Grocery, including supermarket, is one of the most common categories of our daily spending, which makes rewards credit cards for grocery use very useful. American Express is almost dominant in this aspect. It issues four similar rewards credit cards for grocery: AmEx EveryDay(ED), AmEx EveryDay Preferred(EDP), Blue Cash Everyday(BCE), Blue Cash Preferred(BCP). In addition to those AmEx cards, there’s another less popular credit card with great rewards in grocery and no annual fee named Sallie Mae (SM) Credit Card (no longer accept new application). With so many options, you may be confused about which card suits you best. The most convenient way to find out is to input your own consumption structure in CreditIntro. The system will automatically choose the card that you may get highest rewards. In this article, we will compare these rewards cards specialized in grocery in detail and help you make your decision.

Contents

Introduction To Common Rewards Credit Cards For Grocery

Here are the rewards type and annual fee of the five cards:

| No Annual Fee | Has Annual Fee | |

| Membership Rewards | EveryDay (ED) | EveryDay Preferred (EDP) |

| Cash Back | Blue Cash Everyday (BCE) and Sallie Mae (SM) | Blue Cash Preferred (BCP) |

The table above briefly shows the characteristics of each card. Membership Rewards (MR) is a kind of credit card points. The value of 1 MR point is about 1.6 cents. For detailed connotation and method, please refer to Maximize Your Credit Card Points Values; for our estimated value of points, please refer to Bank & Credit Card Points Value. The following are the similarities and differences among these cards in detail (it only compares rewards in grocery spending, because the rewards in other spending categories can be optimized by properly using other credit cards, see Best Rewards Credit Cards For Everyday Use):

| Rewards Rate on Grocery | Rewards Rate Value | Grocery Spending Cap | Annual Fee | Sign-Up Bonus | |

| Sallie Mae (SM) | 5% cash back | 5% | $250/month | 0 | $25 |

| Blue Cash Everyday (BCE) | 3% cash back | 3% | $6000/year | 0 | $250 |

| Blue Cash Preferred (BCP) | 6% cash back | 6% | $6000/year | 75 | $250 |

| EveryDay (ED) | 2x (2.4x MR) | 3.2% (3.84%) | $6000/year | 0 | 25k MR |

| EveryDay Preferred (EDP) | 3x (4.5x MR) | 4.8% (7.2%) | $6000/year | 95 | 30k MR |

The second column shows the points or cash back you get directly, the third column suggests the estimated value of the second column, the fourth column indicates the upper limit of grocery spending that earns bonus rewards. Above this limit, you can only get 1%/1x MR rewards. Let me explain the percentage between the brackets in the ED and EDP row: For AmEx EveryDay (ED), you will earn 20% more points if you use your card for more than 20 times within one billing cycle; For AmEx EveryDay Preferred(EDP), you will earn 50% more points if you use your card for more than 30 times within one billing cycle. The number between the brackets shows rewards rate when using your for more than 20/30 times.

Which is the Best Rewards Credit Card For Grocery Use?

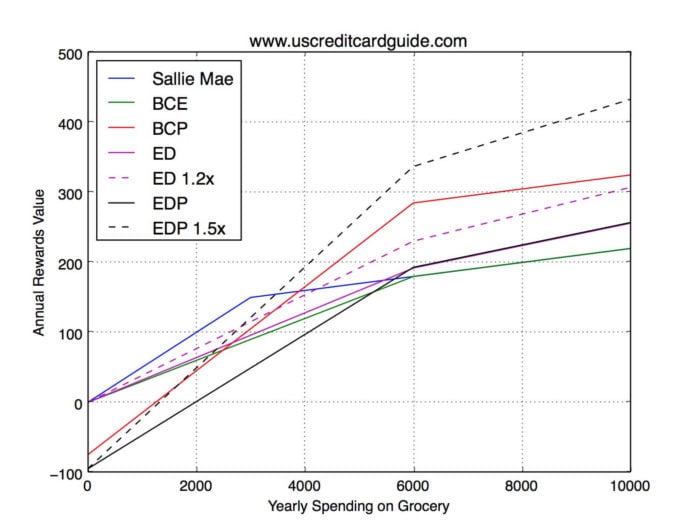

According to the data of each card, we can get the relationship between annual rewards and annual grocery spending for each card:

From the figure above, it is straightforward to see that when grocery spending is small, SM surpass all AmEx counterparts in virtue of its high rewards on grocery and no annual fee. When grocery spending is large, EDP can get the highest rewards if you use it at least 30 times every month, followed by BCP and then ED which is used more than 20 times per month. Notably, EDP/ED can get high rewards not only in grocery spending but also in other categories. They are suitable for all purposes. Please refer to Which Credit Card Should I Pick If I Only Want One Card for detail. If you spend a lot on grocery but can’t use your card for 30 times per month, BCP should be the best option.

Note that it is possible to get more rewards by using Citi Double Cash (DC) or FIA which earns 2% everywhere after grocery cap is reached. Or you can simply get two SM, use the second one after you spend $250 on grocery with the first one. But all these strategies require you to remember how much you have spent on grocery this month, which is quite complex. So let’s only consider the case where you make all your grocery purchases with the same card.

We can get detailed cut-off points with some math: intersection between SM and EDP is $3468, intersection between SM and BCP is $3900, intersection between SM and ED is $4225. Although the above data is annual grocery spending, monthly grocery spending should not be calculated by simply dividing by 12 for most people. The reason is that if you have Chase Freedom, and you should have it, you’ll usually get 5x UR bonus points on grocery during one quarter per year. Taking the estimated 1.6 cents per UR point into consideration (refer to Bank & Credit Card Points Value for detail), the rewards rate would reach 8%. Hence, Freedom shall be used for grocery in that quarter. After some calculation we can get: intersection between SM and EDP is $332/month, intersection between SM and BCP is $367/month, intersection between SM and ED is $455/month

In addition to high rewards on grocery and no annual fee, Sallie Mae offers 5% cash back on the first $250 gas spending and first $750 Amazon spending every month. Those two are highest rewards rate among all common credit cards (even including credit cards with annual fee). In other words, SM has no substitute for it even not for the purpose of grocery spending. In addition, SM has two benefits compared with AmEx grocery cards: first, it is a MasterCard, which is more widely accepted and can be used in supermarkets where AmEx is not accepted; second, its definition of supermarkets/grocery is wider than AmEx. For example, Target and Walmart are not supermarkets by the definition of AmEx, but some Target and Walmart are supermarkets/grocery by the definition of SM. So we recommend that everyone should get one Sallie Mae card.

Conclusion

According to the comparisons above, we can draw the following conclusions:

- Sallie Mae (SM) is recommended for everyone. Even if you don’t use it as your main supermarket/grocery card, it is still suitable for gas and Amazon spending, as well as places where AmEx is not accepted.

- Chase Freedom is recommended for everyone, and should be used for grocery when its 5x categories includes grocery.

- If you have Chase Freedom:

- If AmEx EveryDay Preferred (EDP) can be used 30 times per month:

- If you spend less than $322 on grocery per month, then Sallie Mae (SM) is the best grocery credit card for you.

- If you spend more than $322 on grocery per month, then AmEx EveryDay Preferred (EDP) is the best grocery credit card for you.

- If AmEx EveryDay Preferred (EDP) cannot be used 30 times per month:

- If you spend less than $367 on grocery per month, then Sallie Mae (SM) is the best grocery credit card for you.

- If you spend more than $367 on grocery per month, then AmEx Blue Cash Preferred (BCP) is the best grocery credit card for you.

- If AmEx EveryDay Preferred (EDP) can be used 30 times per month:

- If you don’t have Chase Freedom:

- If AmEx EveryDay Preferred (EDP) can be used 30 times per month:

- If you spend less than $289 on grocery per month, then Sallie Mae (SM) is the best grocery credit card for you.

- If you spend more than $289 on grocery per month, then AmEx EveryDay Preferred (EDP) is the best grocery credit card for you.

- If AmEx EveryDay Preferred (EDP) cannot be used 30 times per month:

- If you spend less than $325 on grocery per month, then Sallie Mae (SM) is the best grocery credit card for you.

- If you spend more than $325 on grocery per month, then AmEx Blue Cash Preferred (BCP) is the best grocery credit card for you.

- If AmEx EveryDay Preferred (EDP) can be used 30 times per month:

- If you only want one credit card, then AmEx EveryDay Preferred (EDP) is best for you, see Which Credit Card Should I Pick If I Only Want One Card for more details.

We hope you could get the most suitable rewards credit card for grocery/supermarket use.