Bilt Card 2.0: Bilt Blue Card Review

Contents

Application Link

Features and Benefits

- $100 Bilt Cash Welcome Offer: Earn $100 of Bilt Cash when you apply and get approved.

- This card earns two different types of rewards: Bilt Points and Bilt Cash, which we’ll explain in detail below. Based on our own valuation (not an official estimate from Bilt), Bilt Points are worth about 1.6 cents/point, because its 1:1 transfer partners include several high-value programs such as Hyatt, JL, AS, and UA!

- Earn 1x Bilt points on everyday spend (i.e. excluding rent and mortgage).

- The mechanism to earn points on rent and mortgage is a bit complicated, see Bilt 2.0: Explaining the Two Options to Earn Points on Rent and Mortgage for details.

- Cellular Wireless Telephone Protection.

- No Foreign Transaction Fee.

Bilt Points Overview

Bilt rewards points are surprising flexible and valuable. Its 1:1 transferrable partners are:

- Accor (3:2 ratio)

- Aer Lingus (EI) Avios

- Alaska Airlines (AS) Mileage Plan

- Air Canada’s (AC) Aeroplan

- Air France (AF)/KLM FlyingBlue

- Avianca (AV) LifeMiles

- British Airways (BA) Avios

- Cathay Pacific (CX) Asia Miles

- Emirates (EK) Skywards

- Etihad (EY)

- Iberia (IB) Avios

- Japan Airlines (JL) JAL Mileage Bank

- Marriott

- Qatar Airways (QR) Privilege Club

- Southwest Airlines (WN) Rapid Rewards

- Spirit (NK) Free Spirit

- TAP (TP) Miles&Go

- Turkish (TK) Miles & Smiles

- Virgin Atlantic (VS) Flying Club

- United Airlines (UA) MileagePlus

- World of Hyatt

- IHG

- Hilton Honors

- Virgin Red

Note that Hyatt points, JL miles, AS miles, and UA miles are quite valuable and not that easy to get.

Bilt points can also be redeemed towards the Bilt travel portal, powered by Expedia, at a fixed ratio of 1.25 cents/point. Although this is not the best way to redeem Bilt points, it is a flexible way to redeem the points.

Bilt points can also be redeemed as statement credit at a fixed ratio of 0.55 cents/point. It is not recommended to redeem the points in this way because the ratio is too low.

Bilt Cash Overview

Bilt Cash is a newly introduced rewards system with Bilt Card 2.0, and it is separate from Bilt Points. Cardholders earn 4% Bilt Cash on purchases made with the Bilt Card (rent and mortgage payments excluded). However, Bilt Cash does expire:

- Bilt Cash earned expires at the end of the same calendar year. Up to $100 in Bilt Cash can be rolled over to the following year.

Bilt Cash cannot be redeemed as a statement credit. Its primary redemption options include:

- Convert to Bilt Points: When paying rent or a mortgage, cardholders can choose the no-fee mode (otherwise a 3% fee applies) and convert $30 in Bilt Cash → 1,000 Bilt Points, up to the amount of the current bill (for example, a $2,000 payment allows conversion of up to 2,000 Bilt Points).

- Offset eligible purchases: According to Bilt’s official list, Bilt Cash can be used in the Bilt App to offset spending in the following categories: hotel bookings via the Bilt Travel Portal, Lyft, fitness classes, purchases at Bilt partner restaurants, Gopuff home delivery, and the Bilt Collection. The exact limits and redemption value for these uses will need to be confirmed after the program is fully launched.

- Status boost: On Rent Day, Bilt Cash can be used to temporarily boost your Bilt membership status.

Bilt Elite Status Overview

Bilt has the following Elite Status tiers:

- Blue

- Silver

- Gold

- Platinum

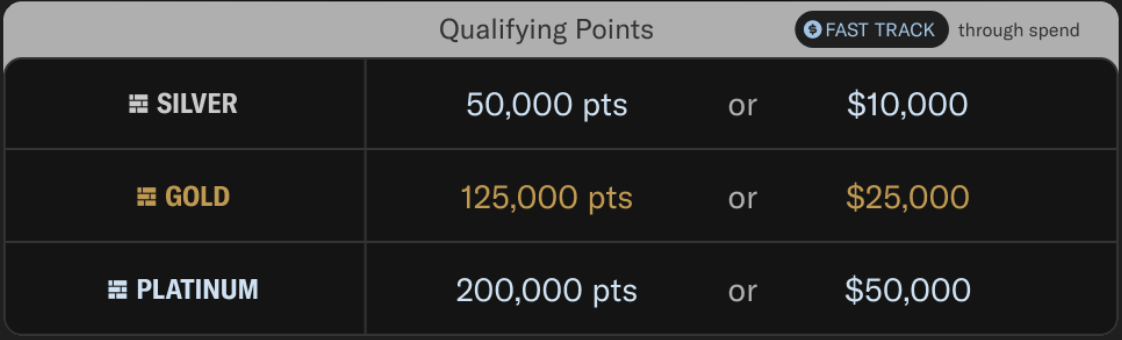

Aside from Blue, which you receive automatically upon registration, the requirements for each tier are as follows (note that rent payments do not count toward spending requirements):

After reaching a given Bilt Elite Status tier, you can unlock additional benefits during special promotions. For example, Bilt has previously offered Rent Day transfer bonus promotions, and higher-tier members could receive significantly larger transfer bonuses.

Related Credit Cards

| Card Name | Bilt Blue | Bilt Obsidian | Bilt Palladium |

|---|---|---|---|

| Annual Fee | $0 | $95 | $495 |

| Bilt Points Earning | 1x on rent, mortgage, and everyday spend | 3x on dining or grocery (choice of one; grocery up to $25K/year); 2x on travel; 1x on rent, mortgage, and everyday spend | 2x on everyday spend; 1x on rent and mortgage |

| Bilt Cash Earning | 4% on everyday spend | 4% on everyday spend | 4% on everyday spend |

| Credits | N/A | $100 Bilt Travel hotel credit ($50 every six months) | $400 Bilt Travel hotel credit ($200 every six months); $200 Bilt Cash annually |

| Other | N/A | N/A | PPS |

Summary

In the Bilt 2.0 era, Bilt Points themselves haven’t changed—and they’re still very strong. Bilt continues to offer a wide range of transfer partners, including some that are hard to earn and highly valuable, and it frequently runs very generous transfer bonuses on Bilt Rent Day, which remains Bilt’s biggest advantage.

However, one of the major selling points of the old Bilt Card—fee-free rent payments—is gone on the new card. The newly introduced Bilt Cash also comes with an expiration date. Under the new system, if you want to pay rent or a mortgage with no fee while still earning Bilt Points, every $1,000 in rent/mortgage requires $750 in everyday spending. Compared to the old Bilt Mastercard, this is significantly less attractive. On top of that, the system is overly complicated and headache-inducing.

As a no-annual-fee card, its points-earning ability is also fairly weak: just 1x Bilt Points on regular spending. When benchmarked against a 2% cash back card, even with the strong usability of Bilt Points, it’s still hard to justify.

Historical Offers Chart

Note: Only the Bilt Points part is shown in the chart; the Bilt Cash part is NOT shown.

Application Link

See Guide to Benefits and Rates and Fees for more details.