Starting around November 2023, AmEx began rolling out a new and rather shady type of welcome offer. Instead of clearly telling you what you’ll get upfront, the offer headline now reads something like “AS HIGH AS xxx points.”The catch? You won’t know your actual bonus until after you fill in your info and submit the application. Only then—before accepting the offer—will AmEx reveal the exact number of points you’re eligible for. At that point, you can choose to accept or decline the offer. No hard pull will occur unless you accept it.

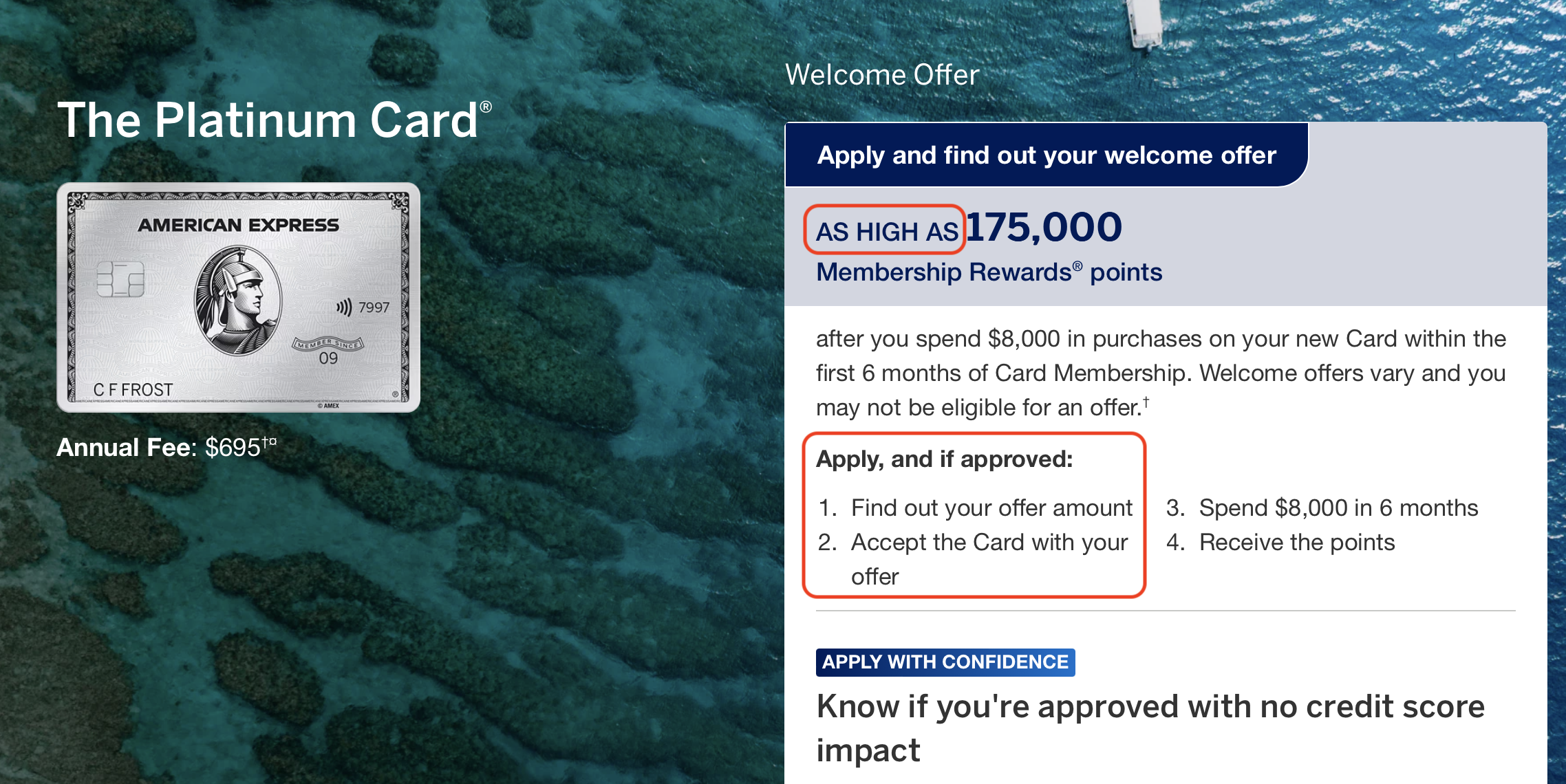

Here’s the exact terms (using the AmEx Platinum as an example):

As High As 175,000 Membership Rewards® points Welcome Offer

After you submit your application and before you accept the Card (if you are approved), we will tell you the exact amount of Membership Rewards®points which you are eligible to earn with your Welcome Offer, which will be an amount as high as 175,000 points. This means that the amount of points which you are eligible to earn with your Welcome Offer may be less than 175,000 points. You can earn these points after you spend $8,000 (the “Threshold Amount”) or more in eligible purchases on your Platinum Card® from American Express within the first 6 months of Card Membership starting from the date your account is opened.

Since this language first appeared in late 2023, AmEx has been pushing these “AS HIGH AS” offers more and more. They’ve even cleaned up the wording—from the more casual “up to xxx” to the now standardized “AS HIGH AS xxx.”

Here are the main cards currently featuring these vague offers:

- AmEx Platinum: AS HIGH AS 175k (regular public offer: 80k)

- AmEx Gold: AS HIGH AS 100k (regular public offer: 60k)

In the past, savvy users (like many of our readers!) could often use incognito mode and VPNs to switch IP address to trigger the highest welcome offers. But AmEx likely got tired of gamers exploiting these methods. So now, they’ve started phasing out those incognito offers and replacing them with these deliberately vague AS HIGH AS variants. The result? A naïve applicant might get triggered by the eye-catching “175k” and actually get this big bonus. Meanwhile, the rest of us “gamers” just get offered something laughably low.

This “AS HIGH AS” system is honestly pretty disgusting. It remains to be seen whether mainstream applicants will also be turned away by this bait-and-switch language, and if enough pushback might eventually make AmEx think twice about this strategy.