As an international financial and transportation hub, Hong Kong (HKG) serves as a great stopover point between North America and the rest of south and east Asia. From a miles and points perspective, Hong Kong has several advantages:

- There is zero fuel surcharge (YQ) imposed on flight departing HKG. You heard it right. Nil.

- There are several sweet spots for mileage redemption departing Hong Kong.

Today we expand on the taxes and fees when departing from Hong Kong, with a special attention paid to Hong Kong’s departure tax. If your ticket has been subject to HK$ 120 departure tax, under certain circumstances you are entitled to a refund.

Contents

1. Taxes & fees when departing HKG

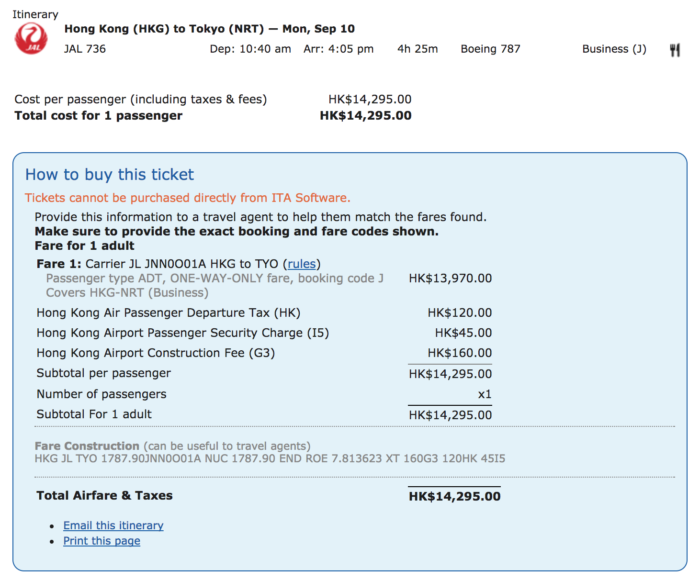

Here we examine the structure of taxes and fees you need to pay when departing HKG. Please note that even if your mileage program does not charge fuel surcharge, you can’t avoid those fees. Below is a summary of taxes and fees when trying to redeem Alaska miles on an award flight by Japan Airlines:

Other than the $12.5 “Partner award booking fee” assessed by Alaska, you need to pay $41.6 in taxes and fees, consisting of three parts.

- Hong Kong Air Passenger Departure Tax, $15.3;

- Hong Kong Airport Construction Fee, $20.5;

- Hong Kong Airport Passenger Security Charge, $5.8.

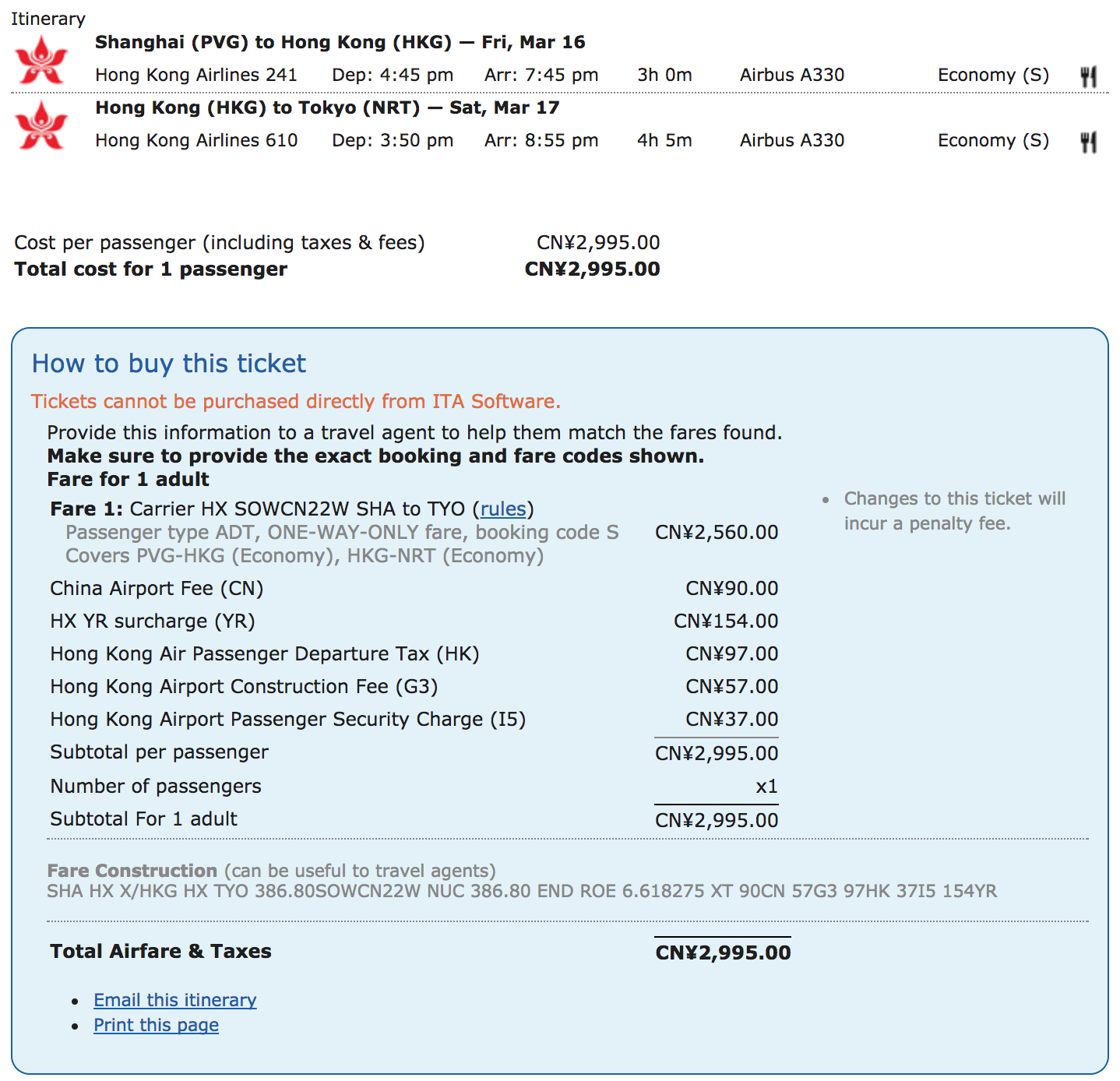

Those are pretty straightforward, and you can’t really avoid the latter two. ITA Matrix gives you a more detailed fare information. As you could see, the taxes and fees apply regardless of whether you pay by cash or use miles.

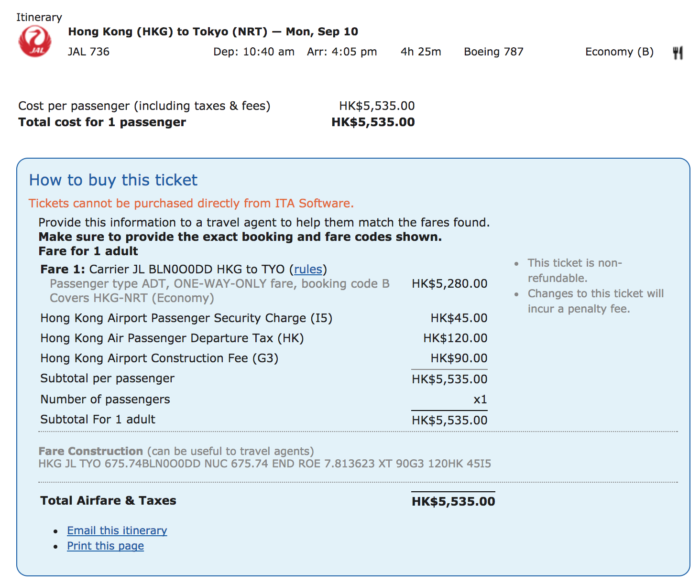

Look at the exact same flight but in economy class. Construction fee drops and the rest two remain the same.

Now let’s focus on the first item, departure tax.

2. When is departure tax levied?

Whether or not you are subject to departure tax depends on if your tickets can sufficiently demonstrate that you are indeed *transiting* through HKG. If in your ticket, HKG is the point of departure, then departure tax applies even though you are flying to HKG on separate tickets. Remember your ticket must be able to prove the nature of transit. Otherwise HKG is considered a point of departure by default.

Now what constitute a *transit*? If I leave the airport does that mean I am no longer transiting? The answer is yes and no. It depends on the nature of your ticket, and when your flight leaving HKG is. If your flight departs from HKG (e.g. the HKG-NRT example above).

If HKG is a stopover/layover point in your ticket, then departure tax depends on the time of leaving HKG and the carrier. In two circumstances no departure tax is imposed:

- Leaving HKG on the same day: for instance, I arrive at HKG from PEK at 0635 hours and leave HKG for EWR on CX890 at 1800 hours. No departure tax imposed at the time of booking.

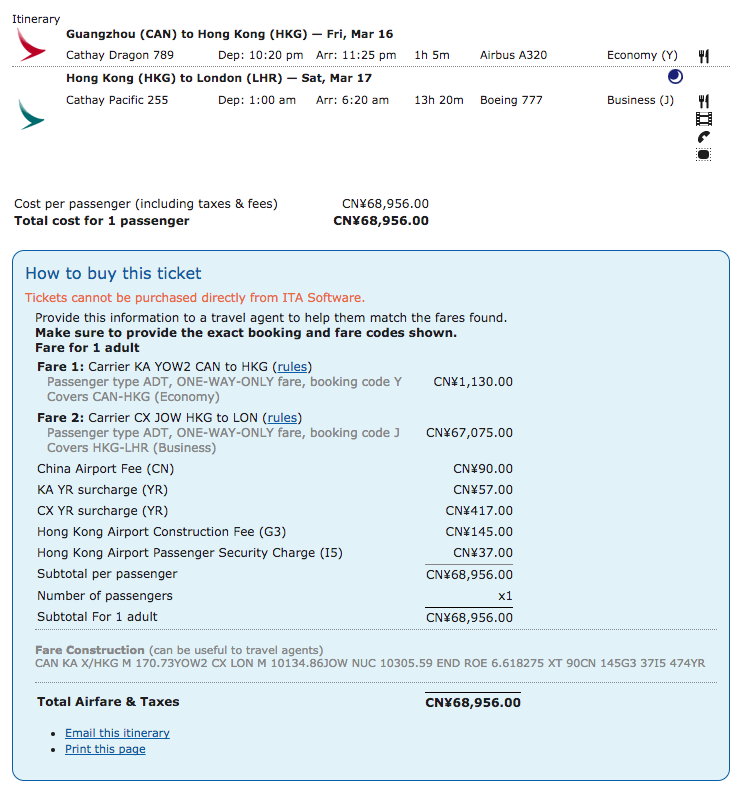

- Leaving HKG midnight the next day, on CX: In this example, you are flying from CAN to HKG to LHR. The first flight brings you to HKG at 2325 hours. After an hour and 35 minutes, you leave HKG for London on Cathay Pacific. As you could see, there is no departure tax.

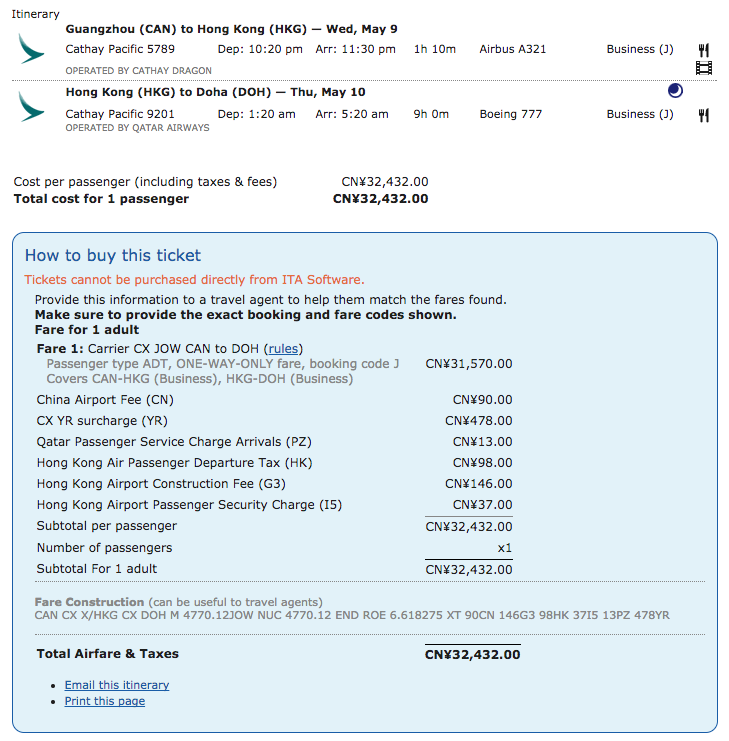

Now a big caveat: the flight departing HKG has to be on CX metal with CX code. In the following example, the flight is actually operated by Qatar but with a CX codeshare. So you could see departure tax is included in the ticket price.

In all other cases, you need to pay departure tax. If you are leaving HKG the next day with a overnight stay in Hong Kong, there will be departure tax.

If your stopover in HKG is longer than 24 hours (making it effectively a layover), you guessed it, there will be departure tax.

Now for those living in Shenzhen and deciding to fly out of HKG, there is a special scenario. We mentioned above if you arrive HKG by ferry then you are eligible for a refund. However, if you enter Hong Kong SAR on land and then go to the airport, you cannot claim your departure tax refund.

When in doubt, check your ticket receipt and look for “HK” in the taxes and fees. It should amount to 120 Hong Kong dollar, or 97 CNY, or $15.3.

3. How do I qualify for a refund?

In the first place, if you have not paid departure tax, there is no tax to claim refund from.

If your ticket does include departure tax, you have the right to claim a refund in one of the following three circumstances:

- You arrive and leave HKG at the same calendar date, regardless of whether you enter Hong Kong or not.

- You arrive and leave HKG by air on separate tickets, and do not leave the airport.

- You arrive at HKG by ferry from cities around Pearl River Delta.

The last case is mostly understandable, since you won’t enter Hong Kong at all.

A ferry boat docked at Skypier, HKG

Now let’s delve into Case 1 and Case 2.

a. Same-day transit; separate tickets (taxes imposed; refundable)

For example I use AsiaMiles to redeem a one-way business class ticket from Hong Kong to Los Angeles, leaving at 1635 hours. In the morning I redeem some BA Avios for a Cathay Dragon’s CAN. Since I hold separate tickets, the departure tax is included in the HKG-LAX ticket. However, since arriving at and leaving Hong Kong are at the same day, the departure tax is refundable.

b. Non-same-day transit; midnight departure (taxes mostly imposed; refundable unless entering Hong Kong)

As mentioned above, departure tax is waived when midnight departure is on Cathay’s flight and on the same ticket.

If you hold separate tickets, you have already paid departure tax but can claim a refund IF you do not enter Hong Kong. The final condition is very important and often overlooked. For the purpose of refund, you need to visit the tax refund counter in the check-in area. Yet, as soon as you enter Hong Kong you are no longer eligible. Hence either you need to claim your refund next time, or you need to mail in your tax refund application.

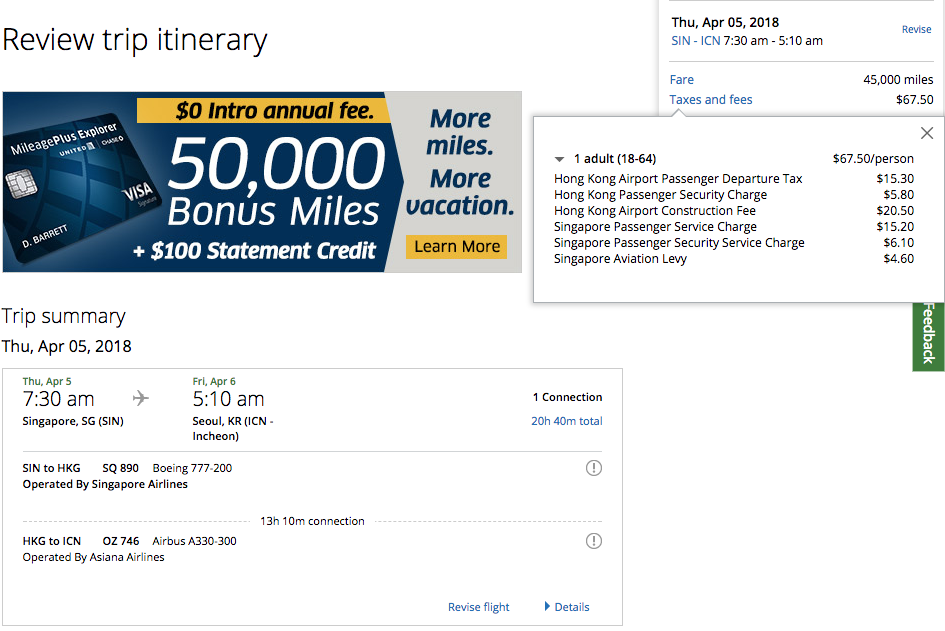

If you hold a single ticket with midnight departure flight but on an airline other than CX, the ticket prices has already included the departure tax. The following is a UA-issued ticket with Singapore Airlines and Asiana, connecting in HKG. Note that the Asiana flight leaving HKG is 30 minutes past midnight, and you could see the departure tax.

In this ticket, you can claim a tax refund on the condition that you don’t enter Hong Kong (same as above).

c. Non-same-day transit; non-midnight departure (taxes imposed; refundable unless entering Hong Kong)

This could be viewed as an extension of (b). Let’s imagine an extreme case. I fly to HKG on a separate tickets redeemed through BA Avios and my onward flight is CX601. Unfortunately the CX601 is canceled due to political unrest in Male, and the next available flight is three days away. As a result I decide to play Tom Hanks in The Terminal. Without leaving the airport, I eat, drink, and sleep at the departure level. Now since I have not entered Hong Kong, I can still claim the departure tax later.

4. How to submit a refund?

a. At SkyPier

When you take the ferry to HKG, you will be able to claim your refund immediately upon arrival at HKG’s SkyPier. You need to present your flight receipt and your boarding pass.

Credit: TurboJET

More information can be found on TurboJET’s website, which is one of the ferry service providers.

b. At HKG departure level

The tax refund counter is located at check-in counter E. You need to present the boarding passes of both the arriving and departing flights. Plus, you need to declare that you haven’t entered Hong Kong during the transit. Don’t think you could fool around: the refund counter has access to the immigration system and they could easily spot if you are lying. Also don’t forget that your eligibility might be lost if you enter Hong Kong to do the refund claim.

c. By mail

Within one month of your flight departing Hong Kong, you can file a tax refund request via mail. Just fill out this form and send it to

Revenue Section, Finance Division

Civil Aviation Department

Level 5, Office Building

Civil Aviation Department Headquarters

1 Tung Fai Road

Hong Kong International Airport

Lantau

Hong Kong

Once processed and approved, a refund will issued back to you via mail. Apparently if you live outside of HKG it is not very convenient.

5. Summary

Unfortunately I have to say that the rules regarding Hong Kong’s departure tax is not very straightforward. However, if your itinerary is eligible for a refund and you have the time to claim it, 120 Hong Kong dollar is not a lot, but still worth the effort.