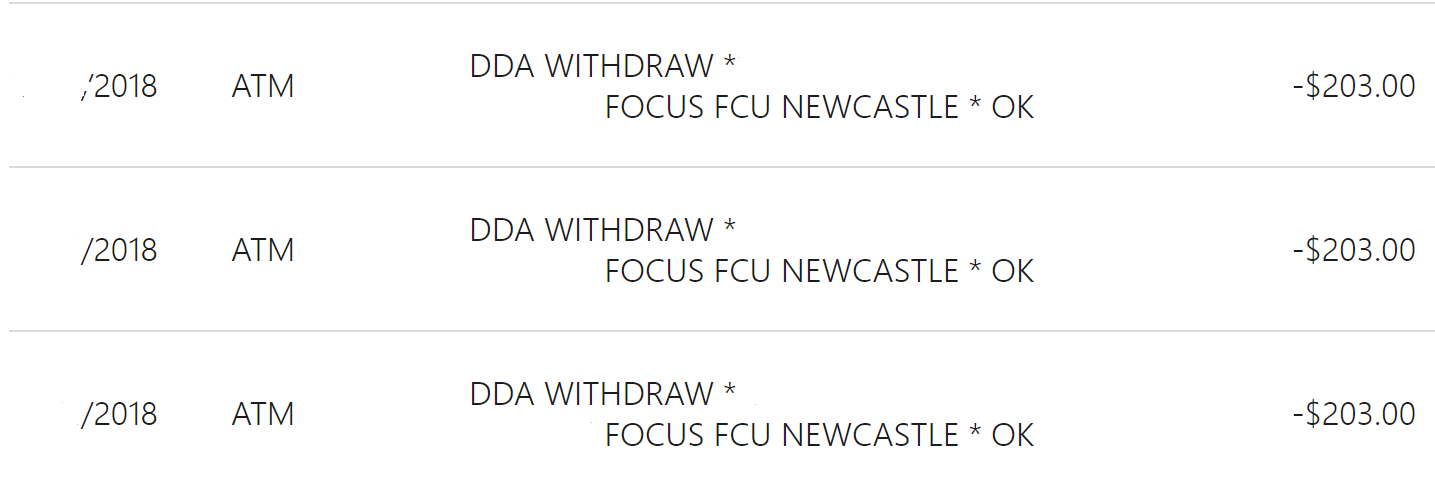

去年年底我的美国TD Bank Debit卡突然被人用来在美国俄克拉荷马州New Castle的某Federal Credit Union的ATM连续取了3次200刀(每次3刀应该为ATM手续费)。

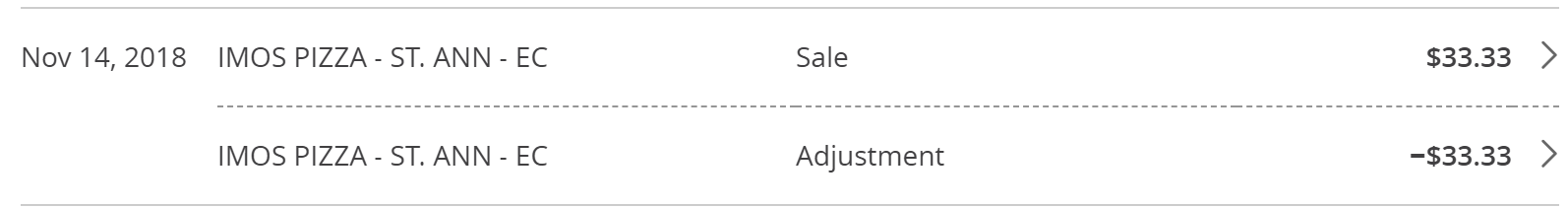

虽然我经历过好多次Chase信用卡的盗刷,但那毕竟是信用卡,而且并不是卡片被盗或者复制,而是纯粹的Chase卡号算法被破解后让别人在网上盗刷。比如去年11月我的CSR就被用来在美国中部某大农村用来网上订了一顿IMOS Pizza,联系Chase后一天就退回来了:

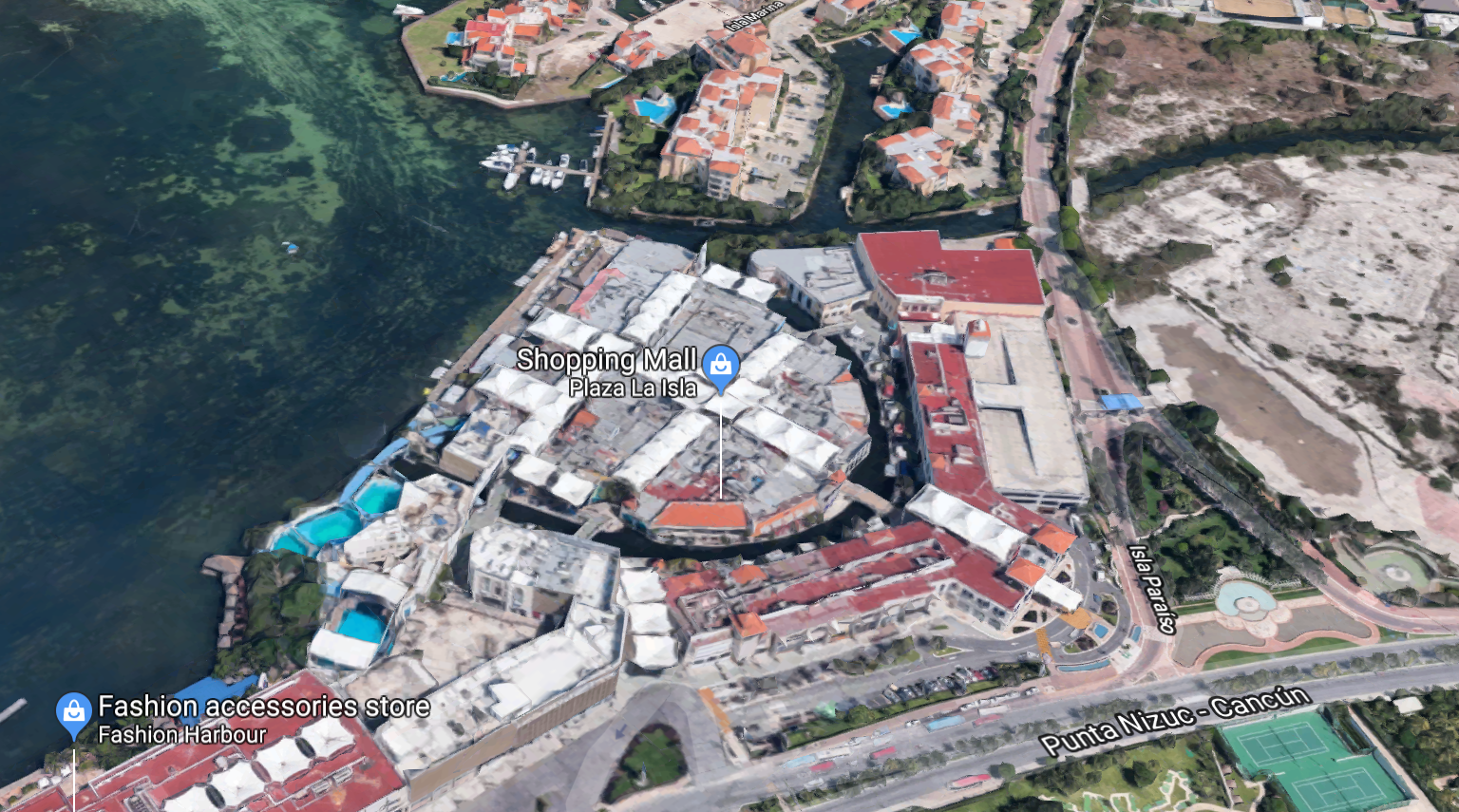

努力思考后我想起来10天前在墨西哥坎昆Ia Isla Shopping Mall里取过几百比索的现金,因为这张Debit卡取款没有手续费(多收的手续费出帐单后会退回),因此就随意找了个ATM取钱而没有选择大银行的ATM。虽然没有证据证明是这次操作导致的,但除此以外我几乎不用Debit卡消费,实在想不到别的场合可能会引起盗刷。

取款地点就在Cancun酒店区热闹的La Isla Mall中心地带。

坑爹的是,当时取款ATM提示每个步骤都有英语,除了最后一步用西班牙文问要不要捐款,结果脑子一热,差点捐了一大笔比索出去。谁料就是这么一次取款,被动过手脚的ATM内的装置就读取了卡片资料和密码然后卡片迅速被复制,10天后复制的卡就被用来在俄克拉荷马州取美元现金。幸亏发现的早,否则估计第二天会被继续取款。

想到这,我感觉拿出当时办银行卡的小册子仔细阅读Debit卡盗刷条款:

Unauthorized Transfers

Tell us AT ONCE if you believe your Card, your PIN, or both has been lost, stolen or used without your permission, or if you believe that an Electronic Funds Transfer has been made without your permission using information from your check. You could lose all the money in your Deposit Account, plus your available overdraft protection. Telephoning is the best way of keeping your possible losses down. If you notify us within two (2) Business Days after you learn of the loss or theft of your Card or PIN, you can lose no more than $50 if someone uses your Card or PIN without your permission. If you do not notify us within two (2) Business Days after you learn of the loss or theft of your Card or PIN, and we can prove we could have prevented someone from using your Card and/or PIN without your permission if you had told us, you could lose as much as $500 ($50 if you are a resident of Massachusetts and this Agreement is governed by Massachusetts law). You will not be liable for unauthorized purchases made with your Debit Card when used as if it were a Visa® Credit Card. However, you can be held liable for fraudulent use of your Card and/or PIN when

PIN-based transactions are made with your ATM or Debit Card.

总结一下就是

- 盗刷/取款两天以内通知,用户损失最多50刀。

- 盗刷/取款两天以后通知,用户损失最多500刀(MA居民依然为50刀)。

- 如果把Debit卡当作Credit来用被盗刷则无需负责(毕竟没有Pin)。

- 如果用Pin产生的盗刷/取款,用户可能需要负责。

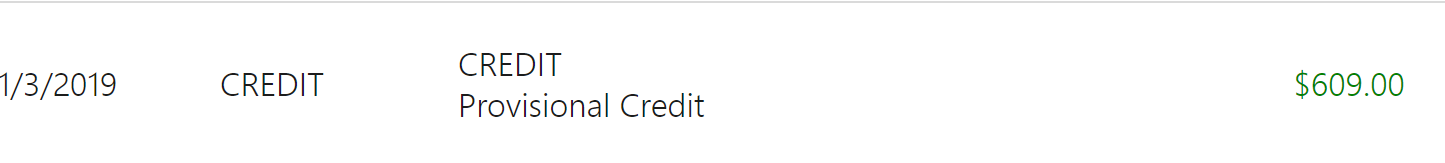

总体来说,规则写的非常模糊,不过似乎不算太糟糕。我赶紧拿起电话联系TD Bank的客服,但是当时盗刷的钱还在pending,因此客服说不能帮我dispute pending的取款,但立即挂失了Debit卡避免更多损失。两天后被盗的三笔203刀取款post,我再次电话客服,客服老奶奶非常慈祥,但是居然又帮我挂失了一遍Debit卡(一周后我收到了两张Debit卡)。老奶奶反复问了我去过俄克拉荷马没有,是否卡一直在身边。我咬定这辈子都没去过那个州并且Debit卡一直在我身边。客服老奶奶看了一眼我的交易记录,立刻发现了Cancun这次取款,她说她觉得就是在那被复制了Debit卡,我表示同意。客服老奶奶帮我Dispute了三笔交易,同时建议我报警然后(但不是必须)。我觉得报警实在太麻烦,等了三天后609刀已经退回账上。这里给TD Bank点个赞!

总结经验教训:

- 去墨西哥玩尽量不要在当地ATM机上取款,因为机器内部可能被人做过手脚。

- 如果一定要取款,建议去银行直属的ATM机器,比如Santander, HSBC这样的大银行ATM取款,而不要去私营的小规模ATM。

- 更加坑爹的是,坎昆现在很多ATM根本不让取比索,只能取美金,也算是给当地创外汇的一条路子。

- 发现Debit卡被盗刷一定要马上报告,Debit卡盗刷的法律保护虽然比不上Credit卡,但大部分银行对客户的保护依然是不错的。