Introduction

A credit score is a three-digit number that represents “creditworthiness,” or the degree of perceived risk a lender is assuming by providing an individual with credit. A credit score is generated through a statistical analysis of a credit report based on five primary factors, including payment history, amount of outstanding debt owed, length of credit history, types of credit, and recent pursuit of new credit. Higher credit scores are deemed less risky by lenders than lower scores and generally lead to lower interest rates and higher loan approval rates.

There are hundreds of different types of credit scores throughout the world. This post will focus on credit scores generated by FICO, the primary credit score model used by lenders based in the United States.

FICO Score

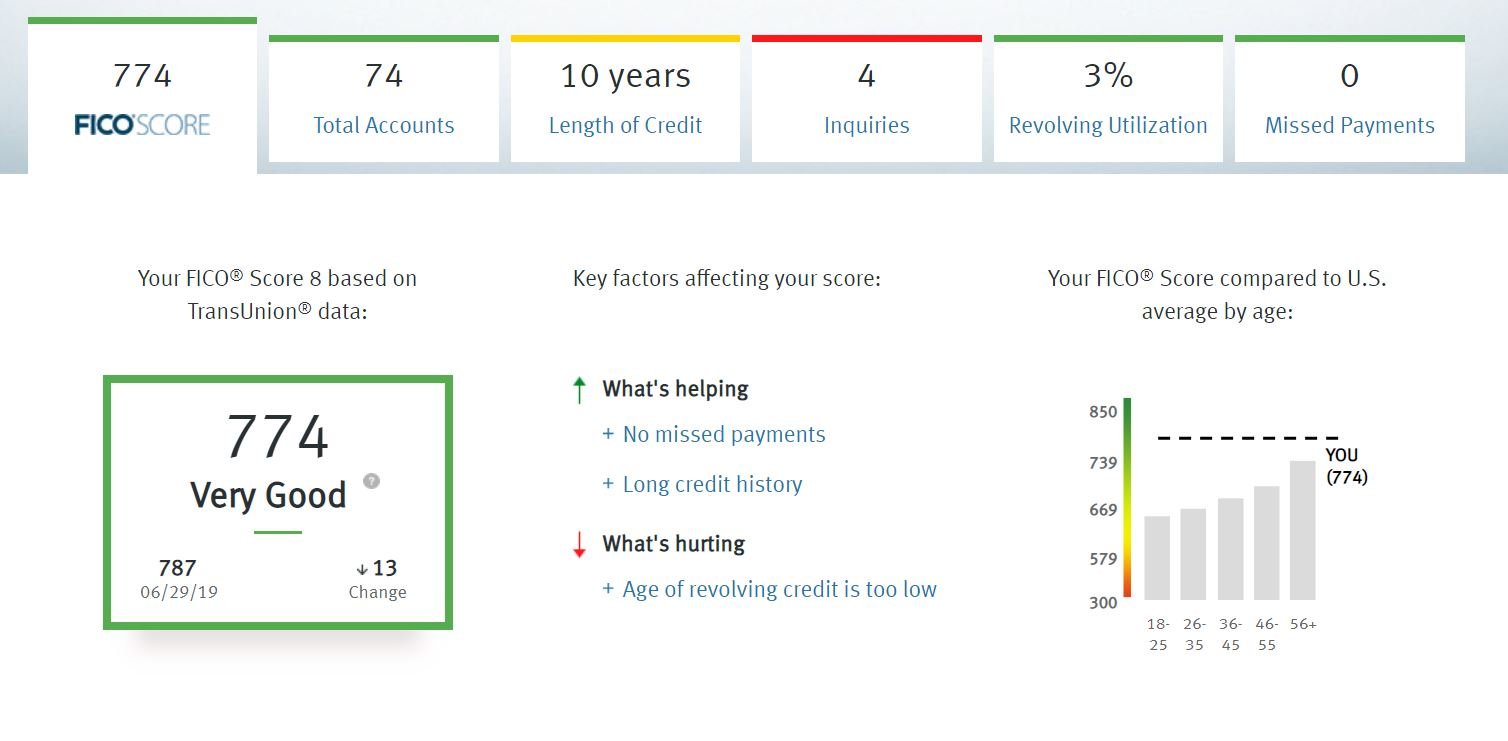

The primary credit score used by lenders in the United States was created in 1989 by FICO (previously the Fair Isaac Corporation). As of 2018, there were over 50 different versions of the FICO score, many which are industry specific and target specific market segments. This is the result of lenders in the automobile, mortgage, and/or consumer credit card industries being interested in different aspects of a person’s credit profile. The FICO score is based on a scale of 850 (good) to 300 (bad) and is the primary credit score used for consumer lending in the United States.

The term “FAKO” has been propagated as a combination of “FAKE” and “FICO” in reference to any non-FICO credit score. “FAKO” scores are offered by Vantage Score, Credit Karma, Credit Sesame, etc. These scores do represent an analysis of your credit profile, however they are non-regulated and should not be viewed as official when seeking out credit.

How your FICO Score is Calculated

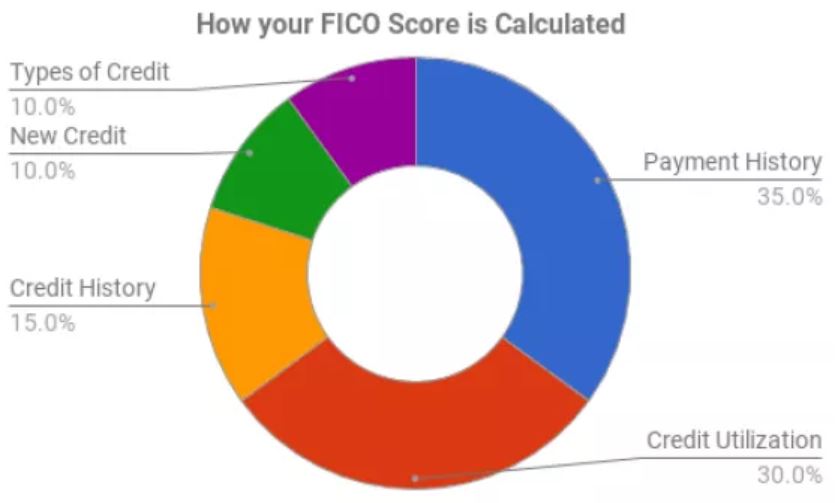

There are five primary inputs to the FICO credit score, including payment history, amount of outstanding debt owed, length of credit history, types of credit, and recent pursuit of new credit. Each input carries a different weight in the scoring model, as shown below. We’ve also generated some charts showing what each of the inputs might look like for someone involved with credit card churning.

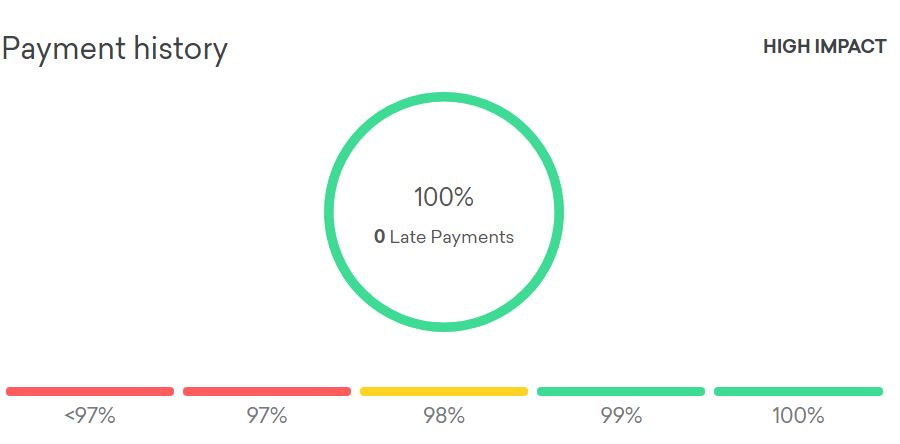

Payment history and credit utilization account for 65% of your FICO credit score, meaning you want to get them right! Payment history is based on the timeliness of your payments (on-time or delinquent). This is the most obvious input – always pay your debts on time according to the payment schedule of your loan and your payment history will be perfect. Payment history is calculated by dividing the total number of delinquent payments by your total number of payments due. Generally, a consumer is provided a 30 day buffer to pay a “delinquent” debt beyond the payment date before a negative remark will be issued to the credit report.

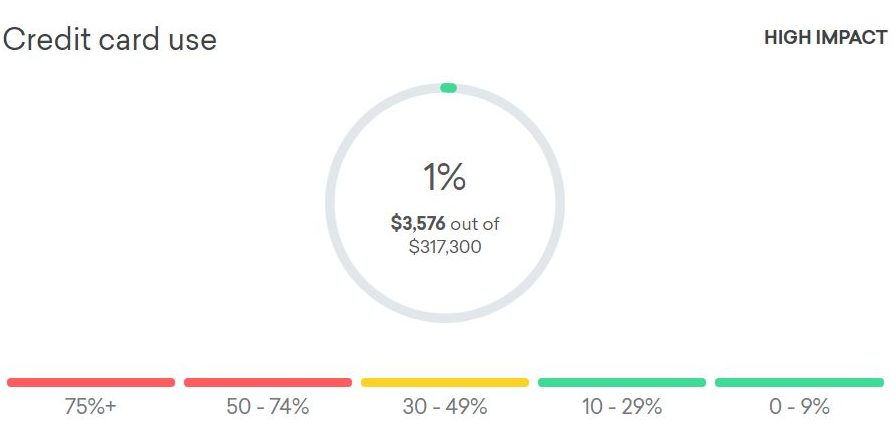

Credit utilization is calculated by dividing the amount of credit used by the total available credit at the time of statement closing. For example, if your credit card statement closes with a $2,000 balance and you have $10,000 in credit extended to you, your utilization is 20%. If you pay your credit card statement in full before the statement closes, your utilization as posted on your credit report for that account will be 0%. Utilization is calculated on both an account level and a credit report level, meaning you could show 20% utilization for one credit card but have an overall much lower utilization for your entire credit profile if you have unused credit extended to you on other accounts.

You generally want your utilization to remain as low as possible. To a lender, low utilization represents the ability to responsibly manage credit and a higher ability to repay debt, whereas high utilization is viewed as the potential for higher rates of payment delinquency or loan default and therefore lead to a lower credit score.

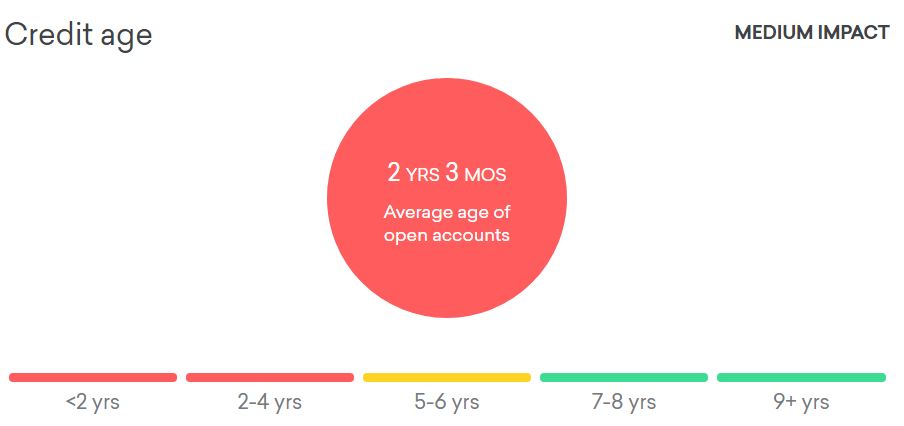

Credit history accounts for 15% of the FICO score and represents how far back your credit report goes and the number of accounts on it. If you were ever encouraged by your parents to open a credit card in college and pay it off each month, this is why! Older accounts represent stability, and stability is a key to repayment in the eyes of a lender. The FICO model accounts for the age of your oldest account, the age of your newest account, and the average age of all accounts.

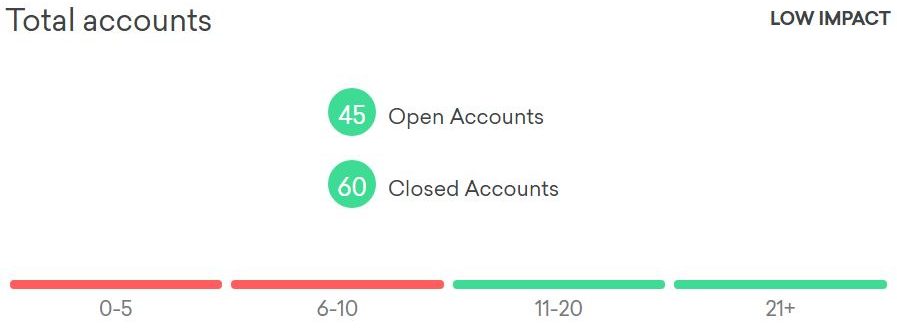

Types of credit accounts for 10% of the FICO score and represents the variety of loans you have in your credit profile. Someone with a car loan and mortgage in addition to revolving credit like credit cards represents stability, and again, stability is a key to repayment in the eyes of a lender. Total number of closed accounts includes the closure of any account where credit was extended to you, including credit cards, auto loans, or a mortgage.

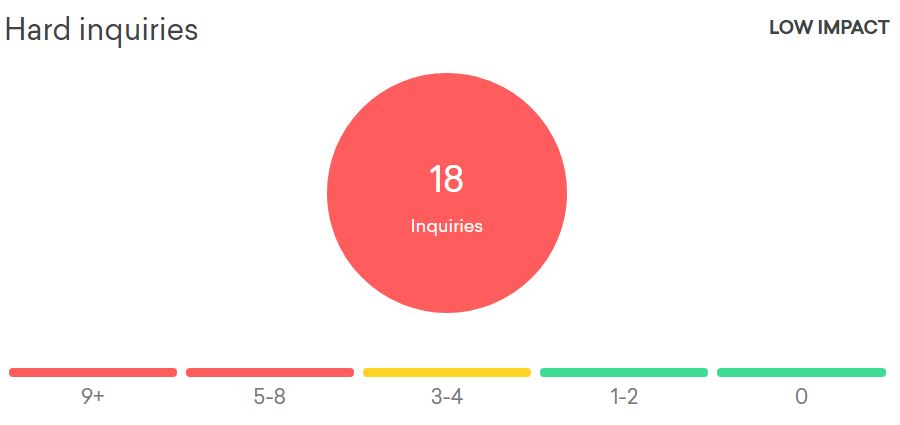

New credit also accounts for 10% of the FICO score and represents the rate at which you are seeking new credit. The FICO model uses the number of inquiries and number of new accounts found on a credit report for this input.

Now onto the most frequent question we receive by anyone interested in the miles and points game….

Will Churning Credit Cards Lower My Credit Score?

The simple answer is that every new credit card account comes with additional credit. More extended credit means more lower utilization in the long run, which leads to a higher credit score (all things equal). For example, if you have $1,000 in debt and only have $2,000 in credit extended to you across all accounts, your utilization will be 50%. If instead you have $10,000 in total credit extended to you across all accounts, your utilization would drop to 10%. Because utilization accounts for 30% of your overall credit score, assuming you continue to make on-time payments to all your accounts, the additional credit extended from new card applications will lead to lower utilization and actually increase your credit score over time.

In the immediate period after an application for credit, the hard inquiry on your credit report can lead to an immediate 2 to 5 point decrease to your credit score per inquiry. This is temporary for two reasons. The first is that inquires fall off your credit report two years from the date of the inquiry. The second is that hard inquires fall under “new credit” and therefore only represent 10% of your overall credit score. If you have a diverse credit profile with on-time payments and low utilization, your score will tend to increase with time regardless of the number of new accounts or inquires.

How Do I Improve My Credit Score?

This one is easy – identify the problem and fix it! While a credit profile can not be fixed overnight, it can be repaired with strict planning. Negative remarks on your credit profile are generally removed after 7 years. The bad news is that, if you missed a payment today, it would not fall off your credit report for 7 years. The good news is that the moment the negative remark falls off your report, your credit score will jump up, inclusive of the payment history immediately after your missed it. In that regard, time becomes your greatest ally and provides a chance to fix a mistake in the medium term.

If your utilization is high, you are either not paying off your credit cards before the statement closes or carrying credit card debt. I would encourage anyone to pay off a credit card before the statement closes. If you are paying interest on credit card debt, you will never out earn that interest in the form of miles and points. Ever. Interest from credit card debt is the funding mechanism for the lucrative games we play. If you are paying interest on credit card debt, your goals should be to get a control on your spending and pay down your debt in a responsible manner, then reconsider the place that credit cards may have in your life.

If you are worried that the number of new accounts or inquires on your credit report is dragging down your credit score, simply apply for credit less frequently.

Where Can I Find My FICO Score?

The three major credit bureaus (Equifax, Transunion, and Experian) are legally required to provide access to a consumers’ credit report once per year through Annual Credit Report. This is great for reviewing content on your credit report, but it doesn’t provide a credit score.

The easiest way to receive a copy of your official FICO score, as calculated for the report from each credit bureau, is through your credit card issuer. At present, all the major issuers offer a way to access a FICO score that is updated monthly. Because this benefit can change with card issuers, I’d rather just link to the Doctor Of Credit page on the subject, which is constantly updated and exhaustive of both big banks and smaller credit unions.

Summary

Activities that go along with maintaining a healthy credit score are paramount to a successful credit card churning strategy. If your credit score needs improvement, assess which of the FICO model inputs are dragging down your score and do your best to fix it! If you have any questions or comments, please let us know below.