Blue Cash Preferred Card from American Express (BCP) Review

2024.9 Update: The higher offer is expired. The current offer is only $250.

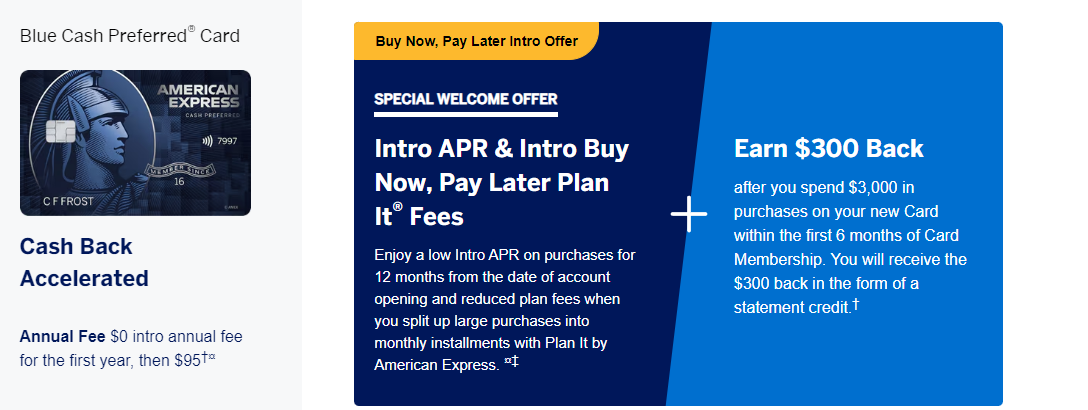

2024.6 Update: The new offer is $300, you may need to see it in incognito mode.

2023.3 Update: The new offer is $400.

Contents

Application Link

Benefits

- $250 offer: earn $250 cash back after spending $3,000 in first 6 months. The recent best offer is $400.

- Earn 6% cash back at US supermarkets; 6% cash back at select U.S. streaming subscriptions (see here for definition); 3% cash back at US gas station and on transit (including taxis/rideshare, parking, tolls, trains, buses and more); 1% cash back on other purchases.

- With this credit card, you can get access to Amex Offers, which often offers very good discounts at some stores. In the past we have seen offers like: Spend $15 or more and get $5 back at Walmart; Spend $75 or more and get $25 back on Amazon.com.

- Refer a friend: You can earn $100 for every approved account you refer, up to $550 per calendar year.

Disadvantages

- $95 annual fee, waived for the first year.

- Only first $6,000 purchases per Calendar Year at US supermarkets can earn 6% cash back, after that you can only earn 1%.

- According to American Express; Target, Walmart, and Costco do not count as supermarkets, and you can only get 1x when shopping there.

- This credit card is on the American Express Network, not Visa or MasterCard, so some small stores may not accept it.

- The 6%/3% bonus categories are limited within the United States. Well, the Foreign Transaction Fee exists anyway, so better not use it outside the US.

Recommended Application Time

- You can only get the welcome bonus once in a lifetime, so be sure to apply when the historical highest offer appears.

- [New] [Family language] AmEx begins to add family language: higher annual fees cards will affect the welcome offers on lower annual fee ones in the same family series. Specifically, having held BCP makes you ineligible for the welcome offer of BCE. So if you want both, you should apply for BCE first.

- AmEx doesn’t care about the number of hard pulls.

- You can try to apply for it when you have a credit history of 6 months.

- You must wait at least 90 days between the application for BCE and BCP, otherwise the application will be cancelled.

- Only 2 AmEx credit cards can be approved within 90 days, but this rule does not apply to charge cards. Multiple cards approved in the same day will only have one Hard Pull.

- You can keep at most 5 AmEx credit cards, but this rule does not apply to charge cards.

Summary

This is a good grocery card. A simple calculation can show that, even though it has an $95 annual fee, you can get more rewards on groceries than any no annual fee credit cards if you spend more than $300 per month on grocery. So if you spend a lot at supermarkets, this credit card is very worth keeping! One alternative worth mentioning, and especially so if you like MR points and can make 30+ purchase per month, is the AmEx EveryDay Preferred (EDP), see Best Rewards Credit Cards For Grocery for more details.

There’s a more savvy way to use this credit card: find Gift Cards for the stores that you visit frequently (such as Shell, Amazon, etc) or Visa Gift Cards in supermarkets, use your Blue Cash Preferred to buy them and you can get 6% cash back (up to $6000 per year)! If you use the card this way, pretty much everything is 5%~6% cash back!

Related Credit Cards

- AmEx EveryDay (ED)

- AmEx EveryDay Preferred (EDP)

- AmEx Blue Cash Everyday (BCE)

- AmEx Blue Cash Preferred (BCP) (this post)

- AmEx Old Blue Cash (OBC)

Recommended Downgrade Options

After Applying

- Click here to check AmEx application status.

- AmEx reconsideration backdoor number: 877-399-3083. The “real” backdoor number of Amex is well protected. Different from Chase, the representatives from this AmEx reconsideration backdoor number only have the right to help you submit requests.

Historical Offers Chart

Note: There were offers like $250 + $200 in the past. But the $200 part is actually 10% cash back on some category in the first 6 months.