Contents

【2025.9.18 更新】塵埃落定

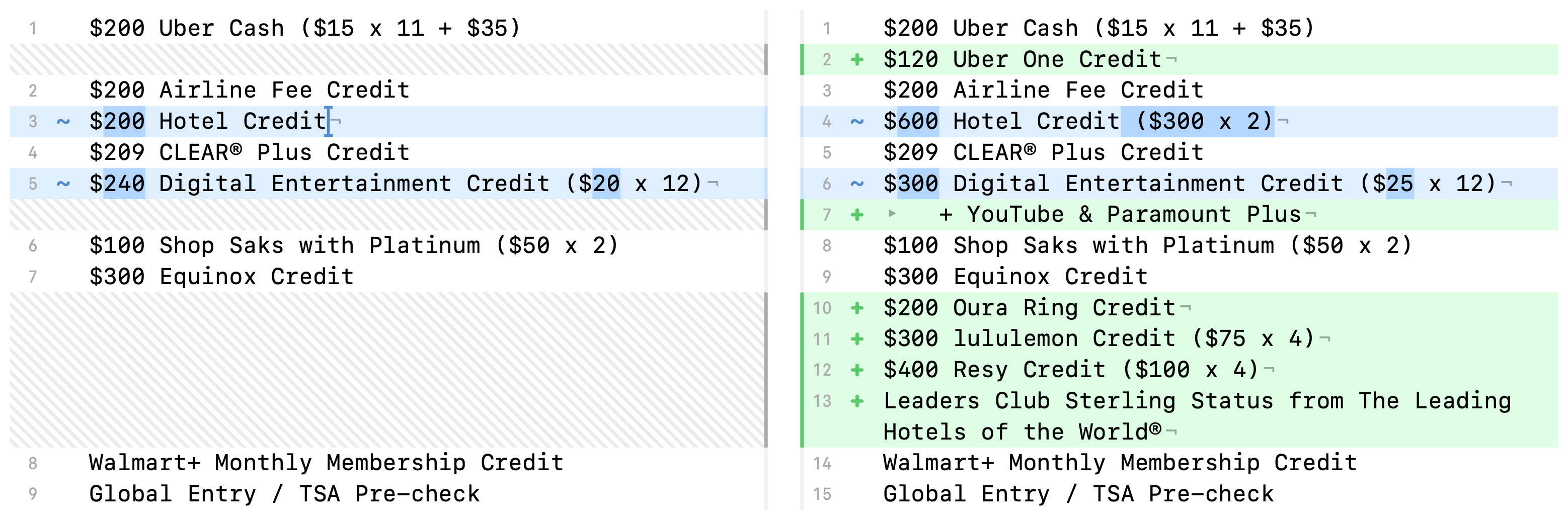

AmEx Platinum 全面刷新,福利得到了大幅提升,同時年費從 $695 升高到了 $895。這次福利的升級幅度巨大,此卡現在又變成了可以考慮長期持有的卡了!福利變更內容如下,感謝美卡論壇 awash 提供的直觀對比圖:

AmEx Business Platinum 小幅刷新:

- 年費從 $695 升高到了 $895。

- 新增了 $600 FHR 酒店報銷。

- 35% airline rebate 福利被削弱了,需要指定航司了。

在今天的改版後個人白金卡相比之下明顯更強。

【2025.9.16 更新】個人白金卡福利細節漏出

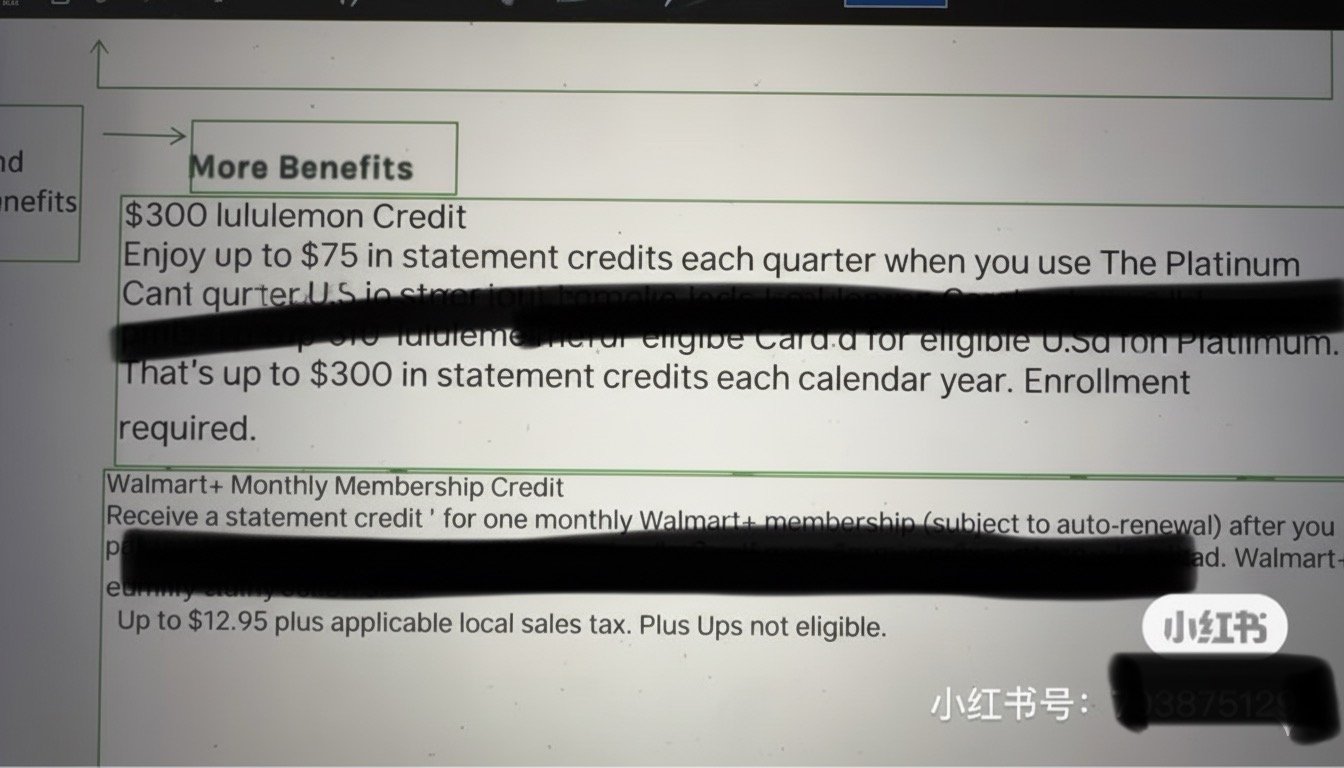

Reddit 上有人分享了一張圖,上面列出來了個人白金卡9.18的新福利(的一部分?):

可見至少非常確定的是FHR福利是變成$300每半年(共$600每年)了,$400 Resy credit 也加上了。Lululemon 沒提,航空報銷還有沒有沒提,大家都猜測這張截圖應該是不全的。

DoC 說trusted source告訴他rumor中的所有credit和所有原有的舊credit全都在。對於這一點,我個人表示有點懷疑,這也 too good to be true 了!怎麼才漲 $200 的年費,就能FHR增加$400、新增Lululemon $300、Resy $400這麼多coupon、居然還不砍舊 coupon?即使是 coupon book 這也有點太給力了,真這麼給力那麼個人白金卡居然又要變成可以長期持有的一張高端卡了。

Anyway,9.18 馬上就要來了,很快就清楚了。下面是9.18之前大家應該至少考慮一下的建議:

年費確實將變成 $895。大家可以趁著現在年費還是 $695,趕緊申請,然後賭新福利9.18之後立刻跟進,這樣低年費享受高福利至少一小段時間。前提是你刷得到個人白金卡 175k 的高開卡獎勵,如果是低開卡獎勵那麼大概率不值得。

FHR credit 確實將從一年 $200 變成半年 $300(一年共 $600)。不管高年費高FHR credit你喜歡不喜歡,如果你現在正在持有個人白金卡,強烈建議趕緊把今年的 $200 FHR credit 給擼掉,這樣9.18福利一刷新今年估計可以$200和新的半年$300都享受到。

【2025.9.15 更新】商業白金卡福利細節漏出

DoC 分享了商業白金卡泄漏出來的福利細則,新卡將於9.18起變成這些福利(這個日期和之前的小道消息一致):

- $895 annual fee

- 200,000 Membership Rewards after $20,000 in spend within the first 3 months

- Choice between regular and mirror finish card

- $600 hotel credit ($300 semi annual credit for Fine Hotels & Resorts/The Hotel Collection)

- Additional credits when you spend $250,000+ on qualifying purchases in a calendar year:

- $2,400 American Express One AP credit

- $1,200 Amex Travel Online flight statement credit

- Up to $209 CLEAR Plus credit

- Leaders Club Sterling status for Leading Hotels of the World

- Dell credit of up to $1,150

- $150 in statement credits on U.S. Purchases

- An additional $1,000 statement credit after you spend $5,000 or more on those purchases per calendar year

- $250 Adobe credit when you spend $600+ or more on Adobe purchases

- Card earns at the following rates:

- 5x on fine hotels & resorts and the hotel collection booked through American Express travel

- 5x points on all flights booked through AmExtravel.com

- 2x points on key business purchases (limited to $2 million per calendar year)

- Select categories (Construction material and hardware suppliers Electronic goods retailers and software & cloud system providers Shipping providers)

- Single purchases of $5,000+

- 1x points on all other purchases

- $200 airline incidental credit per calendar year

- Lounge access:

- Centurion lounge access

- International American Express lounge access

- 10 Delta SkyClub loungevisits

- Priority pass select membership

- Airspace lounge access

- Hilton $50 credit per quarter

- $90 quarterly credit for Indeed

- $10 a month for wireless phone service providers

- Marriott gold status

- Hilton gold status

其中比較重要的內容有:

年費確實將變成 $895。大家可以趁著現在年費還是 $695,趕緊申請,然後賭新福利9.18之後立刻跟進,這樣低年費享受高福利至少一小段時間。

FHR credit 確實將是半年 $300(一年共 $600),商業白金卡如此估計個人白金卡亦是如此。不管高年費高FHR credit你喜歡不喜歡,如果你現在正在持有個人白金卡,強烈建議趕緊把今年的 $200 FHR credit 給擼掉,這樣9.18福利一刷新今年估計可以$200和新的半年$300都享受到。

Lululemon credit 的rumor沒提,當然商業卡沒有這個credit也正常,就是不知道個人卡是不是會有。9.18 沒幾天了,馬上就知道了。

【2025.8.29 更新】要增加 Lululemon 和 Resy credit?

最近關於 AmEx Platinum 運通白金卡的小道消息真是接二連三不斷。先是有官方發布下半年(可能是 9 月 18 日)會有大改,然後有人扒出來年費可能會漲到 $895,然後傳出來 FHR credit 將從每年僅有 $200 增加到半年 $300。最近美卡論壇的 ayzg 轉載小紅書上的某位用戶(TA 好像介意別的平台直接發 ID,這裡就隱去了)發布的消息,有可能又有以下兩種變化:

- 增加 Lululemon credit,按照季度發放,每個季度 $75 共 $300;

- 增加 Resy credit,沒說頻率,可能按照季度或者月平均發放,共 $400。

並且一樓的回復里還有一些更新:

- 會去掉 $300 Equinox credit;

- 其他現有的 credit 暫時保留,包括 $200 航空報銷、$200 Uber Cash、$240 流媒體報銷按月給、$100 Saks credit 按照半年給、Walmart+ $12.95 每個月稅後報銷;

- 別忘了 FHR credit 會變成半年 $300,共 $600。

消息的截圖如下,主要為了留存憑證。

首先想說明這個消息源非常小道消息,沒頭沒尾的,請大家不要太當真。本著記錄的心態,我們暫且記錄一下,等到 9 月 18 日大概率就知道究竟如何改了。

首先想說明這個消息源非常小道消息,沒頭沒尾的,請大家不要太當真。本著記錄的心態,我們暫且記錄一下,等到 9 月 18 日大概率就知道究竟如何改了。

簡單來分析一下,我本人本來是覺得 FHR credit 增加到 $600,應該會去掉不少其他的 credit 才對,$895 的年費看上去比較靠譜,但就算再高一些,應該短期內不會超過 $995。Equinox $300 去掉看上去還是挺有可能的,Saks 如果真的能保留下來,我覺得還是有點意外,尤其之前傳言 Saks 可能破產的消息滿天飛。還有我覺得 Walmart+ 的按月報銷遲早要去掉,因為它跟 Amex 白金卡對標的用戶形象太不統一了。

Amex 有句宣傳語:Don』t live life without it。看來白金卡的目標真的是滲透到生活的方方面面。不知道大家覺得這個小道消息有多真呢?如果真的增加了 Lululemon 和 Resy,你歡迎這兩種報銷福利嗎?

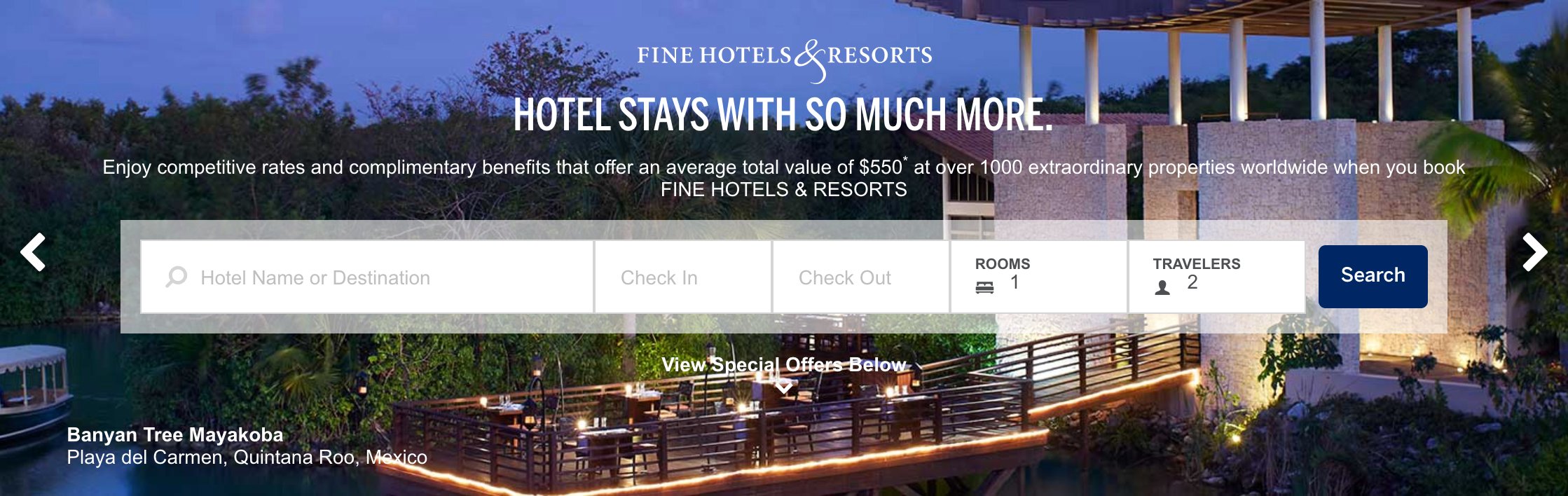

【2025.8.14 更新】9.18 福利變更;FHR Credit 福利升級:年度$200變半年$300(一年共$600)?

今天,美卡論壇 tlitb 發現,AmEx白金卡的FHR Credit福利可能從2025年9月18日開始從每年$200增加為每半年$300,每年總共$600。原始的Term官網出現了一下以後又刪了,我們截錄如下:

†$600 HOTEL CREDIT: Basic Card Members on U.S. Consumer Platinum Card Account are eligible to receive up to $300 in statement credits semi-annually (January to June, and July to December) for up to a total of $600 per calendar year, when they or Additional Platinum Card Members use their Cards to pay for eligible prepaid Fine Hotels + Resorts® and The Hotel Collection bookings made through American Express Travel (meaning through amextravel.com, the Amex Travel™ App, the Amex® App, or by calling the phone number on the back of your eligible Card) or when Companion Platinum Card Members on such Platinum Card Accounts pay for eligible prepaid bookings for The Hotel Collection made through American Express Travel (meaning through amextravel.com, the Amex Travel™ App, the Amex® App, or by calling the phone number on the back of your eligible Card). Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $600 per calendar year, per Card Account. Fine Hotels + Resorts® program bookings may be made only by eligible U.S. Consumer Basic Platinum and Additional Platinum Card Members. The Hotel Collection bookings may be made by eligible U.S. Consumer Basic and Additional Platinum Card Members and Companion Platinum Card Members on the Platinum Card Account. Delta SkyMiles® Platinum Card Members are not eligible for the benefit. To receive the statement credits, an eligible Card Member must make a new prepaid booking (referred to as 「Pay Now」 on amextravel.com, the Amex Travel™ App, and the Amex App) using their eligible Card through American Express Travel for a qualifying stay at an available, participating Fine Hotels + Resorts or The Hotel Collection property. Bookings of The Hotel Collection require a minimum stay of two consecutive nights. Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise). Statement credits are typically received within a few days, however it may take 90 days after an eligible prepaid hotel booking is charged to the Card Account. Eligible bookings must be processed before June 30th, 11:59PM Central Time, to be eligible for statement credits within the January to June benefit period, and December 31st, 11:59PM Central Time to be eligible for statement credits within the July to December benefit period. American Express relies on the merchant』s processing of transactions to determine the transaction date. If there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date then your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, then the statement credit available in the next calendar year benefit period will be applied, if available. If you have transferred to a different Card at the time the merchant submits the transaction, you may not receive the statement credit. Statement credit(s) may not be received or may be reversed if the booking is refunded, cancelled, or modified. If the Card Account is cancelled or past due, it may not qualify to receive a statement credit. If American Express does not receive information that identifies your transaction as eligible, you will not receive the statement credits. For example, your transaction will not be eligible if it is a booking: (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs, (ii) not made through American Express Travel, or (iii) not made with an eligible Card. Participating properties and their availability are subject to change. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide and may reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead, the statement credit may be applied to your Pay In Full balance. Please refer to AmericanExpress.com/FHR and The Hotel Collection Bookings | American Express Travel for more information about Fine Hotels + Resorts and The Hotel Collection, respectively.

Basic Card Members on U.S. Business Platinum Card Accounts (「Card Account」) are eligible to receive up to $600 in statement credits per calendar year when they or eligible Employee Card Members on the Card Account use their Cards to pay for eligible prepaid Fine Hotels + Resorts® and The Hotel Collection bookings made through American Express Travel (meaning through amextravel.com, the Amex Travel App™, the Amex® App, or by calling the phone number on the back of their eligible Card). Purchases by both the Basic Card Member and any Employee Card Members on the Card Account are eligible for statement credits. The total amount of statement credits for eligible purchases will not exceed $300 semi-annually for a total of up to $600 per calendar year in statement credits across all Cards on the Card Account. Each semi-annual eligibility period is defined as January to June and July to December. Starting on September 18, 2025, customers will have $300 available for use, expiring on December 31, 2025. Fine Hotels + Resorts® program bookings may be made only by eligible U.S. Business Basic and Employee Business Platinum Card Members. The Hotel Collection bookings may be made by eligible U.S. Business Basic and Employee Business Platinum and Employee Business Expense Card Members. To receive the statement credits, an eligible Card Member must make a new booking using their eligible Card through American Express Travel on or after September 18, 2025, that is prepaid, for a qualifying stay at an available, participating Fine Hotels + Resorts or The Hotel Collection property. Bookings of The Hotel Collection require a minimum stay of two consecutive nights. Eligible bookings must be processed within the eligibility period to be eligible for statement credits within that period. Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise). Statement credits are typically received within a few days, however it may take 90 days after an eligible prepaid hotel booking is charged to the Card Account. American Express relies on the merchant』s processing of transactions to determine the transaction date. If there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date, then your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31 but the merchant processes the transaction such that it is identified to us as occurring on January 1, then the statement credit available in the next eligibility period will be applied, if available. If you have transferred to a different Card at the time the merchant submits the transaction, you may not receive the statement credit. Statement credit(s) may not be received or may be reversed if the booking is refunded, cancelled, or modified. If the Card Account is cancelled or past due, it may not qualify to receive a statement credit. If American Express does not receive information that identifies your transaction as eligible, you will not receive the statement credits. For example, your transaction will not be eligible if it is a booking: (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs, (ii) not made through American Express Travel, or (iii) not made with an eligible Card. Participating properties and their availability are subject to change. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide, and may reverse, any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead, the statement credit may be applied to your Pay In Full balance. Please refer to AmericanExpress.com/FHR and The Hotel Collection Bookings | American Express Travel for more information about Fine Hotels + Resorts and The Hotel Collection, respectively.

等正式Term發布以後,我們也會相應的更新AmEx個人和商業白金卡的福利。

【2025.6.21 更新】年費將會上漲為 $895?

根據對amex qwww網址的分析,美卡論壇 吹小號的鵝發現AmEx Platinum出現了一個正在內測的網頁,裡面寫著年費 $895。(DoC也發了rumor文章,然後他標記的來源是 Reddit oxymoronic99,然後這個Reddit用戶說他的來源是美卡論壇,所以其實真正的來源就是美卡論壇 吹小號的鵝對qwww網址的分析。)

看起來我們之前猜測的很對,AmEx就是不能忍CSR改版後的年費$795超過AmEx Platinum,所以一定要漲年費壓Chase一頭!

目前的信息還僅限於年費,具體福利會有何變更還沒有消息。不過盲猜就是coupon book變厚吧,這是近年來的確定性趨勢了。

【2025.6.16 更新】下半年將要推出「重大更新」?

就在Chase正在宣傳針對 Chase Sapphire Reserve (CSR) 推出改版之際,AmEx 官方發新聞稿稱將於2025年下半年對 AmEx Platinum 運通白金卡(個人版&商業版)推出」重大更新「 (“major updates”)。官方新聞稿在這裡:

根據通告,目前還沒有公布太多細節,包括年費將漲到多少、增加什麼新福利都還沒有公布。

儘管目前的信息並不多,一個很顯然的猜測是:AmEx 可能是覺得CSR改版後的$795年費超過了當前AmEx Platinum的$695年費,這讓AmEx顯得很沒面子,所以估計至少要對等加年費加到$795,甚至反超至$995。

通告中說更多細節將於今年秋天公布,有了更多細節之後我們會回來更新本文。Stay tuned!