It is very common for Chinese people in the US to receive remittance from China. Remittance often charges commission fees, and how to save money as much as possible concerns many people. Today we will help you to find out a relatively economical and easy way to make remittance.

Contents

Introduction to General Wire Transfer Process

Many people are likely to choose this method, and we will introduce this procedure in details. Generally speaking, the most common wire transfer procedure from China to America is as follows:

Chinese bank → the bank in the middle → American bank

Normally wire transfers are processed directly from a Chinese account to an American account. But under some specific conditions, the bank in the middle is required, which is marked by brackets above. If you want to know how to save commission fees, you should first know how commission fees are charged. During the procedure, every part may charge commission fees:

- Chinese Bank: commission fees and telegraphic fees are charged. The former usually charges 1‰ of your remittance (RMB), with the lowest amount and the highest amount, while the latter often charges RMB 100 or 150 yuan.

- The Bank in the middle: transition fees of certain amount are charged. If the bank in the middle belongs to America, several dollars or ten will be charged directly.

- American Bank: income wire transfer fee is charged. If foreign currency is directly transferred into your account,foreign wire transfer incoming fee is often charged; if foreign currency is transferred into your account through the American bank in the middle, or through subsidiary banks in America from the Chinese bank, domestic wire transfer incoming fee is charged. Both of them cost 15 dollars per bill.

Generally speaking, your commission fees paid is as follows, according to normal wire transfer procedure. And if every part cost you some money, the amount of your money in the end will reduce a lot.

Total commission fee paid = wire transfer fee of the Chinese bank + commission fee charged by the bank in the middle + incoming wire transfer fee of the American bank

Normally, you can save part and even all the commission fees if you become the senior client of major banks. For example, Citi Gold card can save your incoming fee, and HSBC Premier client can save commission fees of transition account globally. Besides, banks may share specific cooperation, such as the past China Construction Bank and BoA, which can save you a certain amount of commission fee and provide you a lot of help. Next we will make a summary of individual overseas wiring fees of major Chinese banks and commission fees of major American banks in particular.

Wire Transfer fee of major Chinese banks:

| 銀行 | 手續費 | 最低手續費 | 最高手續費 | 電報費 |

|---|---|---|---|---|

| 工商銀行 | 0.8‰ | 16 | 160 | 100 |

| 中國銀行 | 1‰ | 50 | 260 | 150 |

| 建設銀行 | 1‰ | 20 | 300 | 80 |

| 農業銀行 | 1‰ | 20 | 200 | 80 |

| 交通銀行 | 1‰ | 50 | 250 | 100 |

| 光大銀行 | 1‰ | 20 | 250 | 150 |

| 民生銀行 | 1‰ | 50 | 200 | 200 |

| 中信銀行 | 1‰ | 20 | 250 | 100 |

| 招商銀行 | 1‰ | 100 | 1000 | 150 |

| 華夏銀行 | 1‰ | 50 | 1000 | 150 |

| 郵政儲蓄 | 0.8‰ | 20 | 200 | 70 |

Wire Transfer fee of major American banks:

| Bank | Account Type | Domestic-Incoming | Domestic-Outgoing | Foreign-Incoming | Foreign-Outgoing |

|---|---|---|---|---|---|

| Chase | Total Checking | $15 | $25 | $15 | $40 |

| Premier Plus Checking | $15 | $25 | $15 | $40 | |

| Premier Platinum Checking | $0 | $25 | $0 | $40 | |

| Chase Private Client (CPC) | $0 | $0 | $0 | $0 | |

| Bank of America | Core Checking | $15 | $25 | $16 | $35 |

| Interest Checking | $0 | $25 | $16 | $35 | |

| Preferred Rewards: Gold | $0 | $25 | $16 | $35 | |

| Preferred Rewards: Platinum and Platinum Honors | $0 | $25 | $0 | $35 | |

| Citibank | Basic Checking | $15 | $25 | $15 | $35 |

| Citigold | $0 | $17.5 | $0 | $25 | |

| Citi Private Bank | $0 | $0 | $0 | $0 | |

| Fidelity | Fidelity Cash Management Account | $0 | $10 online, $15 via representative | $0 | $10 online, $15 via representative |

| Charles Schwab | Schwab Bank High Yield Investor Checking Account | $0 | $25 | $0 | $25 |

| Discover | Discover Checking | $0 | $30 | $0 | $30 |

| Wells Fargo | All | $15 | $30 | $15 | $30 |

| Ally Bank | $0 | $20 | $0 | They don't offer international outgoing transfer | |

| Capital One | $15 | $25 | $15 | $50 | |

| PNC Bank | $15 | $25 | $15 | $45 | |

| US Bank | $20 | $30 | $25 | $50 |

Though Discover Checking hasn』t the so-called Incoming Wire Fee, Mellon Bank which opens your Discover account, the bank in the middle, still charges you fees if you make direct remittance abroad (not through other American banks in the middle). Someone says it charges 12 or 15 dollars per bill, which have been found by us. You should be noted that not all the conditions charge you no fees.

Some Chinese banks, like the Bank of China, have established subsidiary banks in New York. You can make remittance through the subsidiary bank in New York into your American account, which can avoid commission fees of the bank in the middle. And your American account just charge you domestic incoming wire fee.

Apart from commission fee, there is another important issue, namely exchange rate. A bad exchange rate without commission fee cannot save money for you as well. We will talk about this problem in the next part.

Summary of Remittance Methods

- General bank wire transfer;

- To bring cash directly;

- To issue drafts in China;

- International remittance through Alipay;

- Western Union;

- To draw cash directly through ATM card in China;

- To become a senior client of banks

1. General bank wire transfer

Its procedure has been discussed above. Although many of you may choose to make remittance through this method at present, it may not be the most economical way. Some specific bank accounts may save certain amount of commission fees. For example, ATM Card abroad issued by the Bank of Communications lowers its credit limit of commission fee to 100 yuan and also saves telegraphic fees.

In America, only a senior account can be saved wire fees. But if you have built good relationship with bankers or you have excellent eloquence, you can try to save your wire fee through chatting with the bankers.

2. To bring cash directly

Some new freshman in universities or many people coming back from China may choose to directly bring cash back which can be deposited in banks directly. Yes, this way can save you some commission fees, but you can obviously figure out the shortcomings:

- Compared to remittance, you can not directly get money through this way. By the way, it is very dangerous for you to bring cash outside.

- You should declare with the American Customs if your cash amounts to over 10,000 dollars. It doesn』t mean that your money will be confiscated if your cash is beyond 10,000 dollars. The matter should become complicated if your cash is examined without declaration with American Customs.

Here we want to explain a definition to you. Some friends have found that exchange rate has several rates, including current buying rate, current selling rate, telegraphic transfer buying rate, and telegraphic transfer selling rate. Actually many of you have no idea which one we are talking about. In our daily life, if we give our dollars to the bank, the bank should buy our dollars at the expense of RMB, which refers to the current buying rate and telegraphic transfer buying rate; if we want to exchange the dollar in the bank, the bank should sell dollars to us, which refers to current selling rate and telegraphic transfer rate. The exchange rate of telegraphic transfer mentioned above actually refers to the telegraphic transfer rate of the bank. Thus, you should be careful as you look at the exchange chart.

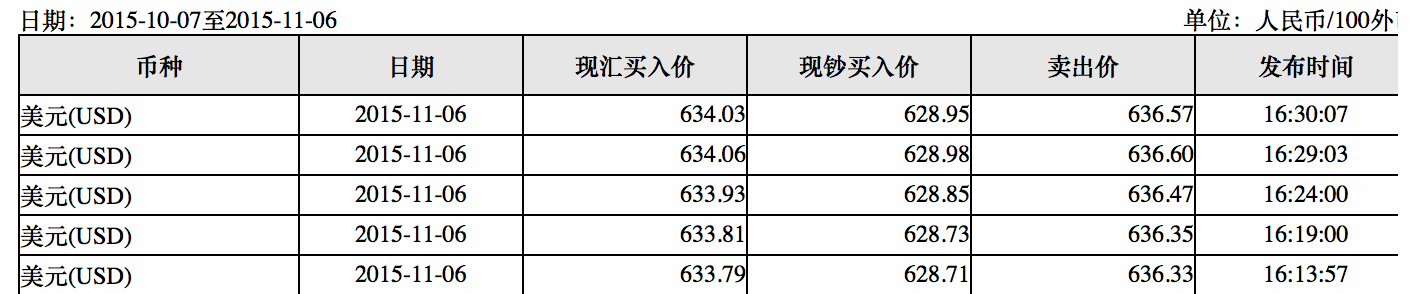

For banks, buying and selling foreign currency is always an opportunity to make money, as there is a disparity between buying rate and selling rate. The following chart is the Dollar』s Nominal Rate in the Bank of China. I can exchange RMB 628.85 yuan through 100 dollars on the bank counter; otherwise is not the same. I cannot exchange 100 dollars through RMB 628,85 yuan on the bank counter.

Nominal Price of Exchange Rate in the Bank of China

Small differences may exist in the exchange rates among different banks. For example, the following chart describes the exchange rate of the Industrial and Commercial Bank of China.

Nominal Price of Exchange Rate in the Industrial and Commercial Bank of China

I think many of you may want to complain about the exchange rate searched on Baidu and Google. Actually the exchange rate doesn』t refer to the bank』s current selling rate. Some people take time and efforts to buy commodities for someone else in order to make some money, and be trapped in the higher exchange rate and the commission fees.

3. To issue drafts in China

Some kind net friends tell us that to issue a draft is very convenient and economical method. Simply speaking, a draft can be functioned as a check for US dollars issued in a Chinese bank, which enables you to deposit your money into any of your American bank accounts.compared with cash, the draft is safer of which can be reported the loss. Compared with wire transfer, the draft charges lower commission fees which at least saves the telegram fees. However, the draft sometimes may be slower than wire transfer. If you still want to bring your draft with you, the draft is considered as dollars with equal value. The draft, amounting to 10,000 dollars should be declared to the American Customs.

| Bank | Condition | Daily Limit | Monthly Limit |

|---|---|---|---|

| Chase | $2000 | $5000 | |

| Citibank | 小於6個月的新客戶 | $500 | $1500 |

| 大於6個月的老客戶 | $1000 | $3000 | |

| Bank of America | $10000 |

4. International remittance through Alipay

Since 2014, Alipay has also provided international remittance service. You can make remittance by filling in your American account information on your Alipay account. Alipay adopts the wire transfer method. It has cooperation with Shanghai Bank, and the bank in the middle is Citi Bank which will transfer your money into your American account.

Alipay will charge you 50 yuan as the commission fee per time for international remittance without limits on the amount and telegram fees. Citi Bank in the middle will charge you 8 to 12 dollars per time. If the amount of your remittance is below 10,000 dollars, you will be charged 8 dollars; if the amount of your remittance is above 10,000 dollars, you will probably be charged 12 dollars. However, I haven』t figure out the detailed boundary. Besides, domestic incoming wire fee may be charged if you transfer money to your American account from Citi Bank. And if you just transfer money to your Citi checking account from Citi Bank, the domestic incoming fee should not be charged.

Let』s make a comparison on the commission fee between Alipay and domestic banks』 direct wire transfer. If domestic banks cannot save telegram fees, Alipay is certainly the better choice. Some banks provide products which may save various commission fees. You』d better check whether you can enjoy similar benefits according to your own bank account conditions.

The speed of international remittance through Alipay is fast. I have used Alipay three times to make international remittance which can be finished in one working day or even shorter time.

5. Western Union

Western Union is a global method for bank transfers and remittance, which supports many banks in many countries. Western Union has established very close cooperation with Unionpay in China. There are three ways for you to transfer money from you Chinese account to American account through the Western Union:

- To directly finish your wire transfer in the website of the Western Union;

- You can directly make your Western Union remittance through your personal e-bank in the China Everbright Bank and the Agricultural Bank of China;

- To make remittance through Unionpay Online.

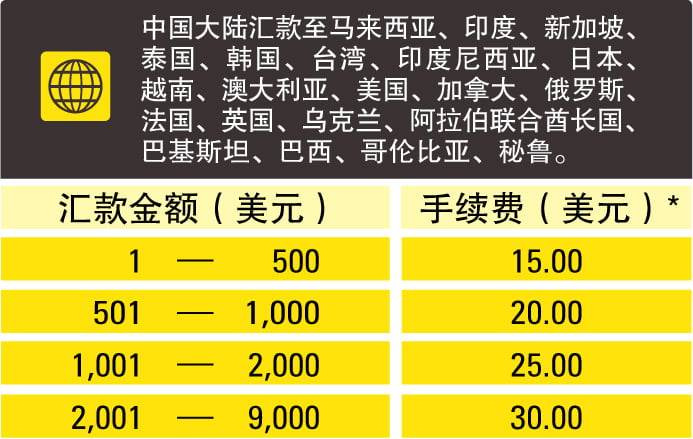

Commission fee should charged for Western Union remittance, which can be seen in the chart below(the upper limit of Unionpay Online amounts to 7,499 dollars)

Commission fee for Western Union Remittance

As to the exchange rate of Western Union Remittance, I only find the one similar to the buying rate of a bank, which is almost like the buying rate in domestic banks. But I haven』t found the selling rate in dollars. We believe that the selling rate should not be bad, and hope you who have used it can provide some data points for us.

6. To draw cash directly through ATM card in China

As more Chinese come to America, America has become increasingly supported various Chinese cards. For example, many stores in famous places have began to enable you to swipe Unionpay card for shopping. UnionPay debit card should draw money from ATM marked with Union, Pulse and STAR, which almost covers the most majority of Automatic Teller Machines in America.

Drawing money through Unionpay ATM adopts real-time Unionpay exchange rate, but you should be concerned about the commission fees.

- Commission fee of the domestic bank which issues your credit card: click this post A Comprehensive Summary Chart to get detailed information. We advise you to pay more attention to bank cards which can save domestic commission fees;

- Utilization fee for ATM charged by American ATM providers

Besides, you should be noted that domestic banks also make limits on UnionPay card for the money-drawing amount overseas everyday, which is often RMB 10,000 yuan per day. So do many American ATMs. Thus, we can say that this method is more suitable for people who are urgent for a small amount of dollars. If you don』t want to be bothered by large amount of ATM, then choose this method.

7. To become a premier client of banks

We have mentioned that clients who have built good relationship with bankers can save some commission fees. According to the summary of commission fees in banks, some American banks can provide some benefits and major Chinese banks may also provide benefits for commission fees. Apart from some American banks, big global banks will also provide better service for their own premier clients.

As far as I am concerned, HSBC provides a better service for global transfer accounts, which saves commission fees among an individual』s global accounts in real-time.

Does that sound terrific? There is a condition for you to enjoy that service that you should first have a HSBC Premier Account, which can be obtained with RMB 500,000 yuan or with foreign currency of equal value in your Chinese sigh-up account and can also be obtained with 100,000 dollars or foreign currency of equal value in your American sign-up account. If you have a HSBC Premier Account in one country, then your account will be automatically upgraded in other countries.

Although HSBC provides a better service for global transfer accounts, there are some hidden traps actually, namely exchange rate.

Dollar』s Nominal Rate in HSBC

For example, the exchange rate for Alipay is 6,3657. If you want to transfer 5,000 dollars through Alipay, you should be charged RMB 31,929 yuan in total, including the domestic commission fee and Citi Bank』s transfer fee. At the same time, if you choose HSBC to transfer money, you should be charged RMB 31,955 yuan due to the exchange rate, which is more than Alipay. We can conclude that HSBC』s service for senior clients is more suitable for a small amount remittance. However, HSBC can make real-time remittance, which is the best of all methods.

I tried to search whether Citi Gold account have similar benefits. Bankers working in the Chinese branch of Citi Bank tells me that the domestic system can not be connected with the foreign one, which means that you should pay telegram fees. Oh, my god! I really cannot persuade myself to believe that! However, I am sure that Citi Gold Debit Card in China will not be charged the commission fee in Citi ATM in America.

HSBC Premier/Advance Account in America can promise to offer you a credit card. If you plan to use your HSBC account for a long period, we advise you to choose a HSBC』s credit card as the first card. Honestly speaking, the benefit of its credit card is not really good, but you can pay no annual fees. A credit card for Premier Account also enable you to transfer points into British Airways and Singapore Airlines. By the way, Singapore Airlines seems to welcome point transfer from any point system.

Summary of Preferred Methods of Remittance

Let』s look at the following best methods of remittance at present.

- General remittance: Alipay;

- The most economical method: bring cash and draft with oneself;

- Small real-time withdrawal: some UnionPay Debit Card;

- Small real-time remittance:HSBC global remittance

Generally speaking, Alipay』s international remittance is recommended frequently. Compared to banks』 wire transfer, Alipay can save a lot of domestic commission fees for you. As Citibank is the bank in the middle of your international transfer, you can also avert Domestic Wire Fee if you make direct remittance into your Citi account or Discovering Checking account. In my opinion, you should make remittance into the Citi bank if you have already had a Citi account, which can save almost $20, including ¥50 + $8~$12. Compared with telegraphic transfer selling rate of other banks, the The exchange rate of Alipay is reasonable.

If you want to bring cash , you must be very careful. And remember that you should declare to the American Customs if your cash amounts to over 10,000 dollars.

It is also a good choice for you to directly deposit money through your mobile App after your draft has been already issued in China. If you are in America, we advise you to choose banks with easy quota, such as BoA.

If you want to draw money overseas through your UnionPay Debit card, we advise you to choose banks which can save domestic commission fees, such as Hua Xia Bank or the Gold Card issued by the Bank of Chengdu.

At last, we sincerely hope that you can provide advice for or share experience with us. After all, a best and the most economical method of remittance can benefit everyone.