Introduction

Introduction

From consumer spending to miles and points, it is tough to currently identify any market where a currency brings you more value today than a year ago. Inflation crushes purchasing power and in an inflationary environment “cash is trash,” leaving many wondering what to do with their savings account or emergency fund. The US Treasury offers a product called the Series-I Savings Bond (“I-Bond”) that carries a semiannual inflation-adjusted return based on the consumer price index (CPI). Below I discuss my process for purchasing I-bonds indirectly with a credit card to earn a signup bonus and take advantage of 0% APR float on a business card to earn a return of approximately 15% over 15-months without tying up any of my own capital.

Contents

I-Bonds Explained

The current interest rate for I-Bonds is 7.12% percent. This interest rate resets every six months based on the current CPI (resets on May 1 and November 1). The product is tied to your social security number and has a 30-year maturity but can be redeemed at any time after one year. If you cash in the bond before holding for 5 years, the last 3 months of interest earned will be forfeited.

For more information on I-Bonds, visit the US Treasury Treasury Direct website. There are also a number of great threads on Bogleheads here and here.

I-Bond Limits

There is an annual (calendar year) limit of $10,000 per SSN in electronic I-Bond purchases directly through the US Treasury at Treasury Direct. Unfortunately, these can only be purchased with a bank account. However, any SSN is also able to redirect up to $5,000 from their tax return for the purchase of paper I-Bonds.

Tax Overpayment

Most people won’t naturally have a tax return of $5,000 (and if you do, you need better tax planning!). However, the IRS allows you to make overpayments on taxes owed and receive the overpayment back on your refund. I have done this for years to hit high-spend signup bonuses. There are currently three payment processors that allow you to make a tax payment to the IRS, with fees ranging from 1.87% to 1.96% per transaction. You are limited to two payments per processor per tax year, meaning you can make a maximum of six payments annually through this process.

For additional information on how to pay (or overpay) your taxes with a credit card, check out the Doctor of Credit post here.

Tax Filing

The Paper I-Bonds can be purchased during submission of your 2021 tax return on IRS Form 8888. Additional guidance directly from the IRS Treasury Direct webpage can be found here.

Engage the Free Money Machine

To take advantage of this deal, I knew I wanted to (1) find a new signup bonus offer combined with (2) a 0% APR offer and (3) no annual fee on (4) a business card. My rationale was simple: the signup bonus would dramatically increase my rate of return on the investment, the 0% APR allows me to float the investment without tying up my own money, and the business card doesn’t report to my personal credit file so there will be no material impact to my credit score for carrying a balance over the 0% APR period. And I wanted a card without an annual fee to prevent erosion of my return over the investment period.

I found exactly the product I was looking for in the US Bank Business Triple Cash card, which offers a $500 bonus after spending $4,500 in 150 days and a 0% APR on purchases for 15 billing cycles. I have a long history with US Bank and was immediately approved after applying.

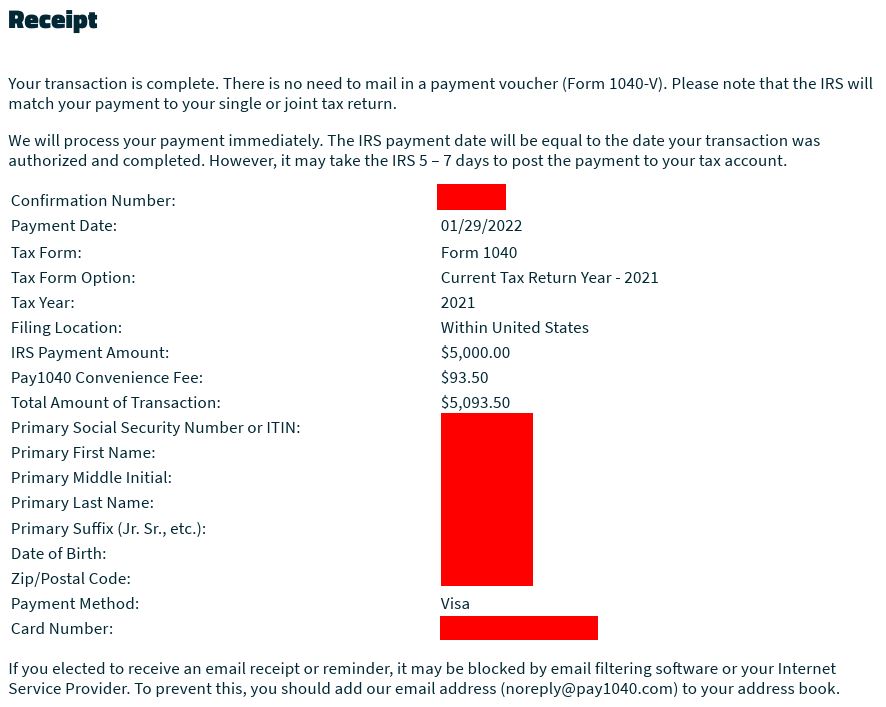

Once the card was received, I headed over to Pay1040.com, which has the cheapest transaction fee of any of the IRS payment processors. My receipt from the process is below. Be sure to apply the overpayment amount to the 2021 tax year.

Return on Investment

The exact return on investment is tough to calculate since the I-Bond interest rate will change on May 1. However, if you purchase before that change, you lock in the current rate for six months. As a conservative assumption, I use an interest rate of 7.12% for the first six month period and 3.5% for the second six month period. My 0% APR period lasts 15 months and remember there is a 3-month interest penalty if you cash out before five years. So my math below assumes a return for 12 months, forfeiting the interest for months thirteen to fifteen, and cashing out the bonds on month sixteen.

Using a principal investment of $5000, the rate of return is calculated as:

Signup Bonus: $500

Payment Processor Fee: $5000 * 0.0187 = -$93.50

1% Cash Back from CC: $5,093.50 * 0.01 = $50.94

Interest – First 6 months: ($5000 * 0.0712)/2 = $178

Interest – Second 6 months: ($5,356 * 0.035)/2 = $99

15-Month Projected Return: $500 – $93.50 + $50.94 + $178 + $99 = $735

Summary

The math above works out to a return of around 15% without tying up any of your own principal. That is about as close to a free-lunch as you’re going to get in this world. While I wish the limits were higher, this could scale nicely if you are playing the miles and points game with multiple players. There is also a limit of $5,000 specifically for trust accounts, so I guess if you juggle (or want to juggle) multiple trust accounts that’s another way to potentially scale this.

Are you using your tax return to fund the purchase of I-Bonds? Questions about prepaying taxes with a credit card? Let us know in the comments!