Supermarket cards, also known as grocery reward cards, refer to credit cards with a high return in the Supermarket / Grocery category. In this regard, American Express is almost the champion. They have four different great supermarket cards: AmEx EveryDay (ED); AmEx EveryDay Preferred (EDP); Blue Cash Everyday (BCE); Blue Cash Preferred (BCP). With so many choices, it’s not easy to decide which one is most suitable? The most convenient way is to enter your credit structure in the CreditIntro, the system will automatically help you choose the card with the highest rate of return. This article gives you a detailed comparison of these supermarket cards / grocery reward cards, you can choose according to your own situation.

Contents

Common Supermarket / Grocery reward cards

Let’s list the types of returns and annual fees for these cards:

| No Annual Fee | With Annual Fee | |

| Membership Rewards | EveryDay (ED) | EveryDay Preferred (EDP) |

| Cash Back | Blue Cash Everyday (BCE) | Blue Cash Preferred (BCP) |

The above table is a brief comparison of the characteristics of these cards. Membership Rewards (MR) is a Amex’s reward currency and 1 MR point is worth about 1.6 cents. Please refer to “Introduction to AmEx Membership Rewards (MR) II: How to Use” for more information on how to use them. The following table summarizes the similarities and differences (Comparing only supermarket categories. You can definitely use some other credit cards to maximize returns in other categories, see “Best Rewards Credit Cards To Keep“):

| Supermarket rebate | Cash equivalent | Supermarket spending limit | Annual Fee | Best public offer | |

| Blue Cash Everyday (BCE) | 3% cash back | 3% | $6000/year | 0 | $250 |

| Blue Cash Preferred (BCP) | 6% cash back | 6% | $6000/year | 75 | $250 |

| EveryDay (ED) | 2x (2.4x MR) | 3.2% (3.84%) | $6000/year | 0 | 25k MR |

| EveryDay Preferred (EDP) | 3x (4.5x MR) | 4.8% (7.2%) | $6000/year | 95 | 30k MR |

The second column “Supermarket rebate” shows the points/cashback you earn. The third column “Cash equivalent” estimates the cash value of your points. The fourth column “Supermarket spending limit” shows that after $6000 in annual spend, you only earn 1%/1x MR on supermarket spend. The numbers in parentheses are the earning rates if you meet the following conditions: The AmEx EveryDay (ED) gives an extra 20% points as bonus if you have 20 or more transactions in a billing cycle; the AmEx EveryDay Preferred (EDP) gives an extra 50% points if you have 30 or more transactions in a billing cycle. Note that we ignore both Premier Rewards Gold (PRG) and Old Blue Cash (OBC) cards, since these two cards require an extremely large amount of supermarket spending to have an advantage. It’s hard for people who do not MS.

Common Supermarket/Grocery credit cards contrast

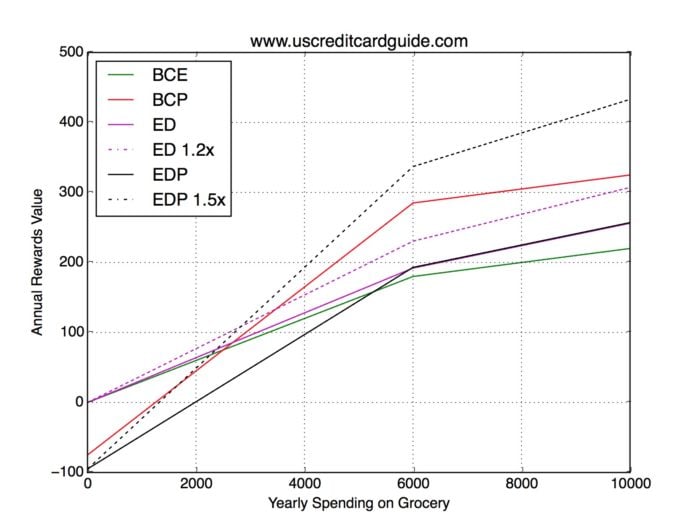

Based on the features of each card, we made a graph to show the relationship between the return on each card and annual supermarket / grocery spending:

From the above chart, we can see that if you are a hard-working bee and are able to trigger the higher earning rates for the ED / EDP, then the two cards will be the best choice to get the highest return in supermarket. As for choosing between the ED with no annual fee or EDP with annual fee, the decision needs to be made based on how much you are spending at the supermarket. See the following calculation for the specific cut-off point. It is noteworthy that the EDP / ED can not only give you the best return in supermarket category when you use them more than 30 / 20 times, but also the return in other categories is also very high. They are suitable cards if you want to bring ONE card with you, see “Which Credit Card Should I Pick If I Only Want One Card“.

If you can not or do not want to use a card 30/20 times a month to trigger additional bonuses, we recommend choosing either the ED or BCP. When you spend very little in supermarkets, we recommend the ED more although return rate on ED / BCE is very close. Because the ED is the only MR card without an annual fee, it’s a great way to retain the MR points – even if you close some other MR cards such as PRG, Platinum, EDP, you do not have to worry about the MR points disappear or expire since the MR points can be retained in ED card. Unless you want cash back only and are not interested in mileage / points at all, we recommend the ED rather than BCE.

Do pay attention however, you may find that changing to use the Citi Double Cash (DC) will give you an even higher return after you hit the annual spending limit on supermarket. Or change to other supermarket cards by owning more than one supermarket card. However, these methods require you to pay attention on how much you spend at the supermarket. We don’t consider this situation since it’s not a simple process.

As for the specific cut-off point, we can get through calculations: the intersection of the 20 times ED use a month and 30 times EDP use per month is at $ 2827, ED and BCP intersection is at $ 2678. Although these figures are the annual spending in supermarket, most people should not be dividing this by 12 to calculate monthly spending in supermarket category. The reason is that normally you can get 5x UR points in one quarter through a year on Chase Freedom card which everyone should have. Considering Freedom’s return, UR points is estimated to be about 1.6 cent per point (refer to “Points and Miles Value“), the return rate is up to 8%! So you should use your Chase Freedom in that particular quarter for supermarket category and use the above-mentioned supermarket card in the remaining 9 months. It is calculated that 20 times uses of ED a month and 30 times uses of EDP a month are intersected at $ 314 / month, and the intersection of ED and BCP is at $ 298 / month, both are about $ 300 per month. Taking into account the estimated spending for the supermarket will not be very accurate, we will just use $ 300 / month as the critical point.

Finally, it is worth mentioning that, after the Sallie Mae Card died, there are no longer Visa/Master cards with high return rates for supermarket spending. The few remaining supermarket cards, such as the US Bank FlexPerks Visa, are not as good as Citi Double Cash (DC) for most people. You can consider purchasing some Visa gift cards to use in grocery stores that don’t accept AmEx ~

Summary

According to the comparison above, we summarize the supermarket card as follows:

- We recommend that everyone hold Chase Freedom and use Chase Freedom as a supermarket card when Chase Freedom’s 5x category rotates to supermarket;

- If you wish to bring ONE card when going out, we recommend the AmEx EveryDay Preferred (EDP), see”Which Credit Card Should I Pick If I Only Want One Card“;

- Otherwise, the credit card with the highest rate of return in the supermarket category is:

| Transactions per month | Exceeding $300 per month in grocery | Less than $300 per month in grocery |

| 30 or more | EveryDay Preferred (EDP) | EveryDay (ED) |

| Less than 30 | Blue Cash Preferred (BCP) |

Hope you can get your own suitable supermarket / grocery reward card soon!