Contents

Introduction

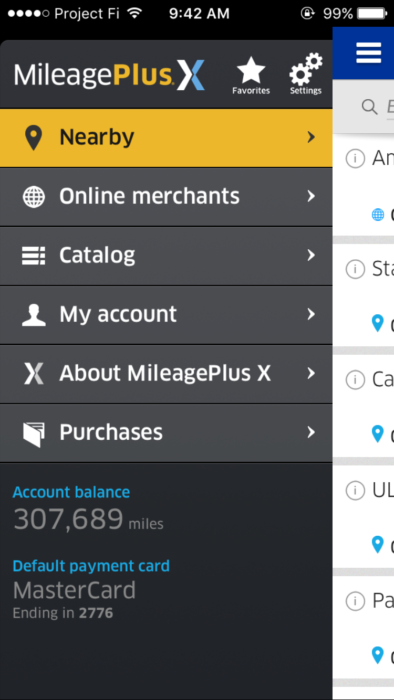

MileagePlus X (MPX) is an app that allows you to earn extra United Airlines miles for shopping with one of their listed partners. The app’s been out for a while but it doesn’t get much discussion. No surprises there, since it doesn’t look like United cares too much about this app either. The UI for iOS devices are still geared for iPhone 5S and older, their payment processing times are laggy, and their participating partners haven’t changed much since launch.

Despite the stale user experience there are still some great uses for the app. I’m going to share 2 of my favorite ways to use the app down below. You can skip ahead if you already know how to use the app. For everyone else, I’ll provide a brief guide.

What do I need?

You’ll need:

- An iOS or Android device. You can download the app through the App Store or the Play Store.

- MileagePlus account

- A credit/debit card

- Optional: United co-branded card – this card will earn additional bonus miles on top

How does it work?

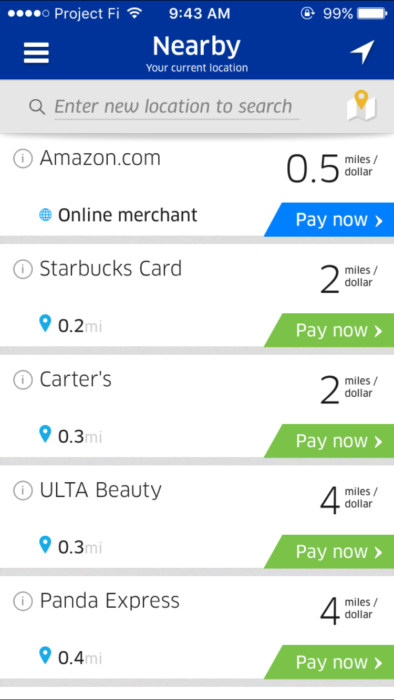

With MPX, you earn United miles by shopping at designated shops through the app. They’re listed like so:

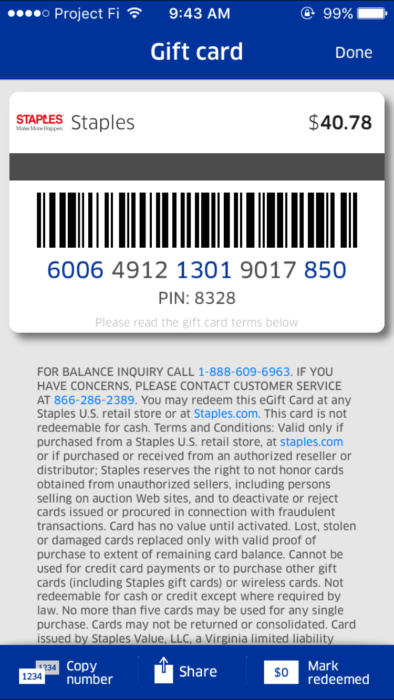

Don’t get it twisted, there’s nothing fancy about how this app works. All you’re doing is purchasing a merchant e-gift card through the app and earning bonus miles for it. You select the retailer, select the amount you want, and process the payment. Once it goes through, the app will display an e-gift voucher for you to hand to the cashier or use online. It should look something like this:

You can sort merchants based on their proximity to you, by category, or by online merchants only.

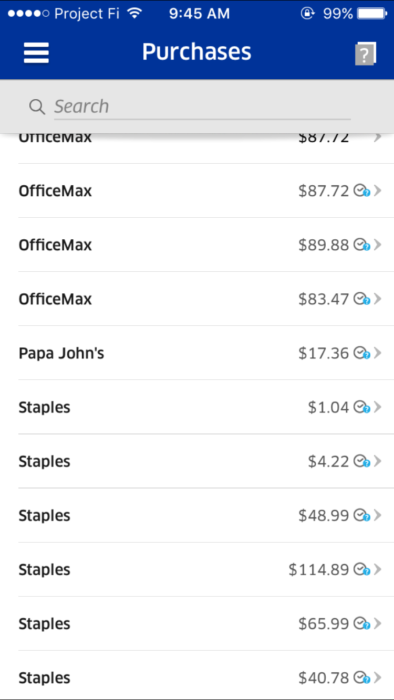

For brick-and-mortar merchants, the idea is to open the app at the register and pay through the app instead of swiping your card at the register; that’s how United marketed this thing anyway. In practice this has been a clunky experience for me. I was at Staples the other day purchasing ink and tried to go through the app. I had really bad reception at the register so the app took forever to process the payment.

You could always avoid these situations by purchasing the e-gift card first before the transaction takes place. For example, since I know I’ll always be spending money at Staples, I could purchase $100 beforehand. This way it’s ready to go at the register.

Which leads me to my next point. The app stores all your past purchases so you can always access them later if you have a remaining balance on them.

Side note: Gift card resellers and online merchants provide great discounts too. For example, Staples gift cards are occasionally on sale on eBay or elsewhere. I still stick to MPX because it’s convenient.

When do I get the miles?

The miles are credited to your United account immediately.

How many miles will I earn?

The app will show you how many United miles you’ll earn through the app. If you have a United co-branded credit card associated with the United account, you’ll earn an additional 25% miles.

Important note: Having a United credit card will add a permanent 25% boost to your earnings. You don’t have to use the United card to make the purchase, you just need to have one associated with the united account.

In addition to the app, you’ll earn normally through your credit card. As a general rule, the transaction will adopt the spending category of the merchant you choose. For example, if I use my Chase Ink Bold to make a Staples purchase on MPX, I will earn 5 UR/dollar for the Office Supply category and 3.75 United miles/dollar through the app (3 miles + 25% United card bonus).

There are exceptions to this rule. For instance, AMEX used to categorize all MPX purchases under the travel category since the purchase was recognized as a United Airlines transaction. This was a popular quirk that allowed many people to use up their AMEX Platinum travel credits through MPX. This particular method no longer works, and although AMEX still codes MPX as travel, no one seems to be getting any category bonuses from it.

Note that Chase is able to recognize the real category correctly, and doesn’t code everything as travel. I know that US Bank also categorizes MPX purchases as travel. For those of you with the Altitude card, I’d like to hear whether you’re earning extra points for MPX purchases. I see some real potential there if that’s the case.

Citi AT&T will code everything in MPX as online purchases, so you will earn 3x TYP.

Limits

I’ve been hearing recently that MPX started imposing a daily purchase limit of $500. I haven’t run into it yet but you should keep that in mind.

My 2 favorite ways to use MPX

I’ll share 2 of my favorite uses for MPX. First one is a little personal but the second one could be pretty useful for many people.

Papa Johns (5 miles/dollar)

I love pizza and Papa Johns runs promos frequently (if you’ve spent any time over at SlickDeals you’ll know this). Whenever they run a promo I always make sure to use my best restaurant category card and go through MPX. The website allows you to include a tip, so your entire purchase can run through MPX.

Office Depot/OfficeMax (5 miles/ dollar)

OD/OM pays out 5 United miles per dollar through MPX (plus 25% if you have a United card). That’s pretty generous. If you have the Ink Business card that earns 5 UR/dollar at Office Supply stores, that’s a killer combination.

The reason why this is so good for me is because Office Depot has a generous price-matching policy. My favorite merchant to price-match is Amazon, since their prices are competitive. So in effect, I can pay the same price as I would on Amazon and earn 5 UR/dollar + 6.25 United miles/dollar for the transaction. If you have Office Depot rewards or coupons, it only gets better from there.

Note: The item must be shipped and sold by Amazon. Price quotes by 3rd party sellers will not qualify for the price-match.

Conclusion

The MPX app gets so little love because there’s not a lot to love. The app is clunky and impractical for most situations and irritating at times. But there are still some cool uses for the app if you know how to use it to your advantage.