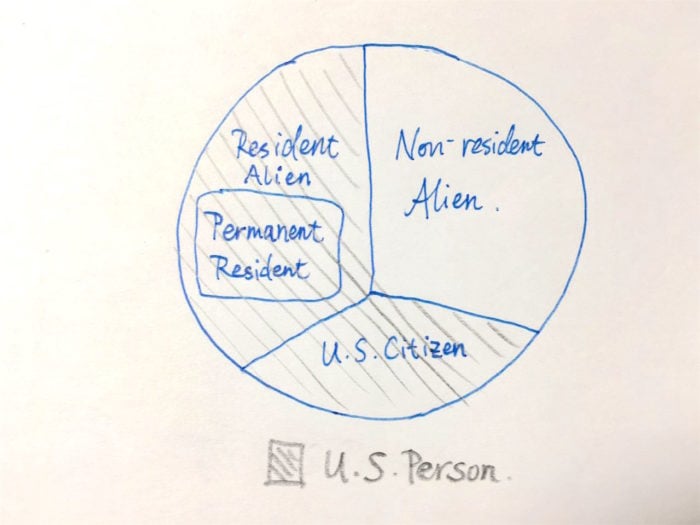

When you apply for a Checking or Savings Account, or some credit cards, the webpage may ask you to certify you are a U.S. Person: “Under penalties of perjury, I certify that: I am a U.S. citizen or other U.S. person.” What is U.S. Person? What is Non-resident Alien? What is Resident Alien? What’s its difference between Permanent Resident?

These words have exact definitions in terms of tax, we will make these words clear and explain their differences and relations according to the official site of IRS (Internal Revenue Service). For banks, the difference between whether you are a U.S. Person is, the tax form for U.S. Person is Form W-9, while the tax form for Non-resident Alien is Form W-8.

Note that in this post we only talk about the definitions related to credit cards/bank accounts, so we are actually talking about Form W-9/W-8, i.e. the federal tax, and state tax has different definitions for resident, so don’t refer to this post if you want to find information about state tax.

The relations among varies status

Contents

1. What is U.S. Citizen

I think I don’t need to explain this, since I believe everyone knows whether you are U.S. Citizen. I need to emphasize that, if you are not a U.S. Citizen, and you claim you are when applying for credit cards/bank accounts, this is a serious fraud and lie, it might affect you application for green card, so be serious about it!

2. What is Lawful Permanent Resident (Green Card Holder)

I believe you also should know whether you are a green card holder.

3. What is Alien

As long as you are not a U.S. Citizen, you are an alien. There are two types of Alien: Resident Alien and Non-resident Alien.

4. What is Resident Alien (RA) and Non-Resident Alien (NRA)

If you are a green card holder, or if you satisfy this substantial presence test below, then you are a Resident Alien:

- 31 days during the current year, and

- 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

- All the days you were present in the current year, and

- 1/3 of the days you were present in the first year before the current year, and

- 1/6 of the days you were present in the second year before the current year.

It’s important that the test above has some exemptions:

Definition of Exempt Individual

- Foreign Government Related Individual

- Employee of Foreign Government

- Employee of International Organization

- Usually on A or G visa;

- Teacher, Professor, Trainee, Researcher on J or Q visa;

- Does NOT include students on J or Q visas;

- Does include any alien on a J or Q visa who is not a student (physicians, au pairs, summer camp workers, etc.);

- must wait 2 years before counting 183 days; however if the J or Q alien has been present in the U.S. during any part of 2 of the prior 6 calendar years in F, J, M, or Q status, then he is not an exempt individual for the current year, and he must count days in the current year toward the substantial presence test;

- Quality of being an Exempt Individual applies also to spouse and child on J-2 or Q-3 visa;

- Student on F, J, M or Q visa;

- must wait 5 calendar years before counting 183 days;

- the 5 calendar years need not be consecutive; and once a cumulative total of 5 calendar years is reached during the student’s lifetime after 1984 he may never be an exempt individual as a student ever again during his lifetime;

- Quality of being an Exempt Individual applies also to spouse and child on F-2, J-2, M-2, or Q-3 visa;

- Professional athlete temporarily present in United States to compete in a CHARITABLE sports event.

So for many people, the most important point is: F1/F2 students must be Non-resident Alien for the first 5 years! J1/J2 scholars must be Non-resident Alien for the first 2 years!

5. What is U.S. Person

The definition of U.S. Person include U.S. Citizen and Resident Alien, exclude Non-resident Alien!

Disclaimer: This article and any content herein are general introduction for readers only, and shall not constitute nor be relied on as legal opinion or legal advice in any form. We assume no liability for anything herein. If you need help about tax, please talk to a tax, legal or accounting advisor immediately.