(Repost because of the news of the Merrill+ credit card.)

The redemption structure Merrill+, FlexPerks, UBS points are all based on tiers. If we look at the official description, it may be difficult to get an intuitive points value. A picture is worth a thousand words, let me show you the picture!

Contents

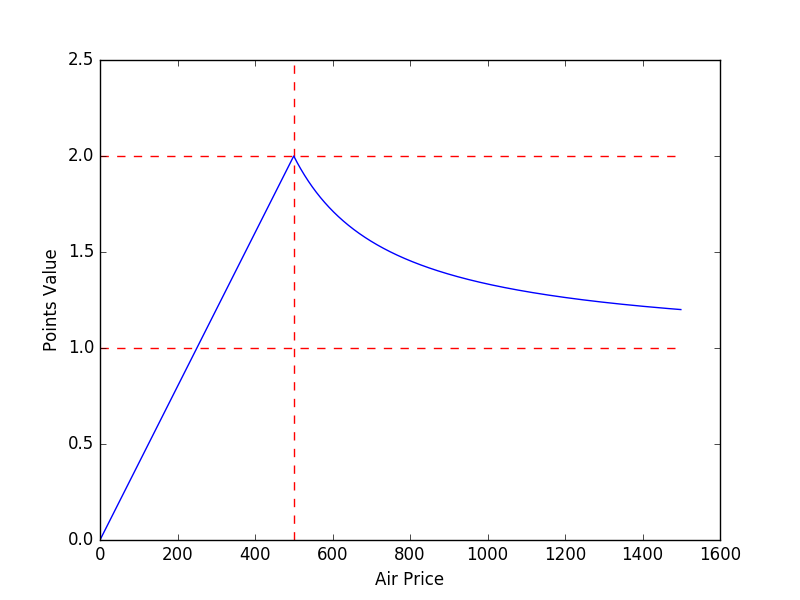

Merrill+ Points Value

Currently basically only the Merrill+ Visa Signature can earn Merrill+ Points. The official terms state:

How You Use Your Points: Redeem points for travel, cash rewards and gift cards. Anytime, Anywhere™ Air Rewards start at 25,000 Merrill Points for flights up to $500 (inclusive of taxes and fees).

They don’t explicitly state the rules for airfare >$500, but based on practice, people find that it’s one more points per one cent spent. Based on this formula, we can make the following picture:

Merrill+ Points Value

Obviously, the points value are the highest (2 c/p) when the airfare is $500. The closer the airfare is, the higher the points value is.

FlexPerks Points Value (2018.1 Update: Now FlexPerks value towards travel is fixed 1.5 c/p)

FlexPerks is a points system for US Bank. The following cards can earn FlexPerks points:

The FlexPerks redemption rate is defined by this table:

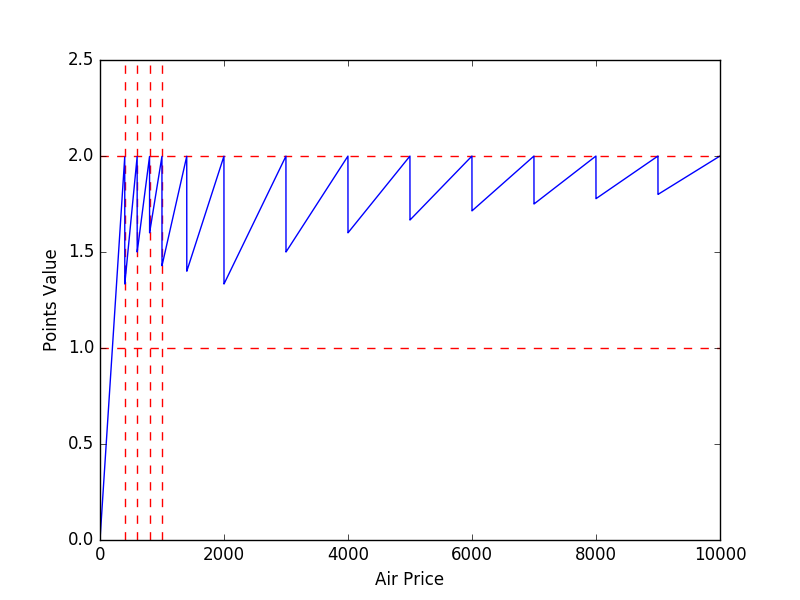

It’s easy to make the following picture based on the table:

FlexPerks Points Value

Obviously, we can get the highest points value (2 c/p) at the breaks ($400, $600, $800, etc). The points value is good if the air price is a little bit less than those breaks, but terrible if the air price is a little over. If the air ticket is really expensive, the difference isn’t important anymore, you can almost always get a good redemption (but why do you want to pay for such an expensive price? Use miles to get an award ticket!) I didn’t realize it’s actually quite easy to get a high redemption value until I made this plot.

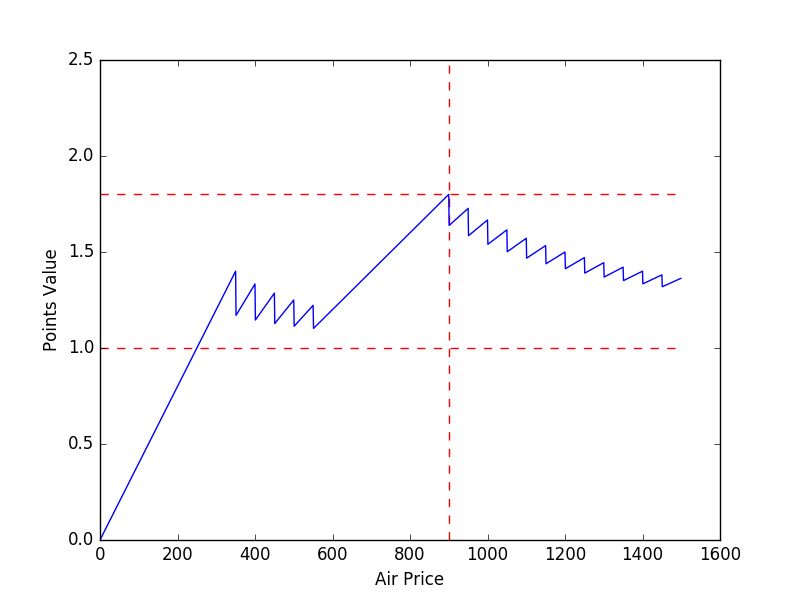

UBS Points Value

Currently only UBS Visa Infinite is the major player to earn UBS Points. The official terms are quite complicated:

Redeem 25,000/50,000 rewards points for one ticket up to $350/$900 on any commercial airline. Tickets must be booked through UBS and charged to your UBS Visa Infinite credit card. Once your purchase is complete, applicable rewards points per ticket will be deducted from your account and a credit posted to your credit card account for the ticket price. For tickets costing more than $350 or $900, you must pay the difference using additional rewards points at a rate of 5,000 points for any additional cost of up to $50 of ticket value. Additional payments may be made only in increments of 5,000 points. You must cover the full cost of ticket with rewards points.

It’s really hard to get an intuitive impression of the redemption value based on such a long term. So, we made the following picture:

UBS Points Value

Now it’s clear! Obviously, the points value are the highest (1.8 c/p) when the air price is $900. The closer the air price is, the higher the points value is. The appearance of the sawtooth is because “additional payments may be made only in increments of 5,000 points”. The amplitude of the sawtooth is not significant.

Acknowledgement: Thank lrdxgm for this idea.