Discover it Credit Card Review

2022.3 Update: It seems the good grade reward is no longer available.

2021.9 Update: Some users are targeted to generate referral links with $100 welcome offer. The link we use on our site has $100 welcome offer.

Contents

Application Link

- Discover it

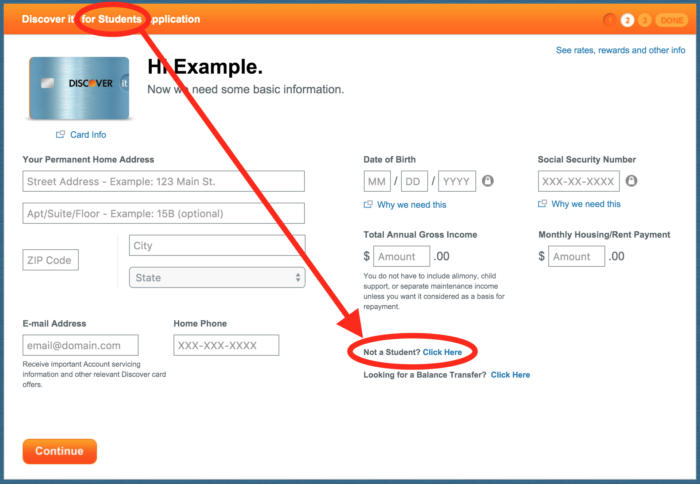

- Through this link, you might see the application page for either Discover it or Discover it for Students. Actually these two are equivalent: no matter which application page do you use, if you choose “College Student” as employ status, you will get Discover it for Students; if you choose other employ status, you will get regular version Discover it.

Benefits

- $100 offer: earn $100 statement credit after making one purchase anywhere within 3 months.

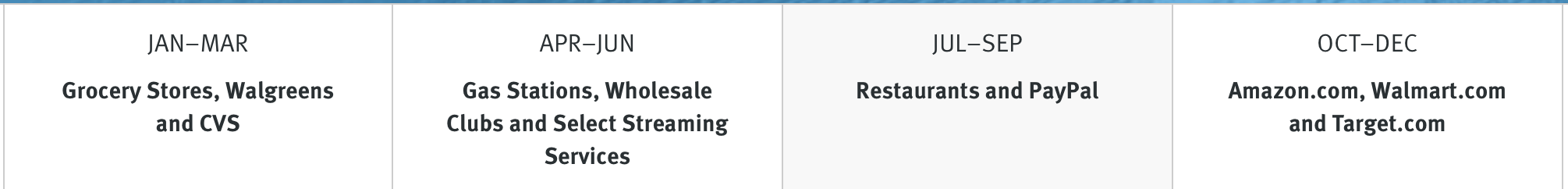

- Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter, 1% cash back on all other purchases. You need to activate the 5% cash back beforehand each quarter. New categories every quarter. The 5% bonus categories for 2021 are:

- Double Cash Back: Double all cash back you’ve earned at the end of your first year, including the 5% bonus category, and Discover Deals. The double part will be credited to you after the first year. Starting from 2018, the sign-up bonus and referral bonus will be granted as statement credit instead of cash back, so they will not be doubled.

Good Grade Reward: Earn $20 each year when you get at least a 3.0 GPA, up to 5 years. Screenshot.[2022.3 update] It seems the good grade reward is no longer available.- No credit history needed.

- Refer a friend: You can earn $50 for every approved account you refer, up to a maximum of 10 approved referrals ($500) per calendar year. The sign-up bonus from these referral links is $50.

- No foreign transaction fee.

- No annual fee.

Disadvantages

- Only first $1,500 purchases per quarter on bonus categories can earn 5% cash back, after that you can only earn 1% cash back.

- This is a Discover card, which is not as widely accepted as Visa or MasterCard.

- Credit limit for Discover it for Students may be VERY low, and it’s hard to get the limit increased.

- 5% bonus categories may not be correctly identified abroad when using some partner networks like UnionPay.

Recommended Application Time

- You can get approved even with no credit history at all! (SSN required)

- You may get rejected if you have some credit history, we recommend you apply when you have a credit history of 6 months.

- You must wait for a year before apply for a second Discover card.

- You can only have at most 2 Discover credit cards.

Summary

This card is a no-brainer choice. Everyone should get it for its 5% cash back in rotating categories and no annual fee. Besides, Discover Deals sometimes have pretty good discounts.

Historical Offers Chart

Note: Between 2015.6 and 2018.1, the $50 sign-up bonus are counted as cash back, thus is doubled to become $100 after one year. However, since 2018.1, the sign-up bonus is counted as statement credit, so it won’t be doubled any more.

Application Link

- Discover it

- Through this link, you might see the application page for either Discover it or Discover it for Students. Actually these two are equivalent: no matter which application page do you use, if you choose “College Student” as employ status, you will get Discover it for Students; if you choose other employ status, you will get regular version Discover it.