreign Country or Countries,來評估自己的情況。

最後,作者想說,其實這個問題怎麼回答都是可以的,如果按照經驗主義來說,稅局是極少在留學生報稅身份上較真的,而且正文開頭也已經說到按resident報稅好處也是不少的。所以請各位看官一笑了之。從個人從業經驗來看,省稅是一方面,省事也是一方面,大家多多權衡。

最後,作者想說,其實這個問題怎麼回答都是可以的,如果按照經驗主義來說,稅局是極少在留學生報稅身份上較真的,而且正文開頭也已經說到按resident報稅好處也是不少的。所以請各位看官一笑了之。從個人從業經驗來看,省稅是一方面,省事也是一方面,大家多多權衡。

時光飛逝,有沒有感覺一眨眼,留學美國已經多年過去?這個時候你就要注意了,從稅務的角度你可能已經和美國居民一視同仁,成為 Resident Alien (RA) 了。如果你對 RA 和 NRA 還不了解,請移步我們的《報稅身份辨析》。在你理解了 Substantial Presence test 之後,你會說我們在美國僅僅一年就超過了183天。請注意之所以留學生可以不受這個的影響,是因為持F簽證等的留學生屬於「Exempt individual」,這樣的話天數是不算入test里的。但是這個是只有五年的(5 calendar years),在你來美的第六年就要開始計算天數了。

那是不是超過5年之後,滿足 Substantial Presence test 的 F1身份的人就必須要按照 Resident Alien 來報稅呢?下文將慢慢分解。

首先,有人可能會問,為什麼有人會想要維持 Nonresident 身份呢?其實從報稅的角度,按照 Resident 報稅能夠帶來更多的好處:夫妻報稅,增加dependent,standard deduction 或者更豐富的 itemized deduction 等等。當然,前提是你沒有很多的海外收入。美國的 Resident 和綠卡持有者或者公民一樣,都是全球徵稅的,而且還有霸氣無比的法案 FATCA 的存在讓監管變得很嚴格。如果有海外收入,這個確實需要進一步考量,甚至牽扯到 foreign earned income exclusion 或者 foreign tax credit,不屬於本文範圍。(你或許會說,Nonresident 還有$5,000的treaty可以抵稅呢,那麼下次,我就來跟大家說說超過五年還能不能用treaty的問題。)

接下來就講講 Resident Alien 判定標準的例外情況。

我們來看看Publication 519, U.S. Tax Guide for Aliens的原文:

You will not be an exempt individual as a student in 2016 if you have been exempt as a teacher, trainee, or student for any part of more than 5 calendar years unless you meet both of the following requirements.

- You establish that you do not intend to reside permanently in the United States.

- You have substantially complied with the requirements of your visa.

從這段看,如果你滿足沒打算永久居留美國並且嚴格服從簽證要求,那麼你還是可以做「Exempt individual」的,維持 Nonresident Alien 的身份。看起來並不難,對吧?

別急,我們繼續:

The facts and circumstances to be considered in determining if you have demonstrated an intent to reside permanently in the United States include, but are not limited to, the following.

- Whether you have maintained a closer connection to a foreign country (discussed later).

- Whether you have taken affirmative steps to change your status from nonimmigrant to lawful permanent resident as discussed later under Closer Connection to a Foreign Country.

第二個好理解,有沒有開始永久居民的申請,這個一般還在讀書或者剛畢業還遇不到,那麼第一條 Closer Connection to a Foreign Country,怎麼證明呢?是不是家人在國內,就足以了呢?在後文有專門介紹Closer Connection to a Foreign Country的,我們簡單看一下基本要求:

Even if you meet the substantial presence test, you can be treated as a nonresident alien if you:

- Are present in the United States for less than 183 days during the year,

- Maintain a tax home in a foreign country during the year, and

- Have a closer connection during the year to one foreign country in which you have a tax home than to the United States (unless you have a closer connection to two foreign countries, discussed next).

因為這裡用的是「and」,所以三個要求都要滿足。第一個要求,在美不超過183天!僅此一點,大多數朋友都不滿足了吧。。。

至於另外兩項,則是比較棘手而且主觀的問題,是需要在審查時你需要像稅局證明的,這其中牽扯到很多因素,工作地方、人際圈、生活圈等等。沒有一個簡單化一的標準答案,而是綜合考量的結果(和bona fide resident的判斷有點像,這個是綠卡持有人在海外工作會常常遇到的,以後再談)。

附上稅局給的一段list,以供參考。

In determining whether you have maintained more significant contacts with the foreign country than with the United States, the facts and circumstances to be considered include, but are not limited to, the following.

1. The country of residence you designate on forms and documents.

2. The types of official forms and documents you file, such as Form W-9, Form W-8BEN, or Form W-8ECI.

3. The location of:

a. Your permanent home,

b. Your family,

c. Your personal belongings, such as cars, furniture, clothing, and jewelry,

d. Your current social, political, cultural, professional, or religious affiliations,

e. Your business activities (other than those that constitute your tax home),

f. The jurisdiction in which you hold a driver’s license,

g. The jurisdiction in which you vote, and

h. Charitable organizations to which you contribute.

It does not matter whether your permanent home is a house, an apartment, or a furnished room. It also does not matter whether you rent or own it. It is important, however, that your home be available at all times, continuously, and not solely for short stays.

可以看出,須考量的方面非常廣,據我所知,甚至包括駕照、圖書卡、協會活動等等。

綜上,想要在五年以後繼續維持 Nonresident,所需條件在天數上就被卡住了,哪怕沒有,後面的判定上也會比較頭疼。

參考鏈接:https://www.irs.gov/pub/irs-pdf/p519.pdf

Caiwade,註冊會計CPA,致力於中國留學生和移民的稅務普及和答疑解惑。