Bank of America AAA Member Rewards Visa Signature® Credit Card Review

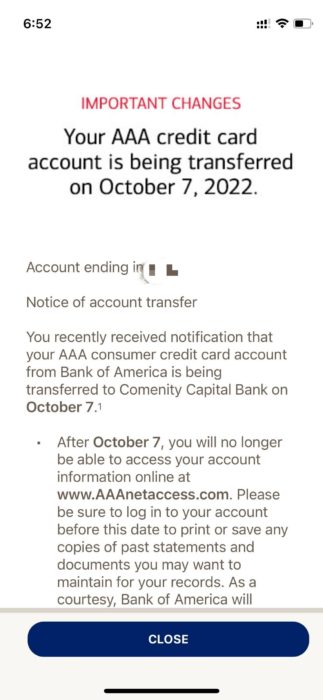

2022.8 Update: This card is discontinued, as all previous application links are dead. Now in BoA app, there is a reminder that says this card will be automatically converted to another weak AAA card issued by another bank. R.I.P.

2021.8 Update: Something strange is happening to this card: The original application link on BoA is now redirecting to a general credit card list page. The application link on AAA is still alive, but there is no language about the Preferred Rewards program any more in the terms. If the Preferred Rewards program no longer applies to this card, then this card is essentially useless.

2021.6 Update: Although this card existed for quite a few years, I did not pay attention to it. It is actually a good card if you have some money in BoA and reach the Platinum Honors tier.

Contents

Application Link

Benefits

- $200 offer: earn $200 statement credit after spending $1,000 in first 3 months.

- Earn 3x points on eligible travel and AAA purchases; earn 2x points on gas, grocery store, wholesale club and drugstore purchases; earn 1x points everywhere else. No cap.

- How to redeem the points: you can redeem the points for statement credit at a fixed ratio 1 cent/point. You can also redeem the points for AAA purchases with a 40% value bonus, which makes the ratio 1.4 cents/point.

- BoA Preferred Rewards program: If you have checking/savings/brokerage account in BoA or Merrill Edge, you can earn additional points based on the amount of asset. Earn additional 25% rewards if you are in Gold tier ($20k or more in balance); 50% if Platinum tier ($50k or more in balance); 75% if Platinum Honors tier ($100k or more in balance).

- No foreign transaction fee.

- No annual fee.

Disadvantages

- You have to be an AAA member to get this card. The lowest tier membership fee is $60 per year.

Recommended Application Time

- 2/3/4 Rule: BoA will only approve you for at most: 2 cards per rolling 2 months; 3 cards per rolling 12 months; and 4 cards per rolling 24 months. Because their IT system hasn’t been fully updated yet, you may not get declined because of this rule. Instead, you may get approved at first, and then the account will be closed because of “approved in error”.

Summary

If you don’t have a lot of money in BoA, then this card is not useful at all.

However, if you have put $100k in Merrill Edge and reach the Platinum Honors tier with 75% bonus, then things become interesting. The earning structure then becomes: 5.25% on travel, and 3.5% on gas, grocery store, wholesale club and drugstore, no cap. 3.5% cashback on wholesale club with no cap really makes it the top earning card in this category.

After Applying

- Click here to check BoA application status.

- BoA reconsideration backdoor number: 877-383-0120 or 866-811-4108. It seems that the number is changing. Please inform us at once if it fails. The representatives here can get in touch with decision-makers directly.