Photo includes authorized user and upgrade/downgrade accounts.

[Update 2017.4] – See Signup Bonus Math: The Best Return on Credit Card Spend for details regarding my return-on-spend.

Contents

Introduction

In June 2014, I came across the term “travel hacking” while reading a personal finance blog. It sounded interesting, so I learned about the basics of credit card points. At that time I had only one credit card, a Capital One Venture, which I used for all purchases. After learning more about the benefits of transferable points currencies, I signed up for the Chase Sapphire Preferred (CSP), transferred the Ultimate Reward (UR) points earned from the signup bonus to United, and booked two roundtrip tickets from the west coast to my sister’s wedding in Pittsburgh, PA.

To say it invigorated me to save on a trip I was already going to take just by signing up for a credit card is an understatement. Between domestic travel and one big international trip per year, travel-related expenses were one of the biggest line items on our annual budget. Not any more.

It has been exactly three years from the date I signed up for that first CSP. Since then, I have been approved for 66 new accounts and earned over 2.5 million points and miles from signup bonuses alone. These points helped offset over $62,000 in retail travel costs over that period, including over 100 hotel nights and 42 flights across Asia, Europe, and North America while allowing us to travel in relative comfort.

Disclaimer

This post is not a guide, but rather my story based on my comfort level. I have never carried a balance or paid interest. This hobby takes an incredible amount of organization and financial cognizance, otherwise the results could be devastating. I am not suggesting or advocating for anyone to follow my lead; rather, I am simply showing what has worked for me. There are risks involved with this hobby, including bank shutdowns. Understand the risks, act within your comfort zone and NEVER because a blog told you to do something, and proceed however you see fit.

The Strategy

Reimbursable work expenses are what started me down this road. Every time I knew a work trip was coming up, I’d sign up for a new card or cards whenever a historically high signup offer would come along. There were also practical things to take into account, like whether airline miles could be used from our home in Seattle or whether we wanted to stay in an Air BNB or hotel on an upcoming vacation.

Over the past 3 years, a lot has changed in this game. Chase now implements the 5/24 rule, Amex signup bonuses are once-per-lifetime, and Citi limits you to one signup bonus per points “type” within 24 months of either opening OR closing an account of that “type.” These changes started rolling in within 6 months to a year after I started chasing signup bonuses.

With a few exceptions, I signed up for all-time high bonus offers for new accounts. This is important given the restrictions implemented by each bank, as you don’t want to leave points on the table. Once I gained an understanding of each issuer, I started formulating a game plan for new applications around these restrictions. Along the way, I also came across some very easy, local manufactured spend pathways that helped with the minimum spends (and to earn a lot of additional points).

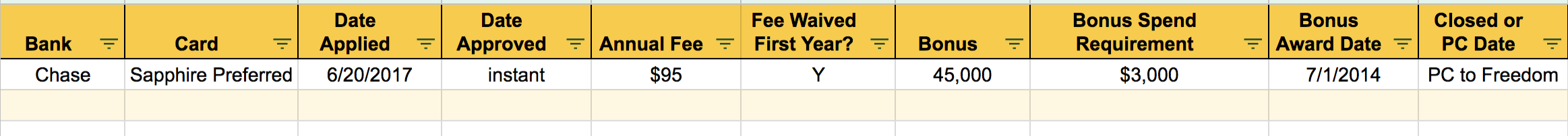

Approved Applications

The table below lists all of my APPROVED accounts in chronological order. Note that the table has multiple pages, which you can scroll through using tabs at the bottom of the table.

| Bank | Product | Date Approved | Bonus | Bonus Spend Requirement |

|---|---|---|---|---|

| Chase | Sapphire Preferred | 6/20/2014 | 45,000 | $3,000 |

| Chase | IHG | 11/1/2014 | 80,000 | $1,000 |

| Chase | Freedom | 12/1/2014 | 20,000 | $500 |

| Barclaycard | USAirways | 12/1/2014 | 50,000 | First purchase |

| Chase | United Explorer | 12/26/2014 | 50,000 | $1,000 |

| AMEX | Delta Gold | 1/11/2015 | 50,000 | $1,000 |

| Barclaycard | Choice Privleges | 1/20/2015 | 32,000 | 1 Choice Hotels stay |

| Citi | AAdvantage Platinum | 2/18/2015 | 50,000 | $3,000 |

| Amex | Everyday Preferred | 3/25/2015 | 30,000 | $2,000 |

| Bank of America | Alaska Airlines | 3/25/2015 | 30,000 | none |

| Bank of America | Alaska Airlines | 3/25/2015 | 25,000 + $100 | first purchase for miles, $1,000 for $100 |

| Citi | Prestige | 4/20/2015 | 50,000 | $3,000 |

| Citi | Hilton HHonors | 6/21/2015 | 50,000 | $1,000 |

| Discover | It | 6/21/2015 | $100 | first purchase |

| Amex | SPG Business | 6/21/2015 | 25,000 | $3,000 |

| Amex | (New) Old Blue Cash | 7/26/2015 | none | none |

| Capital One | Spark Business | 7/27/2015 | $500.00 | $4,500 |

| Capital One | Venture | 7/27/2015 | 40,000 | $3,000 |

| Amex | Platinum | 8/26/2015 | 100,000 | $3,000 |

| Chase | United Explorer Business | 8/26/2015 | 50,000 | $2,000 |

| Bank of America | Alaska Airlines Business | 8/26/2015 | 25,000 | first purchase |

| Citi | Thank You Premier | 8/26/2015 | 60,000 | $3,500 |

| Bank of America | Alaska Airlines | 8/27/2015 | 25,000 + $100 | first purchase for miles, $1,000 for $100 |

| Citi | AAdvantage Platinum | 11/26/2015 | 50,000 | $3,000 |

| Amex | SPG Personal | 11/26/2015 | 25,000 | $3,000 |

| Bank of America | Alaska Airlines | 11/26/2015 | 25,000 + $100 | first purchase for miles, $1,000 for $100 |

| Citi | Preferred | 12/25/2015 | 20,000 | $1,500 |

| Chase | Ink Plus Business | 12/28/2015 | 60,000 | $5,000 |

| Citi | AAdvantage Platinum | 2/1/2016 | 50,000 | $3,000 |

| Chase | Hyatt | 3/7/2016 | 2 free nights | $1,000 |

| Citi | AT&T Access & More | 3/7/2016 | $650 towards phone | $2,000 |

| Bank of America | Alaska Airlines | 3/7/2016 | 25,000 + $100 | first purchase for miles, $1,000 for $100 |

| Bank of America | Alaska Air Business | 3/7/2016 | 25,000 | first purchase |

| Barclaycard | Arrival+ | 3/7/2016 | 40,000 | $3,000 |

| Amex | HHonors | 3/25/2016 | 75,000 | $1,000 |

| Amex | Mercedes Benz Platinum | 5/2/2016 | 75,000 | $3,000 |

| Amex | Green Card | 5/8/2016 | 25,000 | $1,000 |

| Amex | Premier Rewards Gold | 5/9/2016 | 50,000 | $2,000 |

| Citi | AA Gold | 6/8/2016 | 25,000 | $750 |

| Amex | Everyday | 6/26/2016 | 25,000 | $2,000 |

| Amex | Gold | 7/12/2016 | 25,000 | $1,000 |

| Amex | Blue Cash Preferred | 7/19/2016 | $250.00 | $1,000 |

| Chase | Freedom Unlimited | 7/15/2016 | 15,000 | $500 |

| Amex | Business Gold Rewards | 8/9/2016 | 75,000 | $10,000 |

| Chase | Marriott Business | 9/25/2016 | 70,000 | $3,000 |

| Chase | Sapphire Reserve | 10/7/2016 | 100,000 | $4,000 |

| Bank of America | Merrill+ | 11/14/2016 | 50,000 | $3,000 |

| Amex | Blue Cash Everyday | 11/23/2016 | $250.00 | $1,000 |

| Citi | HHonors | 11/22/2016 | 75,000 | $2,000 |

| Capital One | Spark Miles Business | 12/10/2016 | 50,000 | $4,500 |

| Barclaycard | Arrival+ | 1/6/2017 | 50,000 | $3,000 |

| Amex | Platinum Business | 1/16/2017 | 100,000 | $15,000 |

| Amex | Blue for Business | 1/16/2017 | 10,000 | first purchase |

| Amex | Platinum - Charles Schwab | 2/15/2017 | 40,000 | $3,000 |

| Citi | HHonors | 2/17/2017 | 40,000 | $1,000 |

| Bank of America | Merrill+ | 2/17/2017 | 50,000 | $3,000 |

| Discover | It | 3/2/2017 | $100.00 | first purchase |

| Citi | HHonors | 3/20/2017 | 40,000 | $1,000 |

| Amex | Hilton Surpass | 3/24/2017 | 100,000 | $3,000 |

| Amex | Everyday | 4/3/2017 | N/A (previously held) | N/A |

| Citi | HHonors | 4/22/2017 | 40,000 | $1,000 |

| Chase | Ink Preferred Business | 4/26/2017 | 100,000 | $5,000 |

| Chase | Sapphire Preferred | 4/26/2017 | 50,000 | $4,500 |

| Bank of America | Merrill + | 5/19/2017 | 50,000 | $3,000 |

| Amex | Business Gold Rewards | 6/2/2017 | N/A (previously held) | N/A |

| Amex | Ameriprise Gold | 6/2/2017 | 25,000 | $1,000 |

Declined Applications

Apply for enough new accounts and eventually the “declines” will start rolling in. Unfortunately, “too many new accounts” is a common theme for these declines, and this reason is very hard to have reversed through calling the bank for reconsideration. The table below lists all of my DECLINED applications.

| Bank | Product Name | Date Applied | Denial Reason |

|---|---|---|---|

| Chase | Ink Plus Business | 2/3/2015 | Too many new accounts (shouldn't have called recon) |

| Barclaycard | USAirway | 3/29/2015 | Already have product |

| Barclaycard | Arrival + | 4/19/2015 | Sufficient number of accounts with bank |

| Amex | Simply Cash Business | 8/3/2015 | Applied for > 2 CC in 90 days |

| Barclaycard | UPromise | 8/27/2015 | Sufficient number of accounts with bank |

| Bank of America | Fidelity Amex | 11/14/2015 | Too many new accounts |

| Bank of America | Alaska Airlines | 2/1/2016 | Approved as Platinum - closed |

| Chase | Hyatt | 2/5/2016 | Too many new accounts (shouldn't have called recon) |

| Citi | AA Business | 3/23/2016 | Didn't follow 8/65 |

| Bank of America | Alaska Airlines | 6/12/2016 | Approved as Platinum - closed |

| Capital One | Venture | 8/3/2016 | Too many new accounts |

| Bank of America | Alaska Airlines | 3/22/2017 | Too many new accounts |

| Bank of America | Alaska Airlines Business | 3/22/2017 | Sufficient number of accounts with bank |

| Wells Fargo | World Propel Amex | 4/24/2017 | Too many new accounts |

Impact to Credit Score

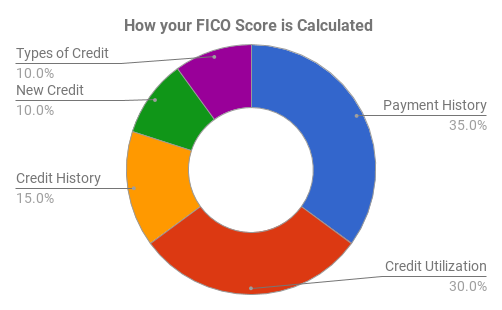

A common misconception is that applying for lots of credit cards will irreparably impact your credit score. While your FICO credit score will take an immediate hit of 3 to 5 points with each credit inquiry (application), your score will actually increase in the long run because each new account means more available credit. More available credit, assuming you aren’t carrying a balance and are fiscally responsible, means your credit utilization will be lower. I put together the chart below to illustrate the components of a FICO score. Having a low utilization and good payment history positively impact a credit score more than new inquiries (“New Credit”) hurt it.

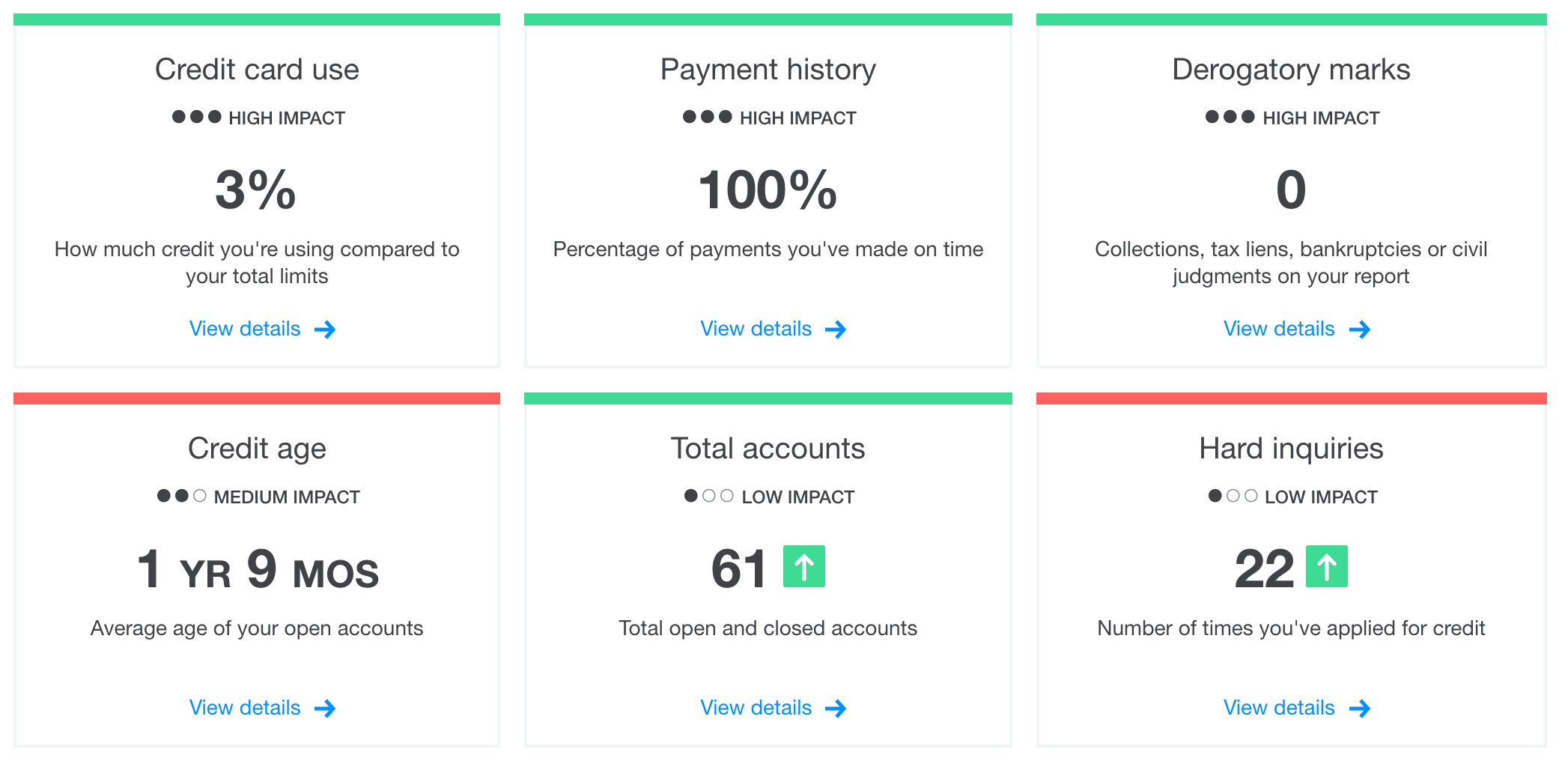

Over the course of the past three years, my FICO credit score has fluctuated within the range provided for each of the three main credit bureaus shown below:

- Transunion – 758 to 802

- Equifax – 755 to 803

- Experian – 723 to 753

Below is a summary of my credit profile from Credit Karma. I highly recommend signing up for a service like this to keep an eye on your credit portfolio, monitor for fraud, and understand the metrics that contribute to your FICO score.

Since 2014, I purchased a new vehicle and qualified for financing at 2.1% on a 36-month loan. Additionally, I submitted a mortgage application last week and was able to lock in a rate of 4.125% for a 30-year mortgage. In the case of the mortgage, the lender did not care in the least about the number of new applications or inquiries on my credit report. Rather, he focused on my credit score and payment history. Each lender may be different – again, I am simply reporting my experience.

Organization

I keep extremely detailed notes of all applications and correspondences in a spreadsheet (and I highly suggest you do the same!). I uploaded a formatted version of my spreadsheet here, which you can download and adapt to your own needs. Additionally, I keep a 3-ring binder and store all my cards in baseball trading-card sleeves to keep my cards organized.

What I’ve Learned (About Each Issuer)

Additionally, I have learned that each bank has its own personality. Below I list my take-homes from interacting with each bank

- Chase: getting to know a personal banker and having a relationship outside of credit accounts may help with qualifying for pre-approvals. I have been extremely fortunate to be pre-approved for the Sapphire Reserve, Sapphire Preferred, Freedom Unlimited, and Ink Preferred within the past year. I know my local banker very well, and always take the time to exchange pleasantries and ask about his life before getting into the WHAT NEW SIGNUP BONUSES DO YOU HAVE FOR ME? spiel. Maybe I’ve just been lucky as well…

- Amex: probably the easiest issuer to get approved for again and again, both personal and business accounts. I have been through two financial reviews (one focused on personal accounts, one seemingly more focused on business accounts), which while annoying were nothing more than a temporary inconvenience. In addition, Amex has great upgrade/downgrade potential with some of their products so you can earn bonuses without a new account or hard credit pull.

- Bank of America: seems to have altered their approval process over the past year. People (including me) used to be able to get multiples of the same card on the same day, but those days are gone. I’m interested to see if they implement a hard-fast rule like Amex, Chase, and Citi regarding signups, but no information regarding this change has been made public (yet).

- Citi: the most beneficial thing about Citi used to be their generous retention offers, which were available like clockwork every 6 months. They seem to have become more stingy or the offers a bit less fruitful, and on a recent call to fish for a retention offer the CSR actually mentioned the number of retention offers I’ve received in the past two years. I’ve started closing or product changing my Citi Thank You Point earning cards to (primarily to the Citi Dividend) to reset the 24-month clock. For years, I did get IMMENSE value out of Thank You Points. The Hilton merry-go-round has been fun over the past year, but that has now come to an end as well.

- Capital One: an overlooked issuer in this hobby. They do pull all three credit bureaus when you apply for a new account, but I fail to see why this matters. Number of inquiries has never been cited as a reason for denial of credit in my experience, and they have some awesome signup bonuses on the Venture and Spark product lines.

- Barclaycard: limit your Barclaycard applications to every 6 months and it seems you’ll increase your likelihood of approval. That said, some people still have trouble getting issued cards from them. YMMV.

What I’ve Learned (Personally)

Staying focused on your end-goal is extremely important in all aspects of life. Figuring out how to get what you want and how to talk to people without condescension, entitlement, or deceit will make anyone better. That has been the most rewarding (non-travel or money) aspect of this hobby to me. I have gained an immeasurable amount of confidence and composure when dealing with stressful interpersonal situations, for example not knowing how a credit analyst is going to respond when I need to call reconsideration and they see dozens of new accounts on my credit report.

Summary

I’ve had a pretty good run in this hobby over the past few years. A recent life change and relocation has me stepping back from new applications for a little bit, so I thought this would be a good time to summarize and reflect. Remember, there are lots of strategies and opinions in this game. What works for me may not work for you and vice-versa. There are lots of people/bloggers/companies that will try to sell you on what “travel” is. To some people it’s first-class flights and over-water bungalows in the Maldives. To others it’s economy flights and staying in locally-owned boutique hotels. Despite what you may read, there is absolutely no wrong answer. Identify your goals, stay financially responsible, and this hobby can accelerate your savings rate without sacrificing experience.

Questions? Comments? Let me know below!