Several days ago Amex finally introduced the 100k offer for the Platinum Card as well as ED and BCE』s 25k/$250, lots of people applied and were approved for these offers. At the same time, however, Amex strengthened their efforts on Financial Review and recent data points show many users going through this process. In this post, we will briefly introduce the risk management policy from Amex: Financial Review.

Contents

1. What is Financial Review

Financial Review is a risk management policy by American Express. They will temporarily freeze a customer’s account (or pending applications), and require them to submit documents including and not limited to simple things such as address and employment verification all the way to IRS transcripts or a full blown audit.

2. Signs of FR

You need to pay attention when you are declined surprisingly even a normal and small purchase, you need to confirm that it is just Fraud Protection and not Financial Review.

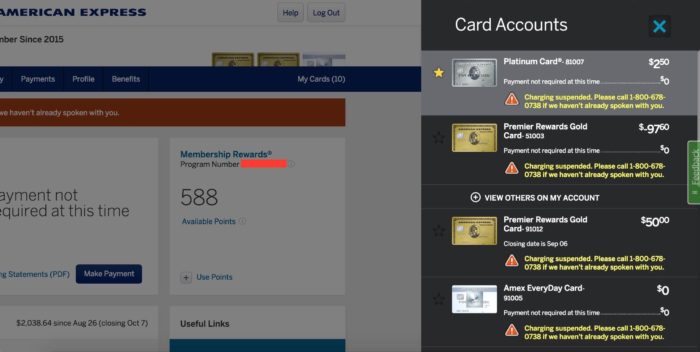

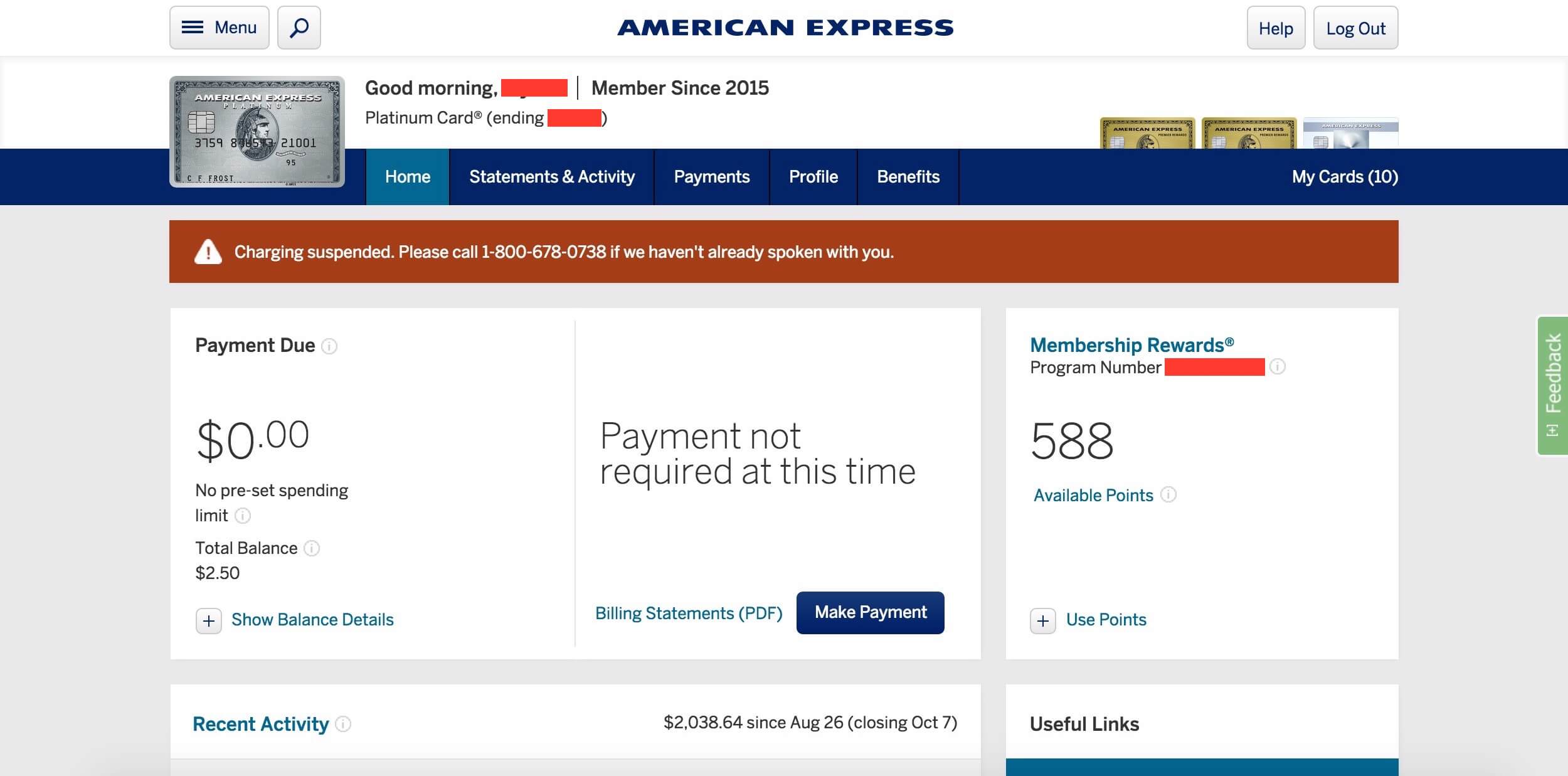

If you log in your account and find the following Charging Suspended, or received the call from Amex and required you to submit tax forms, bank statements, etc. then you can probably be sure that you are under Financial Review.

When you are undergoing Financial Review, all of your cards will lose their function until it is resolved. This is obviously very troubling, so we recommend you read on to find ways to avoid FR.

3. FR reasons and how to avoid

As we stated earlier, Financial Review is done by the American Express risk management team, if you are a non-risk customer and are not flagged by the system, you will not be bothered. So what activities will be considered as risks by Amex?

3.1. Large purchase within short time

Amex, like any other bank, will monitor your spending habits and will likely flag you if start spending in a way that is out of the ordinary.

How to avoid: If your average monthly spending is a couple hundred dollars, surely charging thousands of dollars in one day will raise some flags. If these purchases are legitimate, just make sure to call ahead and let AmEx know what’s going on and you should be fine!

3.2. Meeting minimum spend too quickly

Recently there were many users flagged for this reason. Many of them were completing the 2-5k minimum spend within a week. This translates to $104 – $260K in spending in a year which makes it easy to understand why Amex would flag your account right away.

How to avoid: You have three months to meet your minimum spend, there’s no need to be so urgent and risk an account closure no matter how temporary it may be. Spend slowly and if you do have a very large purchase, make sure to call and try to pay your statement down before it closes.

For those that want to save money through Amex Offers, adding authorized users is an effective method because each AU can set up their own online account and access the offers. In the past, we have seen people get caught for registering too many authorized users,

3.4. Abuse of “Check Spending Power”

Even though Charge Cards have no pre-set Credit Limit, it doesn』t mean that you can spend without a limit. There is a service called “Check spending power” that allows you to see if a potential purchase will go through on your card that you can use to check your “limit”. But generally speaking, you can』t check anymore than three times a day, and there are reports of user undergoing FR due to checking too much

Avoid methods: Amex treats you as someone likely to exceed your spending limits if you check this too often, make sure to only use it when truly necessary.

3.5. Credit Limit have already been high

Aside from the Charge Cards, Amex sometimes has restrictions on your personal Credit Card Limit, it is likely to trigger Financial Review if the limit is exceeded.

This limit is going to vary based on your income but generally, the threshold is 25k for a single card and 34.5k for your Amex account. If you want to avoid FR, please don’t cross the line, and you can ask to reduce your credit limit if necessary.

3.6. Returned Payment

Make sure that you have sufficient balance in your checking account to repay the Amex! Having a payment rejected due to an insufficient balance is definitely a red flag to Amex.

3.7. Faking and modifying your annual incomes

When it comes to faking your income, just don’t do it.

However, modifying your income can be grounds to initiate an FR as well. If your modification is large this is likely but there is no need to worry as long as this is a true representation of your income change. We suggest that you wait to modify that information after it has been updated on your taxes so you can submit those documents if necessary.

How to avoid: File your correct annual incomes if you are employed. Do not add the income of your wife if you are not filing a joint tax income return. Students without jobs and fully paid by parents, please don』t file your tuition into the annual incomes. For PhDs who have payment, only file your payment. Annual income is not the key in credit card approval, credit history is.

3.8. Affected by the same address

Probably the most interesting of the bunch. If someone living at the same address as you received a financial review, you are much more likely to be affected as well. Pick your roommates well and maybe this can be a topic of discussion!

4. How to deal with Financial Review

Don』t panic if your accounts are closed for FR. The reason for an FR by Amex is just to confirm that you have sufficient balance for repayment, so just submit the reports as per their instruction, and two weeks later your review should be over. Generally, Amex will require you to submit the following reports:

- Tax form of last year, they will let you file a 4506T.

- Your payroll: offer letter and pay stub,etc.

- Bank funds proof : bank statement

There are several options if FR happens to you:

- Submit the tax form honestly. If the claimed income on the tax form is different from that in Amex system, you can try to persuade the CSR to let you submit income proof from this year, such as payroll, etc.

- If you don’t have tax history from the last year, tell the truth to them and claim that you have payroll, or show them the balance you have in your account. If you are actively demonstrating that you can provide other documents, Amex will generally accept other proof of funds.

- If you have nothing to provide, truly nothing, pray to God!

5. The possible results after FR

Generally, there are three possible results after Financial Review:

- Review passed, your account remained the same

- Review passed, credit limit was reduced

- Review failed, all accounts closed by Amex

5.1. FR passed, your account remained the same

If the differences of your incomes are nonexistent or not that big, or you prove that you have a sufficient balance, you will pass the review easily. Some people say that if you passed FR once you will never worry about it again, this is a ridiculous statement and make sure to always be wary.

5.2. Review passed, credit limit was reduced

If you are unable to prove your income or have a high enough balance, there is a small possibility that you can still pass the FR, but Amex would likely set some restrictions on your accounts. The commonly seen measures are:

- Decrease the existing credit limit

- Set Credit Limit on Charge Card

This is the best case scenario if you were stretching the truth or your financial situation changed and you failed to indicate it. Use your accounts honestly and your limit should increase again.

5.3. FR failed, all accounts were closed by Amex

This is the worst result. Generally this will only happen when users are unable to submit any proof or choose to ignore the financial review.

Having all your accounts closed also means that you will be put on a blacklist for some time by Amex. So if you undergo Financial Review, submit something! A lower credit limit is much better than having all your accounts closed and being blacklisted.

We know that this article sounds like it’s all bad news, but there’s really no need to worry as long as you are being fiscally responsible and not falsifying any documents!