前天(4/26/2017),财政部长Steven Mnuchin和白宫国家经济委员会主席Gary Cohn在白宫新闻发布会给大家透露了很多税法改革的重磅消息,声称这次税改将是自1986年税改最显著的一次并且也是美国历史上最大的减税改革。川普的大刀果真向税头上砍去了!

其实早在16年9月竞选的时候,川普就已经公布了他的税改方案,当时the Tax Foundation的一个报告估算这个方案会减少联邦政府收入$4.4 trillion 到 $5.9 trillion,在考虑经济增长等因素会缩小为 $2.6 trillion 到 $3.9 trillion。而此次,大部分方案都保持或者做了小幅修改,还有很多尚在计算考量中。尽管川普政府一直强调随着经济增长,减少不必要的减免和杜绝漏洞,税改会pay for itself,国会是否相信并通过,我们拭目以待。

接下来简单分析一下税改对大家的影响。因为目前白宫并未公布官方文件,本文将依据白宫官网简报。开始之前我们简单回顾一下个人报税的公式,方便大家理解:

Total Income 总收入如W2,1099,股票等等

– Adjustment 调整项如退休账户和学费

= Adjusted Gross Income (AGI)

– Large of Itemized deductions or standard deduction (每个人$6,300) 两者选大的抵扣

– Exemptions 每个人额外$4,050免税额

=Taxable Income 应纳税所得

>>> Tax 根据累进税率表算税

– Alternative minimum tax 见后文

– Tax credits 例如教育,抚养子女

= Total tax 一年纳税总额

– total payments 预缴

= Amount you owe or overpaid 多退少补

注:其中Itemized deductions最常见的内容包括当年所有预缴的州税和地方税,房产地税,房贷利息,慈善捐款。

个税七伤拳:

第一招:“We are going to cut taxes and simplify the tax code by taking the current seven tax brackets we have today and reducing them to only three brackets — a 10 percent bracket, a 25 percent bracket, and a 35 percent bracket.”

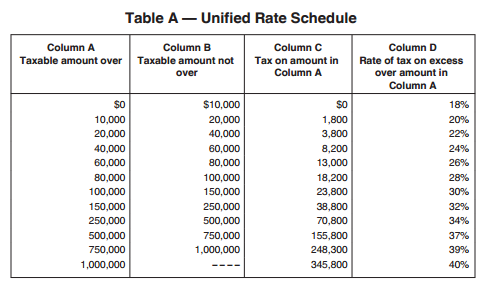

和中国类似,美国目前的个税税率有七档是10%,15%,25%,28%,33%,35%,39.6%,现在要改为10%,25%,35%三档。总体来说税率是降低了,但是具体bracket并没有说,所以对不同收入的影响不尽相同。比如说2016年夫妻合报taxable income在$75,300以内只有10%和15%的税率,但如果新的bracket是$70,000开始25%,那么相当于多出的5000多就要按照25%交税,那么新税法就反而增税了。

第二招:“We’re going to double the standard deduction so that a married couple won’t pay any taxes on the first $24,000 of income they earn. So, in essence, we are creating a zero tax rate — yes, a zero tax rate — for the first $24,000 that a couple earns.”

第三招:“The largest standard deduction also leads to simplification because far fewer taxpayers will need to itemize, which means their tax form can go back — yes — to that one simple page that I talked about earlier…. We’re going to eliminate most of the tax breaks that are mainly benefits to high-income individuals. Homeownership, charitable giving and retirement savings will be protected. But other tax benefits will be eliminated.”

第二招和第三招要结合在一起看,一个是双倍标准扣除额,一个是简化列举扣除额。两者报税的时候只能选其一来抵扣收入,所以目前来看更多人将会直接用标准扣除额,因为更大而且列举扣除额可减项大幅缩减。根据后面的记者提问,财政部长明确表示只有房贷利息和慈善捐款这两个抵税会保留,甚至不包括州税(这点导致高州税州处于不利地位)。那么对于很多家庭如果贷款不算太多又没有捐款,是很难超过$24,000这个界限的。而且这里面有个很狡猾的地方,根据去年的提案,personal exemption也是要拿走的,那么实际上也就是从原本的夫妻可抵税约两万(12,000 standard deduction加上8,000 personal exemption)变到了两万四而已。当然发布会的时候并没有提personal exemption,如果真是这样,那川普就真的不够意思了。

第四招:“Families in this country will also benefit from tax relief to help them with child and dependent care expenses.”

抚养子女会享受到税收优惠。没有太具体的内容,不知道是在现有的credit基础上加强还是增加新的抵扣措施。

第五招:“We are going to repeal the alternative minimum tax. The AMT creates significant complications and burdens which require taxpayers to do their taxes twice to see which is higher. That makes no sense, and we should have one simple tax code.”

去掉AMT。什么是AMT,简单地说就是税局怕你税没有交够,所以让你换种方法再算一算,不够就再补点。一般高收入群体或者有incentive stock option等会遇到这种情况,去掉这个,倒的确是简化了些。

第六招:“As we all know, job creation and economic growth is the top priority of the administration. Nothing drives economic growth like capital investment. Therefore, we are going to return the top capital gains tax rate and dividend rate to 20 percent, repealing the harmful 3.8 percent Obamacare tax on dividends and capital gains. That tax has been a direct hit on investment income and small business owners. ”

废除奥巴马政府的额外3.8%股息和资本利得税,鼓励投资。这里面提到最高20%的税率,应该还是限制在qualified dividend和long-term capital gain。比如短期的股票赚钱,还是要按正常收入税率交税的,根据目前信息不会cap到20%。

第七招:We’re going to repeal the death tax. The threat of being hit by the death tax leaves small business owners and farmers in this country to waste countless hours and resources on complicated estate planning to make sure their children aren’t hit with a huge tax when they die. No one wants to see their children have to sell the family business to pay an unfair tax.

最有意思的一个部分,废除death tax,也就是estate tax。美国的遗产税很高,最高税率达到了40%,但是只要在总遗产加生前送出的礼物总额超过$5,490,000(2017)才会开始计算。所以这最后一招必杀,是为富人们准备的。总统是否会因为这点受益,也成为新闻发布会的焦点之一。

公司税不明朗:

Under the Trump plan, we will have a massive tax cut for businesses and massive tax reform and simplification. As the President said during the campaign, we will lower the business rate to 15 percent. We will make it a territorial system. We will have a one-time tax on overseas profits, which will bring back trillions of dollars that are offshore to be invested here in the United States to purchase capital and to create jobs.

公司税简单带过,税率降到15%,从全球征税体系改成领土制,仅一次优惠离岸资金征税从而可以资本自由流入。可以说是很大胆的举措,但是还有很多疑问(比如flow through entity本来就不用交联邦税而是在个人名下交税,这种情况有何变化)和操作难点,值得关注。

这次税改,川普七伤拳到底会伤到财政还是劳苦大众,还难下定论,不过似乎对于富人们来说,怎么都是一个重大利好。

本文仅分析税改,并无任何政治观点。

Reference:

https://files.taxfoundation.org/20170210092631/TaxFoundation_FF528_FINAL3.pdf